Assessing Bitmine Immersion Technologies After a 477.1% Surge in 2025

- Wondering if Bitmine Immersion Technologies is still a bargain after its huge run, or if most of the upside is already priced in? In this article we break down what the recent action might really be telling us about value versus hype.

- The stock has rocketed 477.1% year to date and 274.2% over the last year, even after a recent 20.0% jump in the past week and a softer 1.8% pullback over the last 30 days.

- Those swings have come as Bitmine Immersion Technologies has stayed in focus as a niche player in immersion cooling and crypto related infrastructure, a space that tends to move sharply when sentiment around digital assets and high performance computing shifts. Broader volatility across speculative tech and blockchain exposed names has only amplified each piece of news and made the price chart look more dramatic than the underlying business changes may justify.

- Despite that momentum, Bitmine Immersion Technologies scores just 0/6 on our valuation checks, suggesting the market may be paying up for growth potential rather than current fundamentals. In the next sections we walk through different valuation approaches to see what that implies, and finish by looking at another way to think about the company’s long term value story.

Bitmine Immersion Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bitmine Immersion Technologies Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock is worth by projecting all future dividends a company is expected to pay and discounting them back into today’s dollars. It works best for businesses with stable, sustainable payouts.

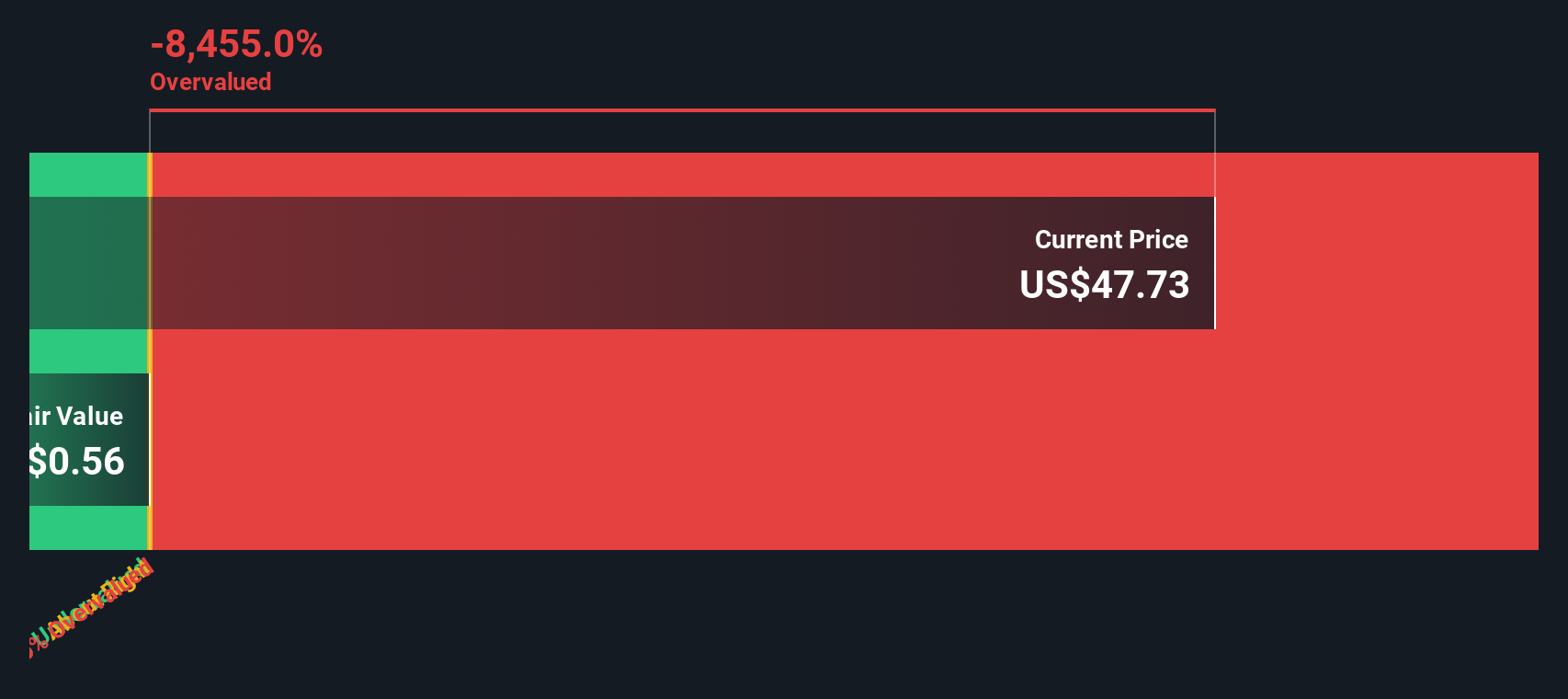

For Bitmine Immersion Technologies, the model starts with an annual dividend per share of $0.01. Simply Wall St assumes a long term dividend growth rate of 3.26%, anchored to the risk free rate. However, the company’s return on equity is deeply negative at around minus 52.19%, which raises serious doubts about how sustainable any dividend growth might be if the business continues to destroy shareholder value.

