Is Santander’s Focus on Large Mortgages Reframing Its UK Strategy for Banco Santander (BME:SAN)?

- In early December 2025, Santander joined more than 20 UK lenders in trimming mortgage rates ahead of an anticipated Bank Rate cut, including a 3.51% deal for home movers on loans between £500,000 and £2,000,000.

- The decision to offer sharper pricing only on larger mortgages highlights Santander’s focus on higher-value, lower-unit-cost lending as competition intensifies in the UK housing market.

- We’ll now examine how Santander’s selective mortgage rate cuts fit into its wider investment narrative around earnings stability and digital-led efficiency.

Find companies with promising cash flow potential yet trading below their fair value.

Banco Santander Investment Narrative Recap

To own Banco Santander, you need to believe its diversified footprint and digital push can support reasonably steady earnings while it manages credit risk in core markets like Brazil. The UK mortgage rate trims look commercially targeted rather than transformational, so they do not materially change the near term earnings catalyst or the key risks around loan quality and technology execution.

The most relevant recent update here is Santander’s Q3 2025 results, which showed solid nine month net income of €10,337 million and reaffirmed full year guidance. Against that backdrop, selective UK pricing moves look like part of the broader effort to balance margin pressures with growth, while the ongoing ONE Transformation remains a central swing factor for future efficiency and returns.

Yet behind these headline numbers, investors should also watch the risk that prolonged stress in Brazil could...

Read the full narrative on Banco Santander (it's free!)

Banco Santander's narrative projects €63.8 billion revenue and €13.2 billion earnings by 2028.

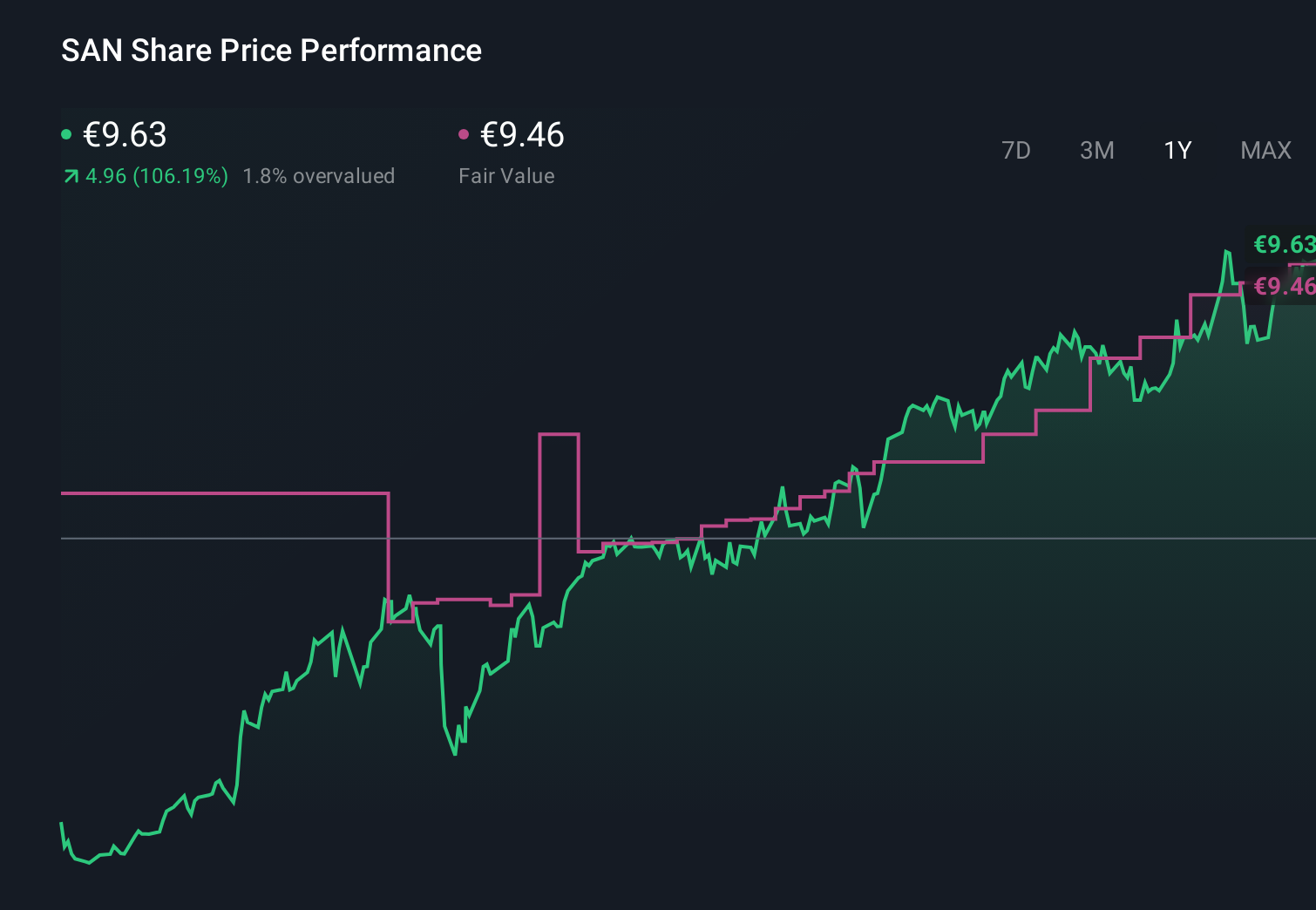

Uncover how Banco Santander's forecasts yield a €9.46 fair value, in line with its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community currently value Santander between €6.14 and €43.78, highlighting how far individual estimates can stretch. Set this wide range against the ongoing ONE Transformation catalyst, which could be decisive for future cost efficiency and earnings stability, and you can see why it pays to compare several viewpoints before forming your own.

Explore 9 other fair value estimates on Banco Santander - why the stock might be worth over 4x more than the current price!

Build Your Own Banco Santander Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banco Santander research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Banco Santander research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banco Santander's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报