Is It Too Late to Consider Antero Resources After Its 680% Multi Year Share Price Surge?

- Wondering if Antero Resources at around $37 a share is still a smart buy after such a massive multi year run, or if the easy money has already been made?

- The stock has climbed 2.0% over the last week, 9.7% over the past month, and is still up 12.9% over the last year, with a huge 680.0% gain over five years that has clearly reset expectations and risk appetite.

- Those moves sit against a backdrop of shifting energy sentiment, with investors rotating back into natural gas names as supply discipline and infrastructure build outs improve the longer term story for producers like Antero. At the same time, ongoing headlines around US LNG capacity expansions and policy debates on drilling and exports are keeping volatility elevated and reinforcing the idea that macro drivers matter as much as company specific execution.

- On our framework Antero scores a 4 out of 6 for undervaluation checks. This suggests there may still be value left. Next we will break down what different valuation methods are really saying about the stock, before circling back to an even more powerful way to judge whether the current price makes sense.

Approach 1: Antero Resources Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes the cash Antero Resources is expected to generate in the future and discounts those projections back to a single value in today’s dollars. This provides an estimate of what the entire business could be worth right now.

Antero generated around $525.8 Million in free cash flow over the last twelve months, and analysts see that figure climbing steadily as production and pricing improve. Simply Wall St combines analyst forecasts for the next few years with its own longer term assumptions, projecting free cash flow to reach roughly $2.0 Billion by 2029, with further growth through 2035.

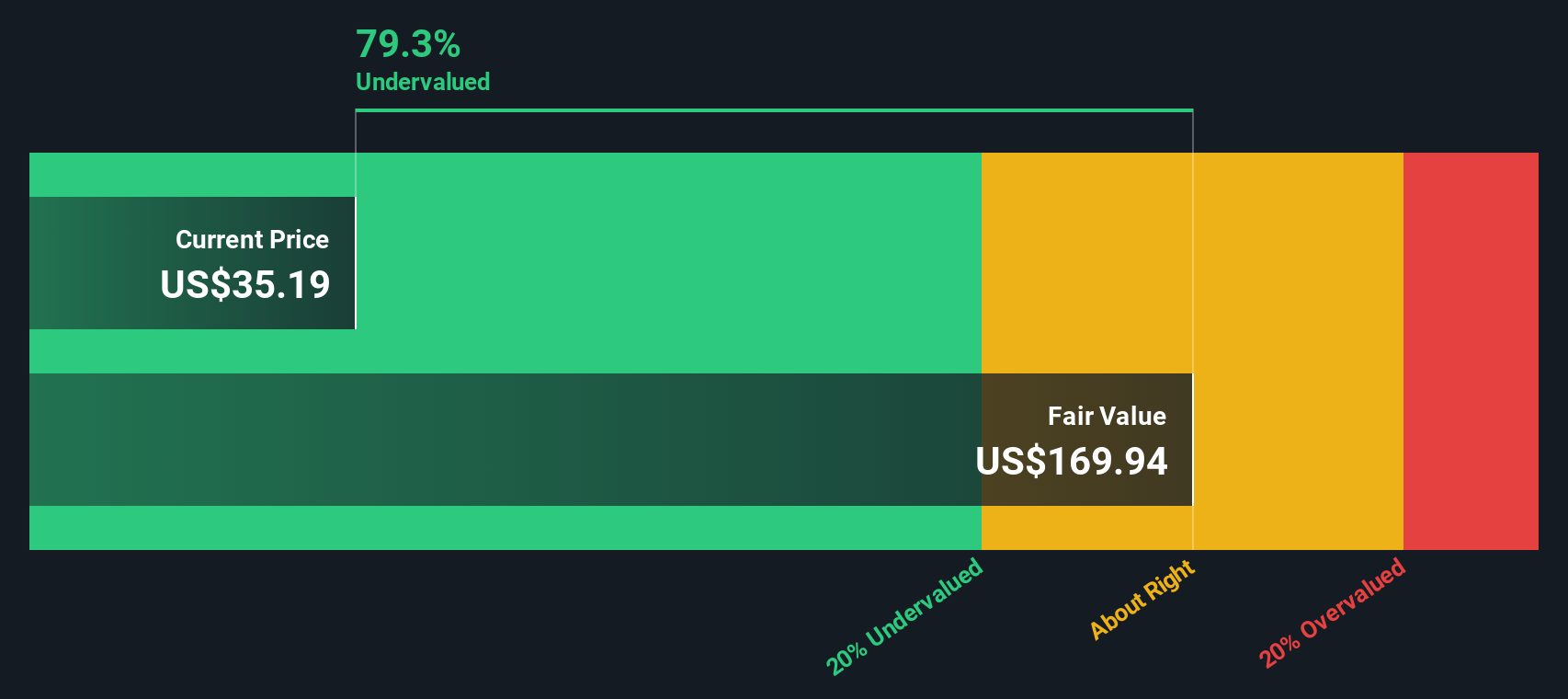

When all of those future cash flows are discounted back to today, the model arrives at an intrinsic value of about $169.94 per share, compared with a current market price near $37. On this basis, the stock screens as roughly 78.2% undervalued, indicating that investors may be paying a substantial discount to the company’s long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Antero Resources is undervalued by 78.2%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Antero Resources Price vs Earnings

