Does Embracer Group’s Coffee Stain Spin-Off Clarify Its Core Strategy Or Complicate It (OM:EMBRAC B)?

- Embracer Group’s recent Extraordinary General Meeting approved the past distribution of its subsidiary Coffee Stain Group AB, granting shareholders one Coffee Stain share per Embracer share, with Coffee Stain’s class B shares now trading on Nasdaq First North Premier Growth Market Sweden under ticker COFFEE B.

- This spin-off reshapes Embracer’s portfolio by separating a key gaming asset, giving investors direct exposure to Coffee Stain while potentially clarifying the value of Embracer’s remaining core franchises.

- We’ll now examine how distributing Coffee Stain shares to existing investors reshapes Embracer’s investment narrative and future capital allocation priorities.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Embracer Group Investment Narrative Recap

To own Embracer today, you need to believe the group can turn a “transition year” of weaker PC/Console sales and restructuring into a leaner business that earns more from its core franchises over time. The Coffee Stain spin off does not change the near term focus: stabilizing revenues, improving margins and proving that upcoming releases and cost cuts can offset past underperformance and revenue pressure.

The most relevant recent development alongside the Coffee Stain listing is Embracer’s Q2 FY2025 results, which showed continued year over year revenue declines but a sharply smaller net loss. Against that backdrop, distributing Coffee Stain shares to existing investors sharpens attention on whether the slimmer Embracer, with fewer diversified assets, can reduce earnings volatility and execute consistently on its remaining PC/Console and transmedia pipeline.

Yet while the Coffee Stain spin off may simplify the story, investors should be aware that it also heightens exposure to...

Read the full narrative on Embracer Group (it's free!)

Embracer Group's narrative projects SEK22.1 billion revenue and SEK2.6 billion earnings by 2028. This requires 2.0% yearly revenue growth and an earnings decrease of SEK1.4 billion from SEK4.0 billion today.

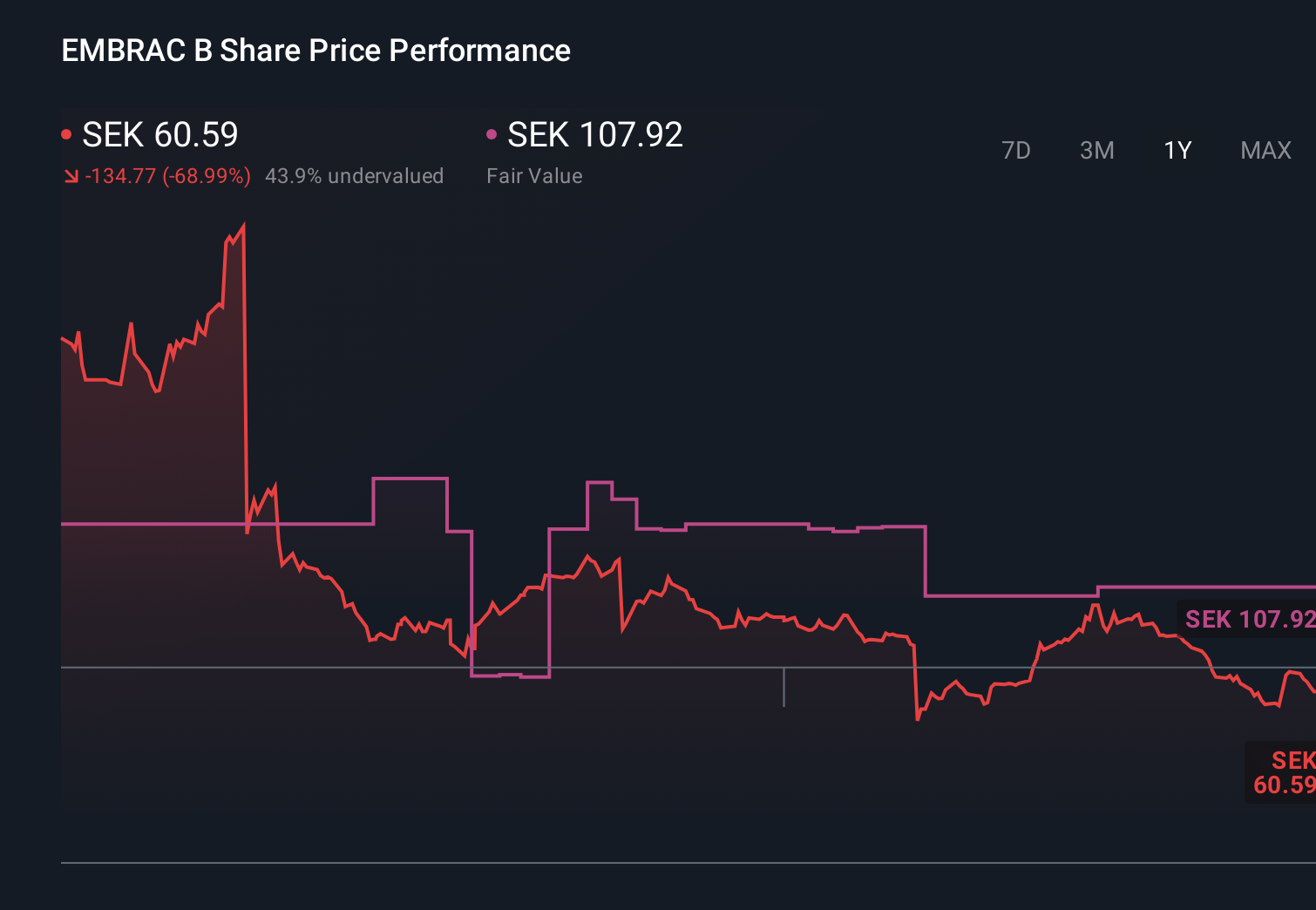

Uncover how Embracer Group's forecasts yield a SEK107.92 fair value, a 78% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community value Embracer between SEK107.92 and SEK562.79 per share, underlining how far opinions can stretch. You can weigh those against concerns about shrinking diversification after spin offs and restructuring, and what that might mean for the stability of Embracer’s future earnings profile.

Explore 5 other fair value estimates on Embracer Group - why the stock might be worth just SEK107.92!

Build Your Own Embracer Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Embracer Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Embracer Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Embracer Group's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报