Assessing Ally Financial (ALLY) Valuation After Its Recent Share Price Strength

Ally Financial (ALLY) has quietly outperformed many financial names this year, with the stock up about 24% year to date and nearly 20% over the past year, drawing renewed interest from value focused investors.

See our latest analysis for Ally Financial.

That strength is not just a blip either, with a 13.3% 1 month share price return and a near doubling in 3 year total shareholder return suggesting momentum is building as investors reassess Ally’s earnings power and credit risk.

If Ally’s move has you rethinking financials, this could be a useful moment to broaden your search and explore fast growing stocks with high insider ownership.

With earnings and revenue both growing briskly and the share price still sitting below analyst targets, investors face a key question: Is Ally still trading at a discount, or has the market already priced in its next leg of growth?

Most Popular Narrative: 7.4% Undervalued

With Ally Financial last closing at $44.49 against a narrative fair value of $48.06, the story frames a modest upside driven by improving profitability and growth.

Ongoing balance sheet remixing into higher yielding auto and corporate finance loans, as well as optimized deposit pricing, are increasing net interest margin beyond recent headwinds (e.g., card sale, mortgage runoff). This points to a path for above peer NIM and sustained earnings improvement.

Curious how this blend of faster earnings growth, expanding margins, and a richer future multiple all stack up into one valuation call, and what happens if those assumptions misfire or overdeliver? Step into the full narrative to see the exact levers behind that upside.

Result: Fair Value of $48.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors still need to watch Ally’s heavy auto lending exposure and rising competition, which could pressure margins and derail the current earnings upgrade story.

Find out about the key risks to this Ally Financial narrative.

Another Angle on Valuation

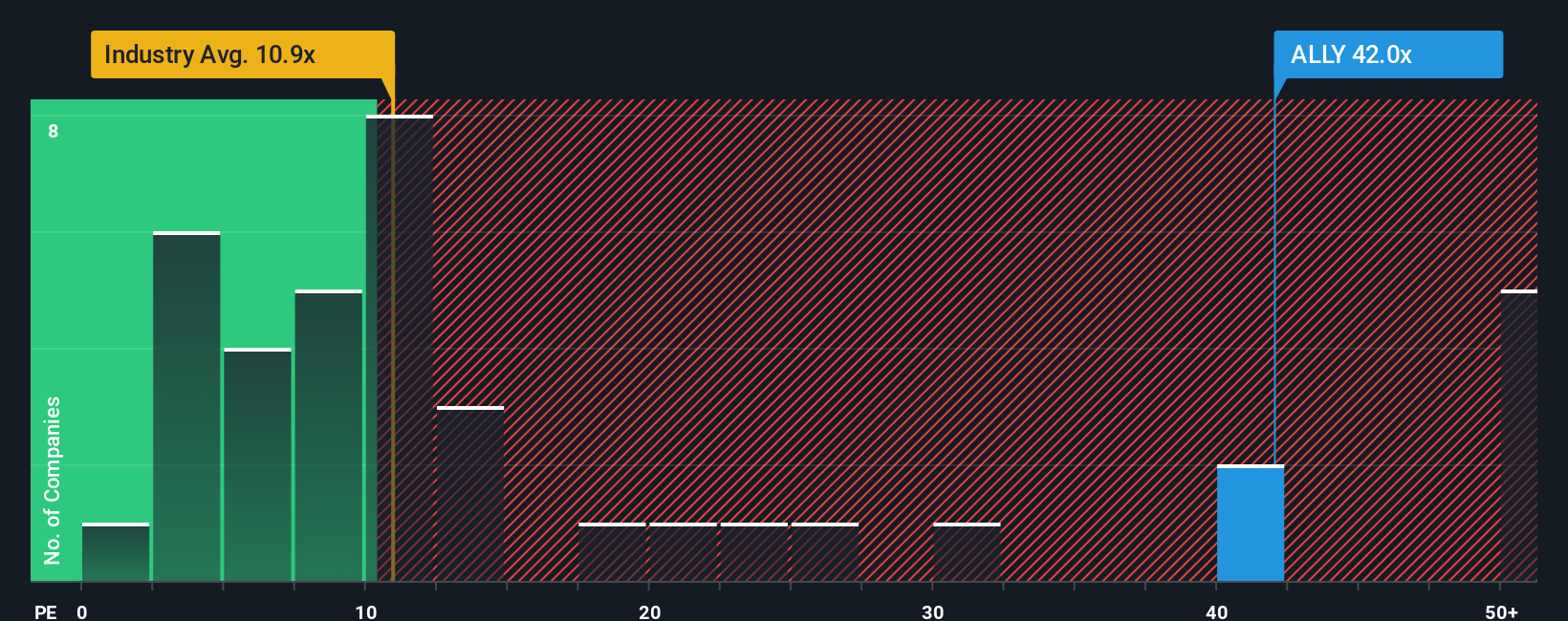

On a simple price to earnings lens, Ally looks far less generous than that 7.4 percent upside suggests. The shares trade at about 26.2 times earnings, not only above the US consumer finance average of 8.8 times, but also above a fair ratio of 20.6 times that the market could drift back toward.

That premium might reflect faith in the earnings rebound, but it also raises the risk that any stumble in credit quality or growth sees the multiple compress, leaving little room for error. Or is the market correctly front running a more durable profit cycle?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ally Financial Narrative

If you see the story differently or simply want to test your own assumptions against the numbers, you can build a custom thesis in just minutes: Do it your way.

A great starting point for your Ally Financial research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning fresh opportunities our community tracks, so you are not late to the next standout winner.

- Upgrade your watchlist with these 904 undervalued stocks based on cash flows that pair solid fundamentals with prices the market has not fully appreciated yet.

- Explore innovation waves through these 25 AI penny stocks positioned at the heart of real world artificial intelligence adoption.

- Review these 12 dividend stocks with yields > 3% that combine ongoing payout histories with balance sheet stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报