Marriott (MAR) Valuation Check After Recent Share Price Pullback

Marriott International (MAR) shares have been drifting after a weak past week, so it is a good moment to step back and see how the stock lines up with its recent fundamentals.

See our latest analysis for Marriott International.

At around $286.96, Marriott’s recent 7 day share price return of negative 6.42 percent and softer 30 day share price return sit against a still positive 90 day share price return and strong 3 year total shareholder return of 85.61 percent. This hints that long term momentum remains intact even as near term enthusiasm cools.

If Marriott’s recent wobble has you rethinking where growth and conviction overlap, it could be worth exploring fast growing stocks with high insider ownership as a fresh set of ideas.

With shares now sitting just below analyst targets after years of strong compounding, investors face a key question: Is Marriott’s premium valuation still backed by future earnings power, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 2% Undervalued

With Marriott closing at $286.96 against a narrative fair value near $292, expectations lean slightly ahead of price, setting up an ambitious growth story.

Diversification of high margin, luxury/lifestyle offerings and alternate revenue streams (e.g., branded residences, Marriott Media Network, co branded credit cards) leverages consumer preference for experiences over goods, expanding ADR and introducing new, capital light earnings streams for sustained earnings and margin growth.

Curious how premium fees, aggressive top line expansion, and a rich future earnings multiple all fit together. Want to see the full playbook behind that target.

Result: Fair Value of $292.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro uncertainty and heavy tech investment could temper RevPAR growth and margins, which may challenge the premium multiple implied by today’s narrative.

Find out about the key risks to this Marriott International narrative.

Another View: Market Multiple Sends a Different Signal

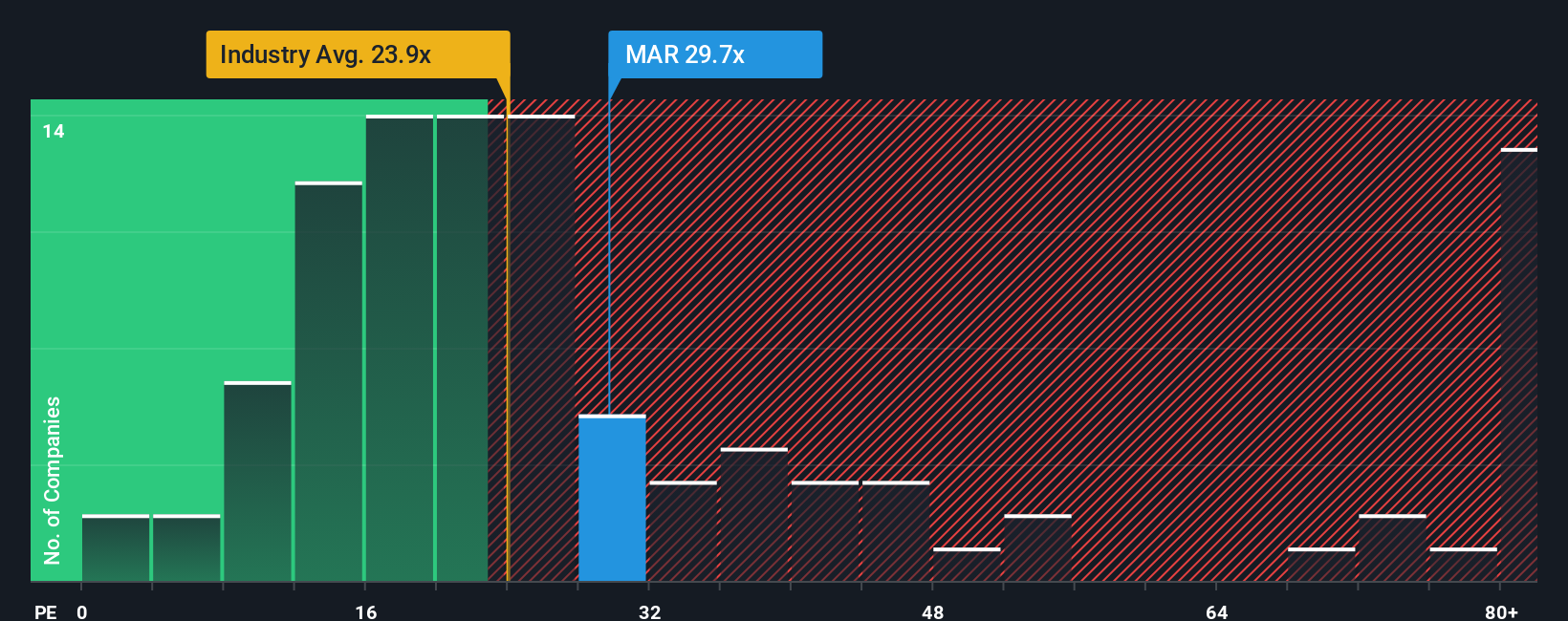

While the narrative fair value suggests a small upside, the market’s own yardstick is less forgiving. At a 29.5x earnings ratio versus a 23.1x industry average and a 27.7x fair ratio, Marriott screens clearly expensive, which raises the chance that even good news is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marriott International Narrative

If this perspective does not quite fit your view, or you would rather dig into the numbers yourself, you can build a personalized thesis in just a few minutes using Do it your way.

A great starting point for your Marriott International research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity when the Simply Wall Street Screener can quickly surface fresh, high conviction ideas tailored to the themes you care about most.

- Capture potential mispricings by targeting compelling bargains through these 908 undervalued stocks based on cash flows that may offer stronger upside than widely followed names.

- Position your portfolio for disruptive innovation by focusing on transformational businesses across these 26 AI penny stocks reshaping entire industries.

- Strengthen your income stream by zeroing in on reliable payers using these 12 dividend stocks with yields > 3% to uncover companies sharing more of their profits with shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报