DexCom (DXCM): Reassessing Valuation After Launch of Dexcom Academy for Healthcare Professionals

DexCom (DXCM) just rolled out Dexcom Academy, a tailored learning platform for healthcare professionals that could quietly reshape how its continuous glucose monitors are used day to day and, in turn, how investors view the stock.

See our latest analysis for DexCom.

That launch lands at an interesting moment, with the share price at $67.55 and a 30 day share price return of 23.18% suggesting short term momentum is rebuilding, even as the 1 year total shareholder return of negative 16.06% underlines how much confidence was dented by the class action headlines and earlier drawdown.

If Dexcom Academy has you thinking about where innovation and execution might show up next in healthcare, it is worth exploring healthcare stocks as potential follow up ideas.

With shares still down sharply over one and three years, yet trading at a roughly 47 percent discount to intrinsic value estimates, the real question now is whether DexCom is a mispriced recovery story or if markets already see the next leg of growth.

Most Popular Narrative: 19.9% Undervalued

With DexCom closing at $67.55 against a narrative fair value near the mid $80s, the gap rests on ambitious growth and margin expectations.

The recent expansion of insurance reimbursement for type 2 non insulin diabetes patients now covering nearly 6 million lives across the three largest U.S. PBMs opens a large, previously untapped segment of DexCom's addressable market, driving new patient growth and supporting robust multi year revenue expansion. Growing global recognition of CGM efficacy, with recent clinical trial evidence and expanded coverage in international markets (e.g., France, Japan, and Ontario, Canada), positions DexCom to penetrate underpenetrated regions and diversify revenue streams, creating sustainable top line growth.

To understand how this growth wave may translate into a richer margin profile and higher earnings power, while still using a disciplined discount rate and premium valuation multiple, the full narrative outlines the playbook and the numbers behind it.

Result: Fair Value of $84.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, upcoming Medicare competitive bidding and intensifying CGM competition could squeeze pricing power, dent margins, and challenge the long term growth assumptions underpinning this narrative.

Find out about the key risks to this DexCom narrative.

Another Angle on Valuation

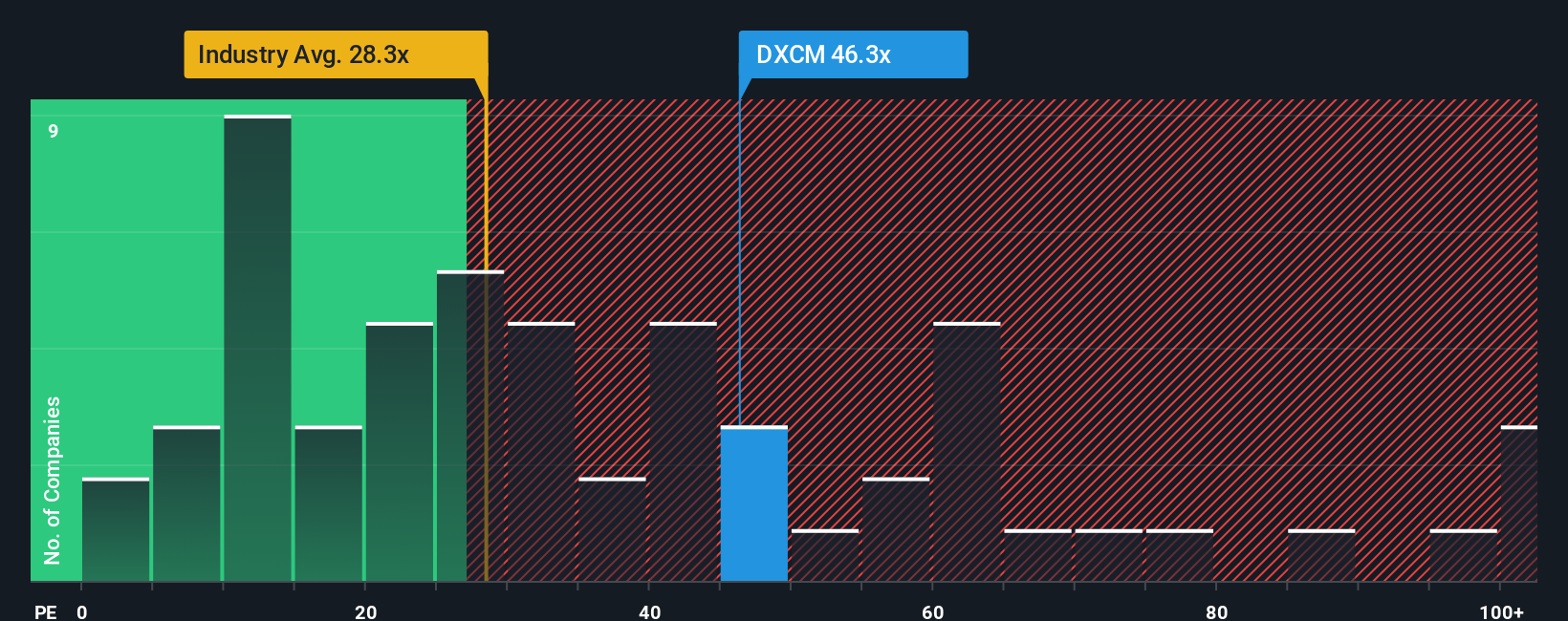

Step back from narrative fair value and the picture looks tighter. At 36.6 times earnings versus a fair ratio of 34.6 times and an industry average of 29.5 times, DexCom screens as expensive, even if it is cheaper than peers on 42.4 times. Is that premium really safe?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DexCom Narrative

If you see things differently or want to test your own assumptions with the numbers, build a complete DexCom thesis in minutes by starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding DexCom.

Ready for more investment ideas?

Before you move on, lock in your next round of opportunities by using the Simply Wall Street Screener to uncover stocks that fit your exact strategy.

- Capture potential mispricings by screening for companies that our models flag as attractively valued using these 900 undervalued stocks based on cash flows.

- Target powerful trends in automation and machine learning by filtering for innovators at the intersection of growth and technology through these 26 AI penny stocks.

- Strengthen your portfolio’s income stream by searching for companies with reliable cash returns using these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报