Even using these relatively modest growth assumptions, the DDM output suggests an intrinsic value of roughly $0.18 per share. With the stock price trading so far above that level, the model implies it is about 22970.7% overvalued, highlighting a large gap between cash backed dividend potential and current market optimism.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Bitmine Immersion Technologies may be overvalued by 22970.7%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Bitmine Immersion Technologies Price vs Earnings

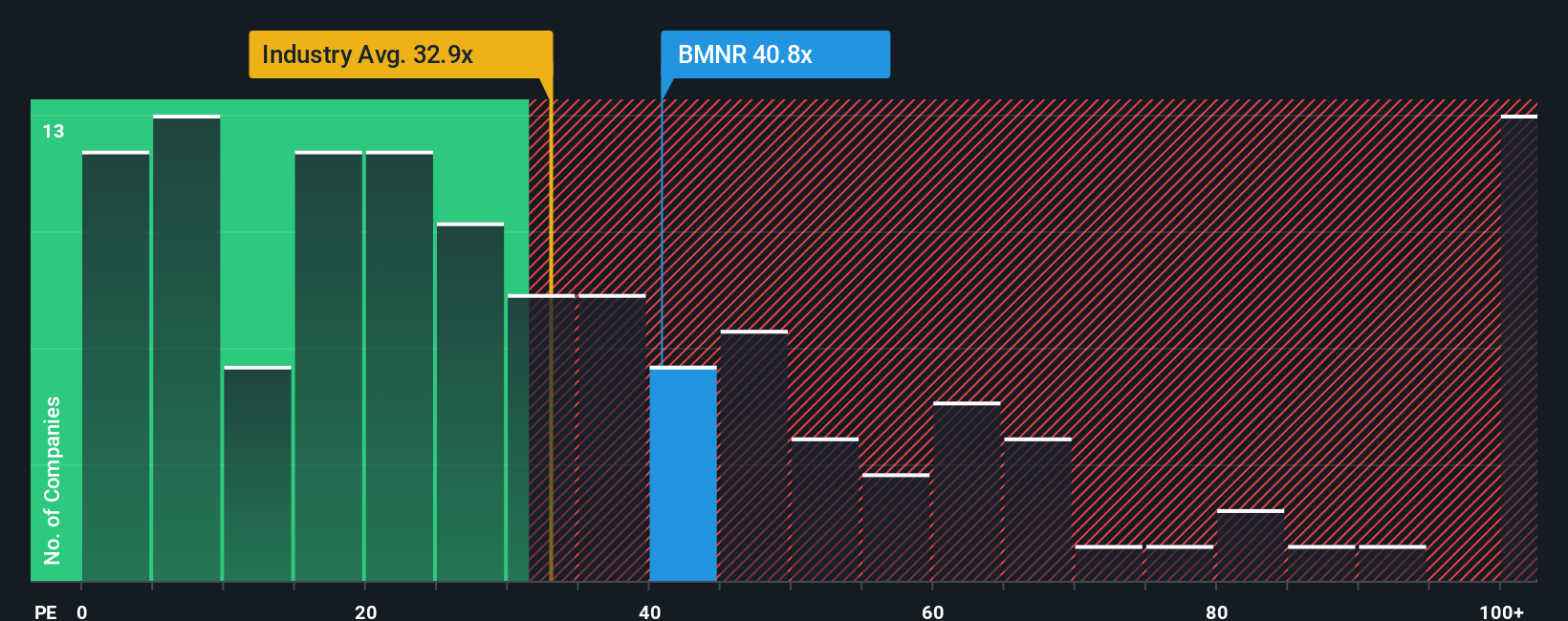

For profitable companies, the price to earnings ratio is often the go to yardstick because it links what investors are paying directly to the profits the business is generating today. In general, faster earnings growth and lower perceived risk justify a higher PE, while slower growth, more cyclicality, or greater uncertainty usually deserve a lower multiple.

Bitmine Immersion Technologies currently trades on a PE of about 47.28x, which is well above both the broader Software industry average of roughly 32.66x and a peer group average of around 28.62x. On those simple comparisons, the market is clearly pricing in a premium for Bitmine’s prospects relative to typical software names and closer peers.

Simply Wall St also uses a proprietary Fair Ratio, which is the PE multiple you would expect for Bitmine Immersion Technologies after accounting for its specific earnings growth outlook, profitability, industry positioning, market value, and risk profile. This forward looking Fair Ratio is more insightful than a basic peer or industry comparison because it adjusts for how different Bitmine really is from the average software stock. With the current PE sitting meaningfully above this Fair Ratio, the shares look stretched on an earnings based view.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bitmine Immersion Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story, your perspective on a company, to the numbers behind its fair value, like your assumptions for future revenue, earnings and margins. A Narrative connects three pieces: what you believe about the business, how that belief translates into a financial forecast, and the fair value that drops out of those forecasts. On Simply Wall St, millions of investors build and share these Narratives on the Community page, making it easy to see different scenarios for the same stock in an approachable, visual way. Narratives also help you decide when to buy or sell by constantly comparing each scenario’s Fair Value to the current market Price, and they update dynamically as new information, such as fresh earnings or major news, flows in. For Bitmine Immersion Technologies for example, one Narrative might assume aggressive adoption of immersion cooling and assign a very high fair value, while another assumes persistent losses and minimal growth, leading to a much lower fair value and a very different decision.

Do you think there's more to the story for Bitmine Immersion Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报