Is Colgate Palmolive Offering Value as DCF Signals 36.7% Upside in 2025?

- If you have ever wondered whether Colgate Palmolive is quietly becoming a bargain while markets chase flashier names, you are exactly the kind of investor this breakdown is for.

- The stock has drifted lower, with shares at around $77.76 and returns of 5.2% over 3 years and just 2.9% over 5 years. This hints at subdued expectations rather than runaway optimism.

- Recently, investor attention has focused on Colgate Palmolive's push into higher margin premium oral care products and its broader portfolio shift toward faster growing personal care segments. At the same time, commentary around defensive consumer staples has softened as markets rotate toward higher growth themes. This helps explain why a solid franchise like this has been left treading water.

- Right now, Colgate Palmolive scores a modest 2 out of 6 on our valuation checks. In the next sections we will compare what traditional multiples, cash flow models and other yardsticks say about the stock, before finishing with a more holistic way to decide what its value really is to you.

Colgate-Palmolive scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Colgate-Palmolive Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes the cash Colgate Palmolive is expected to generate in the future, then discounts those projections back into todays dollars to estimate what the business is worth now.

Using a 2 Stage Free Cash Flow to Equity model, Colgate Palmolive starts with last twelve month free cash flow of about $3.4 billion. Analyst forecasts and Simply Wall St extrapolations see this rising gradually, with projected free cash flow of roughly $4.9 billion by 2035. Early years are based on analyst estimates. Later years extend the trend at modest growth rates to avoid overly aggressive assumptions.

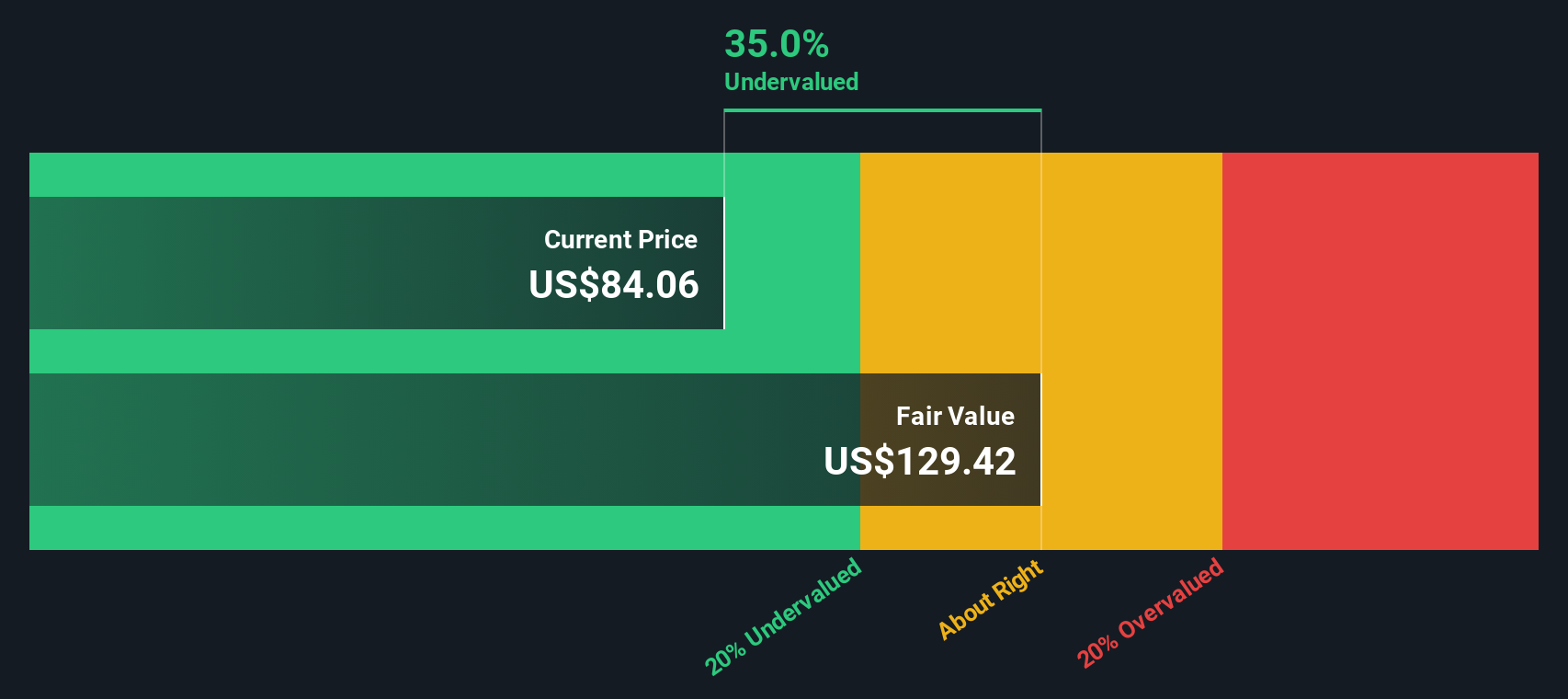

When these projected cash flows are discounted back, the model suggests an intrinsic value of about $122.83 per share. The current share price is around $77.76. On this basis, the DCF implies the stock is roughly 36.7% undervalued, which indicates a margin of safety for long term investors willing to ride out short term sentiment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Colgate-Palmolive is undervalued by 36.7%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: Colgate-Palmolive Price vs Earnings

