Ezaki Glico (TSE:2206) Valuation Check After Chocolate Recall and Ongoing Financial Impact Review

Ezaki Glico (TSE:2206) just moved to voluntarily recall 20 chocolate products, including Pocky Chocolate, after spice contamination led to unintended flavor changes. This puts short term margins, brand perception, and recall costs under the microscope.

See our latest analysis for Ezaki Glico.

Despite the recall headlines, Ezaki Glico’s 90 day share price return of 4.70% and 1 year total shareholder return of 16.89% suggest momentum is still quietly building rather than breaking.

If this kind of event has you reassessing your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership for other potential standouts.

Yet with earnings still growing, the share price well above analyst targets, and a recall clouding near term sentiment, is Ezaki Glico now quietly undervalued, or are markets already pricing in its next leg of growth?

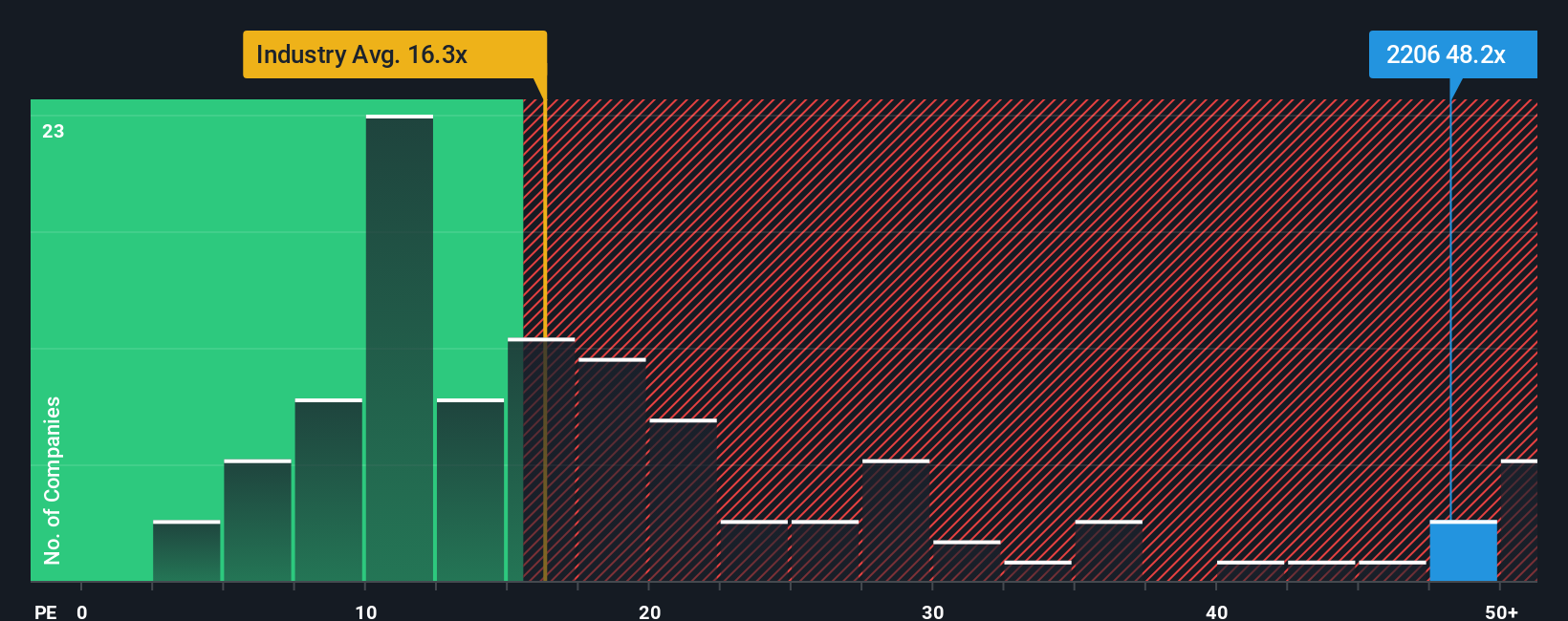

Price-to-Earnings of 47.5x: Is it justified?

Our DCF model estimates Ezaki Glico’s fair value at ¥6,883.39 per share, implying upside from the last close at ¥5,349 despite recent volatility.

The SWS DCF model projects Ezaki Glico’s future cash flows and then discounts them back to today, aiming to capture the long term earning power of its global confectionery and food operations. By focusing on underlying cash generation rather than short term noise, it can sometimes diverge meaningfully from headline metrics and sentiment.

For a mature consumer brand owner with modest forecast revenue growth of around 1.6% per year but significantly faster expected profit growth above 20%, a cash flow based lens is especially relevant. The recall, soft recent margins and slower top line expansion contrast with strong forecast earnings growth, making a DCF anchored on future profitability a useful counterbalance to short term concerns.

Look into how the SWS DCF model arrives at its fair value.

Result: DCF Fair value of ¥6,883.39 (UNDERVALUED)

However, the recall fallout and a share price trading far above analyst targets could quickly unwind sentiment if earnings momentum disappoints.

Find out about the key risks to this Ezaki Glico narrative.

Valuation Check Against Earnings Multiples

Step away from the SWS DCF model and the picture looks less comfortable. Ezaki Glico trades on a 47.5x price to earnings ratio, far richer than the JP Food industry at 16.4x, peers at 20.3x, and even its own 26.7x fair ratio, raising clear valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ezaki Glico for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ezaki Glico Narrative

If you read this differently, or want to stress test the numbers yourself, you can build a personalized view in just a few minutes: Do it your way

A great starting point for your Ezaki Glico research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

If Ezaki Glico has sharpened your appetite for opportunity, do not stop here, your next market win could be hiding in plain sight.

- Capture mispriced potential by targeting value opportunities using these 908 undervalued stocks based on cash flows that focus on strong cash flows and overlooked upside.

- Ride the next wave of innovation by zeroing in on transformational themes through these 26 AI penny stocks reshaping how businesses use data and automation.

- Strengthen your income strategy by locking onto reliable payers via these 12 dividend stocks with yields > 3% with yields above 3% and the balance sheets to sustain them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报