Veris Residential (VRE): Reassessing Valuation After a Choppy Year and Recent Share Price Slide

Veris Residential (VRE) has been drifting lower this year, and that slide is catching value investors attention. With the stock down double digits year to date, the question is whether fundamentals justify the discount.

See our latest analysis for Veris Residential.

The recent slide caps a choppy year for Veris Residential, with the share price now at $14.57 and a negative year to date share price return, while the five year total shareholder return remains positive. This suggests sentiment has cooled even though the long term picture has not fully broken.

If you are reassessing your real estate exposure, it can also be worth scanning beyond REITs and seeing what is happening in other corners of the market through fast growing stocks with high insider ownership.

With earnings under pressure but the share price already sitting below analyst targets, investors now face a key question: Is Veris Residential trading at a genuine discount, or is the market already pricing in its future growth?

Most Popular Narrative: 19.1% Undervalued

With Veris Residential last closing at $14.57 against a narrative fair value of $18.00, the storyline hinges on modest growth and steady margins rather than rapid expansion.

The sale of $300 million to $500 million of nonstrategic assets over the next 12 to 24 months is expected to improve debt position, with part of the proceeds used for debt repayment, potentially reducing net-debt-to-EBITDA and interest expenses.

The integration and rebranding of Jersey City Urby, now Sable, aims to achieve meaningful operational synergies, including cost savings and income from enhanced management, directly impacting NOI.

Curious how slow top line expectations can still justify a higher price tag, driven by margin repair, asset recycling and a punchy earnings multiple? Unpack the full valuation playbook behind this fair value call.

Result: Fair Value of $18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stretched leverage and ongoing occupancy headwinds at key properties could quickly erode the upside case if conditions or execution slip.

Find out about the key risks to this Veris Residential narrative.

Another Angle on Valuation

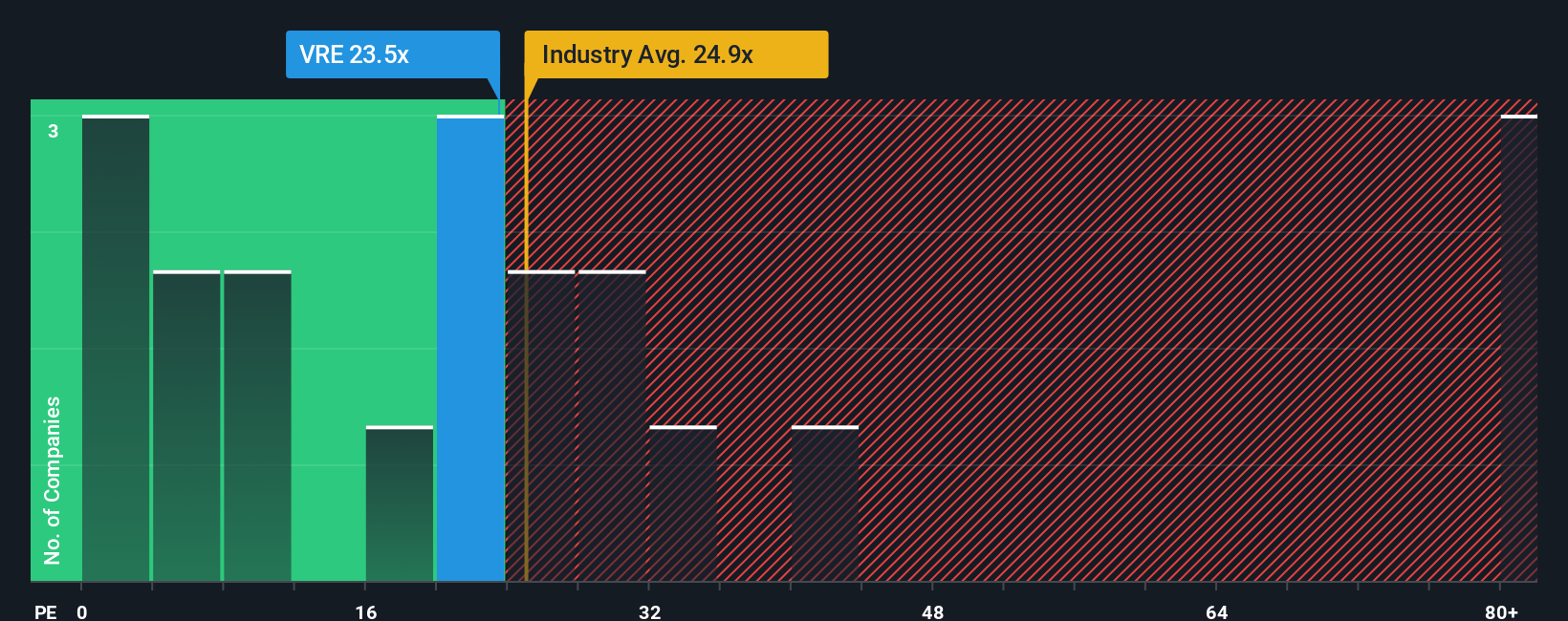

Our fair value work suggests Veris Residential trades about 18.8 percent below intrinsic value, but its 23.2 times earnings multiple still sits above a 17.1 times fair ratio, even if it looks cheaper than peers at 83.7 times. Is this discount a safety margin or a value trap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veris Residential Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Veris Residential research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, use the Simply Wall St Screener to uncover fresh opportunities across themes and sectors that could sharpen your portfolio and widen your edge.

- Capture overlooked value by checking out these 906 undervalued stocks based on cash flows that may be pricing in far less than their long term cash flow potential.

- Ride structural growth trends by reviewing these 30 healthcare AI stocks that blend medical innovation with powerful data driven intelligence.

- Position for market surprises by researching these 81 cryptocurrency and blockchain stocks built around digital assets, blockchain rails, and emerging financial infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报