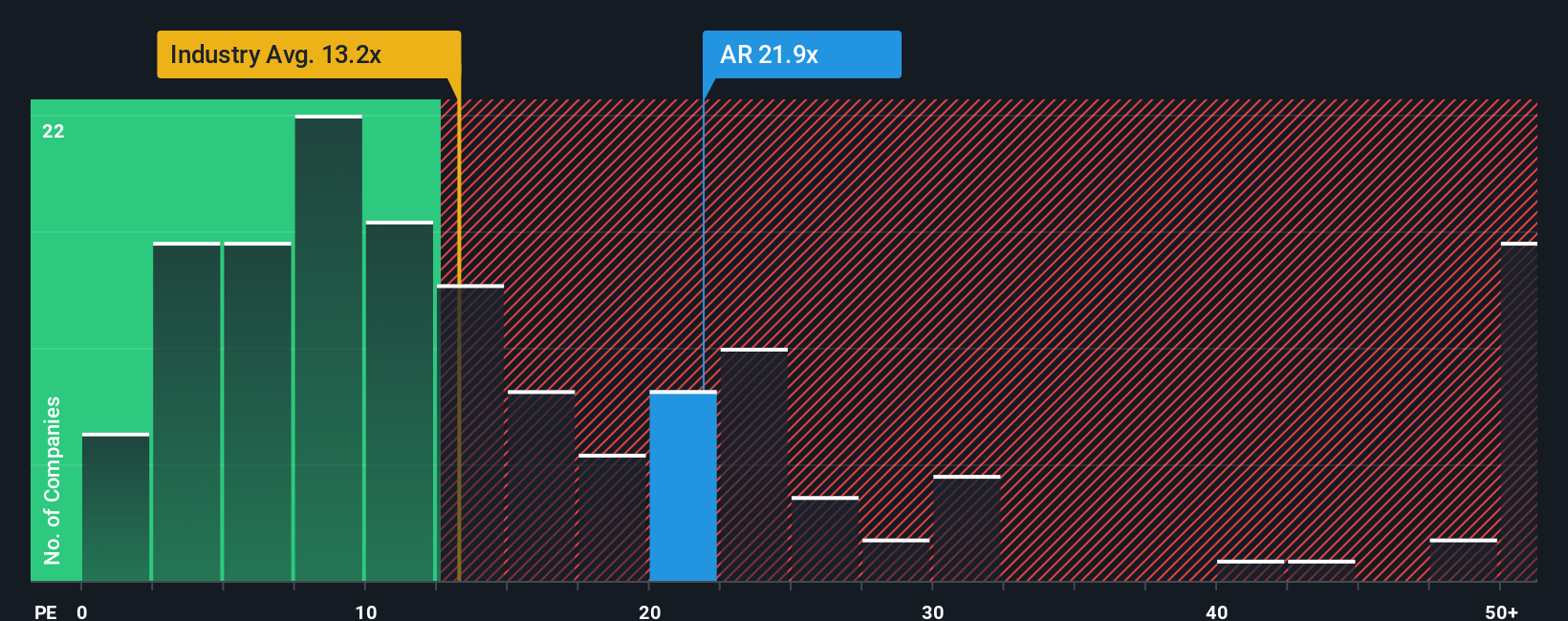

For profitable companies like Antero Resources, the price to earnings ratio is a useful snapshot of how much investors are willing to pay today for each dollar of current earnings. In general, faster growing and less risky businesses can justify a higher PE, while slower growth or greater uncertainty should translate into a lower, more conservative multiple.

Right now, Antero trades on a PE of about 19.4x, which is above the broader Oil and Gas industry average of roughly 13.6x but well below the 41.7x average of its peer group. Simply Wall St also calculates a Fair Ratio of around 20.5x, which is a proprietary estimate of the PE Antero should trade on given its earnings growth outlook, profitability, industry, market cap and risk profile.

This Fair Ratio is more informative than a simple comparison with peers or the industry because it adjusts for company specific drivers rather than assuming all producers deserve the same multiple. With Antero’s current 19.4x PE sitting slightly below the 20.5x Fair Ratio, the stock appears modestly undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Antero Resources Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you write the story behind your numbers by linking your view of a company’s future revenues, earnings and margins to a financial forecast, a fair value estimate and, ultimately, a buy or sell decision based on how that fair value compares to today’s price. Each Narrative updates automatically as new news or earnings are released. For Antero Resources, one investor might build a bullish Narrative around sustained LNG export demand, rising margins and ongoing share buybacks that justifies a fair value near the high end of recent targets. A more cautious investor could focus on clean energy headwinds, regulatory risks and volatile gas prices to support a much lower fair value closer to the most conservative estimates. Both perspectives can coexist transparently on the platform, giving you a dynamic, story driven framework rather than a single static number.

Do you think there's more to the story for Antero Resources? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报