Humana (HUM): Reassessing Valuation After Outlook Cut and Growing Pharmacy Partnership Hopes

Humana trims outlook as Medicare pressures persist, eyes pharmacy growth

Humana (HUM) recently cut its full year earnings outlook as Medicare Advantage pressures continue, even as investors focus on potential upside from a possible Mark Cuban pharmacy partnership and ongoing expansion at its CenterWell pharmacy division.

See our latest analysis for Humana.

The stock tells a mixed story, with a solid 1 month share price return of 7.65 percent, but a weaker 1 year total shareholder return of negative 6.45 percent and an even steeper 3 year total shareholder return decline of 49.25 percent. This suggests that recent momentum is only cautiously rebuilding after a tough stretch.

If this kind of healthcare shake up has your attention, it might be worth exploring other opportunities across healthcare stocks to see how peers stack up on growth and resilience.

With shares still trading below analyst targets but a long term chart damaged by Medicare uncertainty, should investors treat Humana as a discounted turnaround story, or assume the market has already priced in any future pharmacy fueled growth?

Most Popular Narrative Narrative: 10.5% Undervalued

Compared with Humana's last close of $256.66, the most followed narrative sees fair value meaningfully higher, framing today's price as a potential discount.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.2x on those 2028 earnings, down from 20.8x today. This future PE is lower than the current PE for the US Healthcare industry at 21.0x.

Curious how earnings, margins and a sharply lower future multiple can still point to upside from here? The narrative's math might surprise you.

Result: Fair Value of $286.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering uncertainty around Medicare Advantage Star ratings and tougher reimbursement dynamics could quickly derail the recovery story if profitability lags expectations.

Find out about the key risks to this Humana narrative.

Another Lens on Valuation

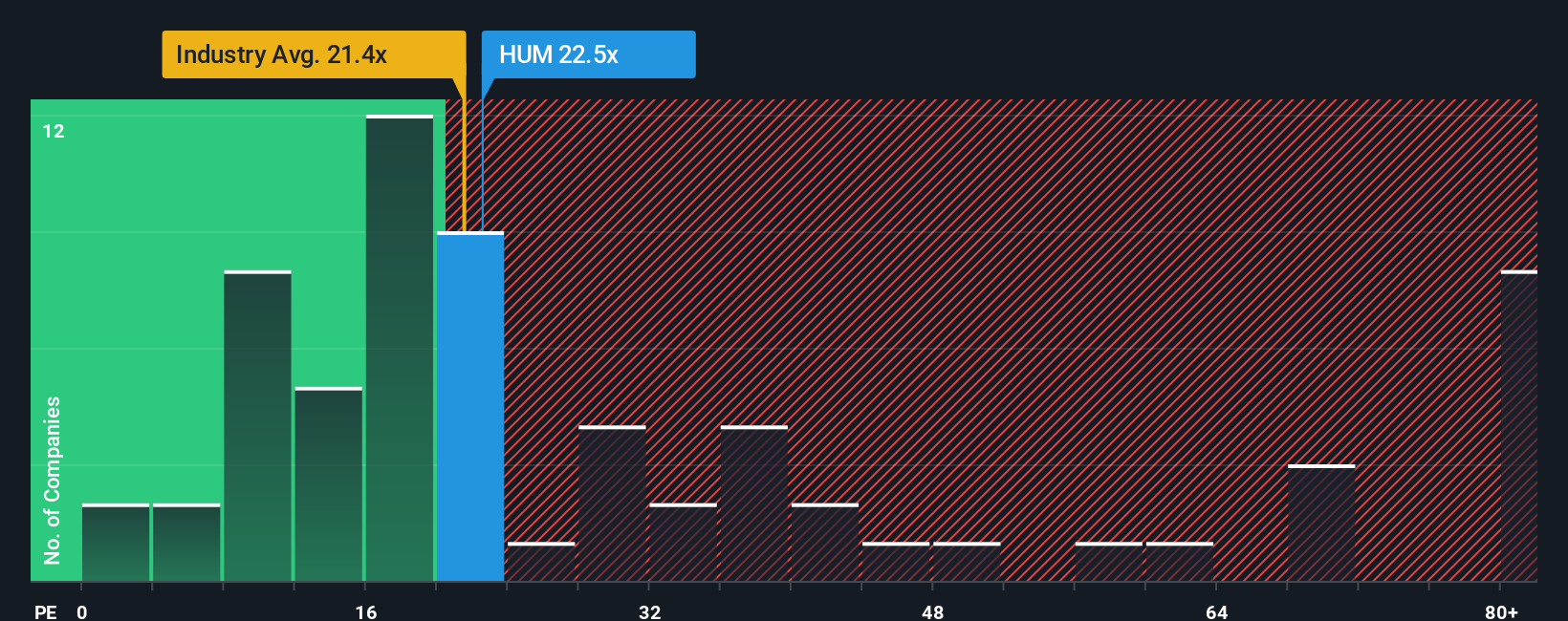

While the narrative points to a roughly 10 percent discount to fair value, the market is not exactly giving Humana away on earnings. Shares trade on about 23.9 times earnings versus 22.4 times for the US healthcare sector, even though its earnings have been under pressure.

Our fair ratio suggests the multiple could sit closer to 40.5 times. This implies the market might eventually pay up if growth recovers. It also means any earnings disappointment could punish the stock from a relatively full starting point, so which side of that trade do you want to be on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Humana Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized thesis in just a few minutes, Do it your way.

A great starting point for your Humana research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, put your research momentum to work by scanning fresh ideas with the Simply Wall St screener so potential winners never slip past you.

- Harness overlooked value and target mispriced opportunities by running through these 906 undervalued stocks based on cash flows, grounded in future cash flows rather than headlines.

- Capitalize on technology’s next wave by sorting through these 26 AI penny stocks, which are using artificial intelligence to reshape industries and long term growth prospects.

- Build a reliable income stream by zeroing in on these 12 dividend stocks with yields > 3%, aiming to balance yield with financial strength and long term sustainability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报