Primo Brands (PRMB): Assessing Valuation After a 50% Share Price Slide

Primo Brands (PRMB) has quietly slid almost 50% over the past year, even as its annual revenue still edges higher and earnings swing sharply. That disconnect is exactly what has value focused investors paying closer attention.

See our latest analysis for Primo Brands.

Over the past year, Primo Brands’ 1 year total shareholder return of around negative 50 percent, alongside a roughly negative 35 percent 3 month share price return from about 15 dollars, suggests sentiment has been fading even as fundamentals nudge higher.

If this kind of volatility has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership for other compelling ideas.

With revenue still growing modestly and annual net income swinging higher, yet the share price cut in half and trading at a steep discount to analyst targets, is Primo Brands a mispriced value play, or is the market already discounting its future growth?

Price to Sales of 0.9x: Is it justified?

On a price to sales basis, Primo Brands appears heavily discounted, with the stock trading at around 0.9 times trailing revenue despite the latest close at 15.72 dollars.

The price to sales ratio compares what investors pay for each dollar of annual revenue to both peers and the broader industry, which is especially useful for companies that are not yet consistently profitable. For a branded beverage group still growing its top line and working toward sustainable profitability, this lens helps highlight whether the market is valuing its scale appropriately.

Today, Primo Brands changes hands at 0.9 times sales, compared with roughly 3.8 times for its direct peer group and 2.3 times across the wider US beverage space. This indicates the market is pricing its revenue stream at a steep discount. That discount is even starker against an estimated fair price to sales level of about 1.1 times, which shows a gap between the current market multiple and this reference level.

Explore the SWS fair ratio for Primo Brands

Result: Price to Sales of 0.9x (UNDERVALUED)

However, persistent net losses and slowing revenue growth could signal structural challenges, especially if competitive pressure intensifies and valuation discounts prove warranted.

Find out about the key risks to this Primo Brands narrative.

Another View on Value

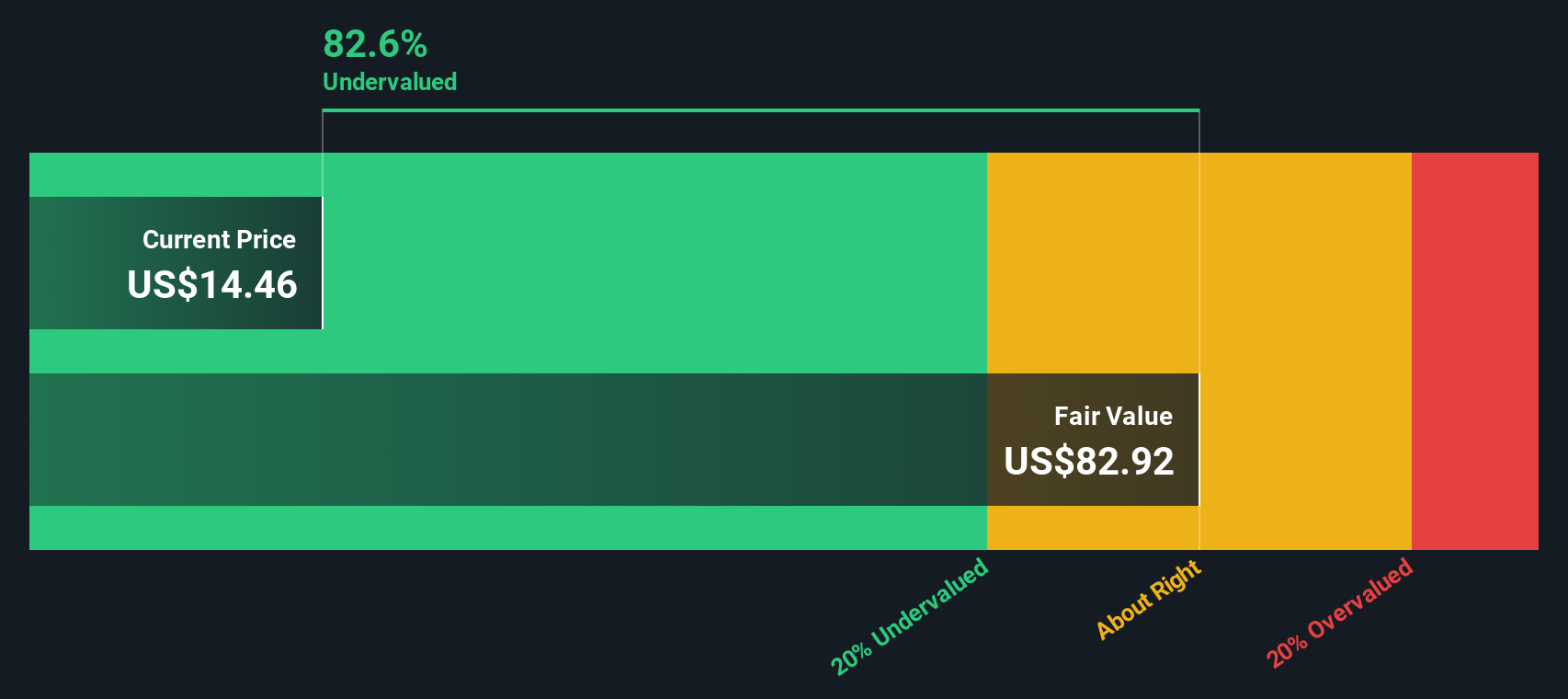

Looking at our DCF model, the story turns even more extreme. It points to a fair value near 75.17 dollars per share, implying Primo Brands could be trading at roughly an 80 percent discount. Is this a rare bargain, or are the cash flow assumptions too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Primo Brands for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Primo Brands Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Primo Brands research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself the edge by scanning fresh opportunities on Simply Wall Street’s Screener so you are not leaving potential returns on the table.

- Capitalize on mispriced opportunities by targeting companies that look cheap on cash flow potential with these 907 undervalued stocks based on cash flows.

- Ride the next wave of intelligent automation by zeroing in on innovators shaping healthcare with these 30 healthcare AI stocks.

- Position your portfolio for resilient income streams by focusing on reliable payers through these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报