Nordex (XTRA:NDX1) Valuation After Record Alliant Energy Turbine Deal and Strong U.S. Growth Prospects

Nordex (XTRA:NDX1) just landed its largest ever United States turbine award, as Alliant Energy has selected the company to supply up to 190 turbines for Midwest wind projects scheduled for 2028 and 2029.

See our latest analysis for Nordex.

That backdrop helps explain why momentum has been so strong, with Nordex’s share price delivering a 142.6 percent year to date return and a 150.2 percent total shareholder return over the past 12 months as investors reprice its growth prospects.

If this kind of contract-driven rerating has caught your eye, it could be a good moment to explore fast growing stocks with high insider ownership as you look for the next potential winner.

With the shares now trading close to analyst targets but still at a sizeable discount to intrinsic value estimates, is Nordex a rare renewable heavyweight still mispriced, or are markets already factoring in years of growth ahead?

Most Popular Narrative Narrative: 3.5% Overvalued

With Nordex last closing at €28.50 versus a narrative fair value near €27.54, the story leans slightly rich, setting up an interesting tension on future delivery.

The combination of market leadership in Europe (especially Germany), growth into new regions (e.g., Australia, Eastern Europe), and the increasing cost competitiveness of wind relative to fossil fuels underpins a strong multiyear demand and pricing environment, supporting long term revenue and earnings growth.

Want to see what kind of revenue runway and margin rebuild the narrative is baking in, and how future earnings power is being repriced? Read on.

Result: Fair Value of €27.54 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Nordex’s heavy European reliance and delayed turbine platform investment mean that policy shifts or faster rival innovation could quickly challenge these upbeat assumptions.

Find out about the key risks to this Nordex narrative.

Another Angle on Valuation

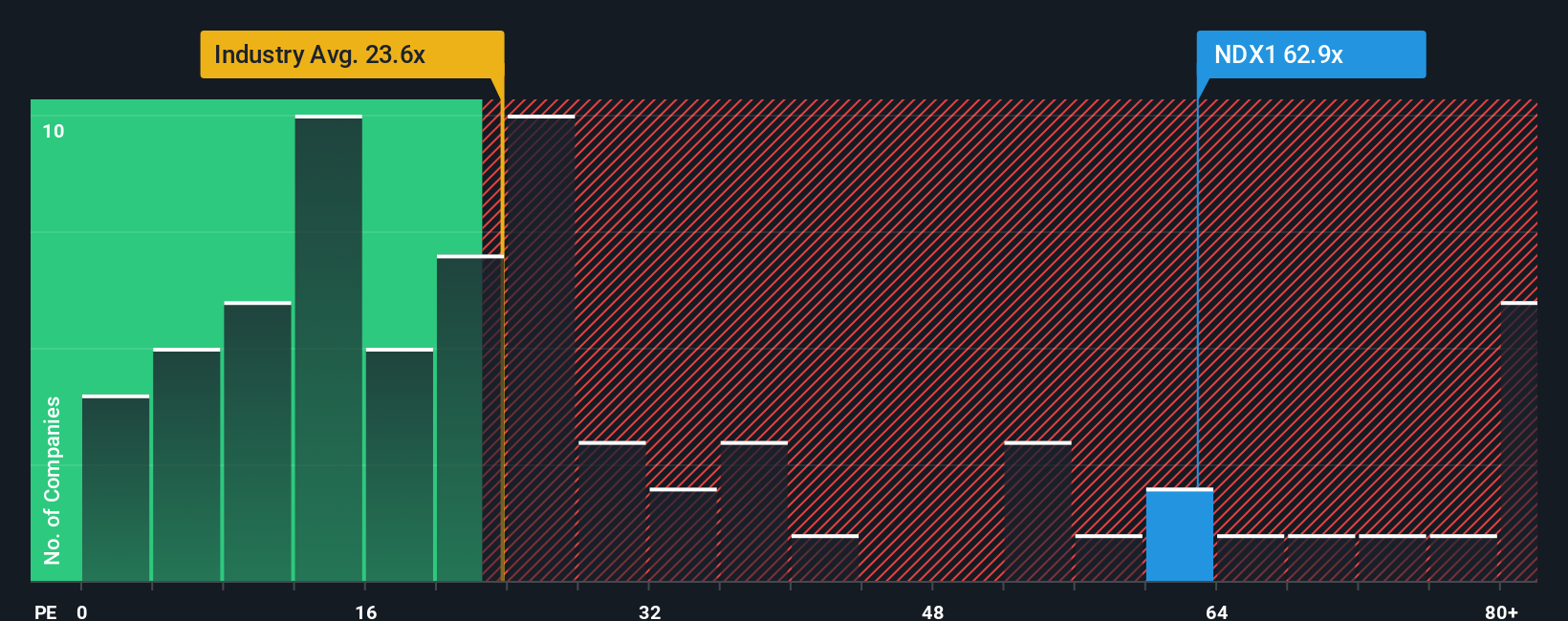

Nordex screens as pricey on earnings, trading on a 62.3x price to earnings ratio versus a 33.7x fair ratio and just 22.8x for the European electrical sector, with peers at 41.9x. This raises the question of how much future growth is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nordex for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nordex Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes with Do it your way.

A great starting point for your Nordex research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before the market’s next big swing, secure your edge by using the Simply Wall Street Screener to uncover fresh stocks that match your exact strategy.

- Capture asymmetric upside by focusing on quality businesses trading below estimated cash flow value through these 904 undervalued stocks based on cash flows and position yourself ahead of a potential rerating.

- Harness long term income potential by targeting companies offering reliable, above average yields using these 12 dividend stocks with yields > 3% while still keeping an eye on fundamentals.

- Ride structural growth in digital assets by filtering listed businesses exposed to blockchain, exchanges, and infrastructure with these 81 cryptocurrency and blockchain stocks before sentiment turns euphoric again.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报