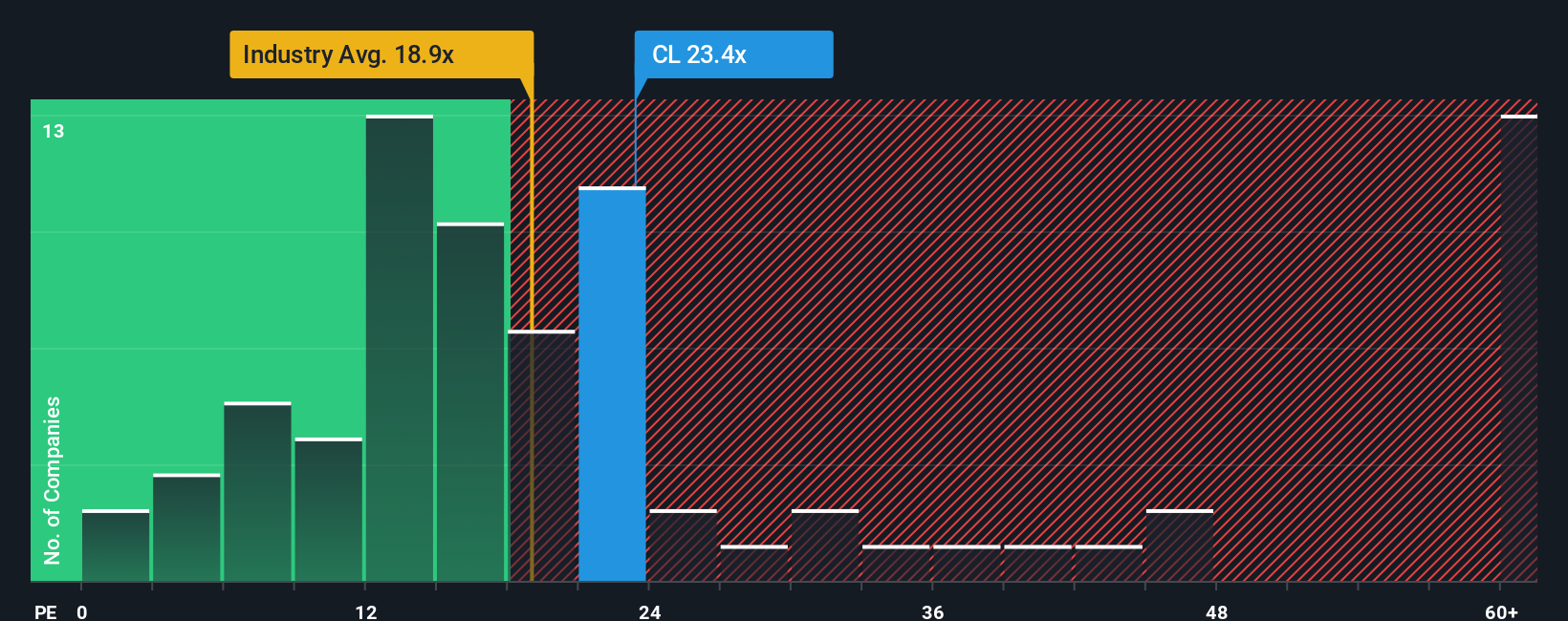

The Price to Earnings ratio is a useful yardstick for profitable, established businesses like Colgate Palmolive because it links what investors pay today directly to the earnings the company is already generating. In general, faster growth and lower risk justify a higher PE, while slower growth, more cyclical earnings or higher risk tend to pull a fair PE lower.

Colgate Palmolive currently trades on a PE of about 21.55x. That is richer than both the Household Products industry average of roughly 17.37x and the broader peer group, which sits near 19.64x. To go a step further, Simply Wall St calculates a Fair Ratio of 19.46x, which reflects what a reasonable PE might be once factors such as Colgate Palmolive's earnings growth profile, profitability, industry positioning, market cap and risk are factored in.

This Fair Ratio is more tailored than a simple peer or industry comparison because it adjusts for the company’s own strengths and vulnerabilities rather than assuming all players deserve the same multiple. With the market paying 21.55x compared with a Fair Ratio of 19.46x, the shares screen as modestly expensive on this lens, pointing to a degree of optimism already in the price.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Colgate-Palmolive Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Colgate Palmolive's future with the numbers behind it. A Narrative is your story about a company captured in assumptions about its future revenue, earnings and profit margins, which then flow through to a financial forecast and ultimately to your own estimate of fair value. On Simply Wall St, Narratives are an easy, accessible tool on the Community page, where millions of investors share and compare these stories so you can see how different assumptions lead to different fair values, and decide whether the current share price looks attractive or stretched. Narratives are kept up to date automatically as new data, news and earnings arrive, so your fair value stays aligned with what is actually happening. For example, one Colgate Palmolive Narrative might see strong emerging market growth and premiumization justifying a fair value near the bullish 106 dollars target, while a more cautious Narrative focused on cost pressures and slower volumes may anchor closer to the bearish 83 dollars view.

Do you think there's more to the story for Colgate-Palmolive? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报