What Ipsos (ENXTPA:IPS)'s CFO Transition Means For Shareholders

- Ipsos has confirmed that Group Chief Financial Officer Dan Lévy recently decided to leave the company, with long-serving finance executive Olivier Champourlier stepping in as Interim CFO from 9 December 2025 while a permanent successor is sought.

- This shift places a seasoned internal leader with deep experience in controlling, consolidation, accounting, tax, and regional finance oversight at the center of Ipsos’ financial decision-making during a key period for the business.

- We’ll now examine how the interim appointment of Olivier Champourlier as CFO may influence Ipsos’ investment narrative and outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Ipsos Investment Narrative Recap

To own Ipsos, you need to believe that its investments in AI-driven research, digital platforms and acquisitions can translate into steadier growth and improving margins, despite recent share price weakness and macro uncertainty. The interim CFO change looks contained, with a seasoned internal finance leader stepping in, so it does not appear to materially alter the near term catalyst around execution on digital and efficiency initiatives, nor the key risk of demand softness in core markets.

The most relevant recent announcement alongside this CFO transition is Ipsos’ H1 2025 results release in July, which gives investors the clearest read on how its AI, digital and acquisition-driven offerings are tracking against expectations. In that context, continuity in the finance function during the search for a permanent CFO may matter most for sustaining cost discipline and monitoring any margin dilution from recent deals while the company pursues higher value, tech enabled work.

Yet for all the promise around new digital solutions, investors still need to be mindful of how exposed Ipsos remains to government budget cycles and the risk that...

Read the full narrative on Ipsos (it's free!)

Ipsos' narrative projects €2.8 billion revenue and €261.1 million earnings by 2028. This requires 4.9% yearly revenue growth and about a €81 million earnings increase from €179.8 million today.

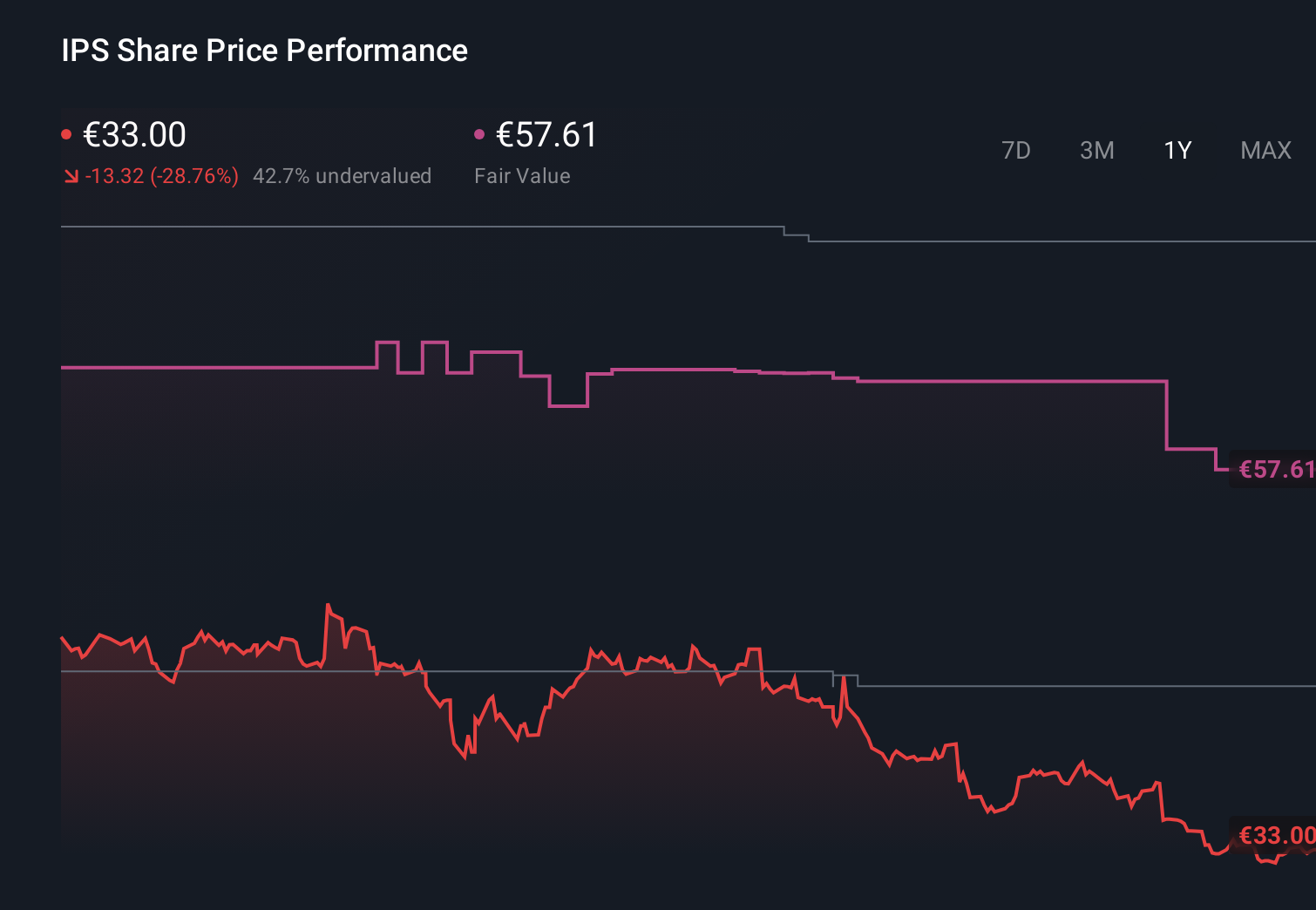

Uncover how Ipsos' forecasts yield a €57.61 fair value, a 81% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently estimate Ipsos’ fair value between €32.61 and €120.66, underscoring how far opinions can stretch. You should weigh those against the risk that prolonged geopolitical and macro uncertainty could keep client spending under pressure and limit how quickly Ipsos’ digital and AI investments feed through to earnings, then explore several alternative viewpoints before forming your own view.

Explore 7 other fair value estimates on Ipsos - why the stock might be worth just €32.61!

Build Your Own Ipsos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ipsos research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ipsos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ipsos' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报