Is CVS Health Still Attractive After Its 2025 Rally and Cash Flow Outlook?

- If you are wondering whether CVS Health is still a bargain after its big comeback, you are not alone. This stock has quietly turned into one of the more interesting value stories in healthcare.

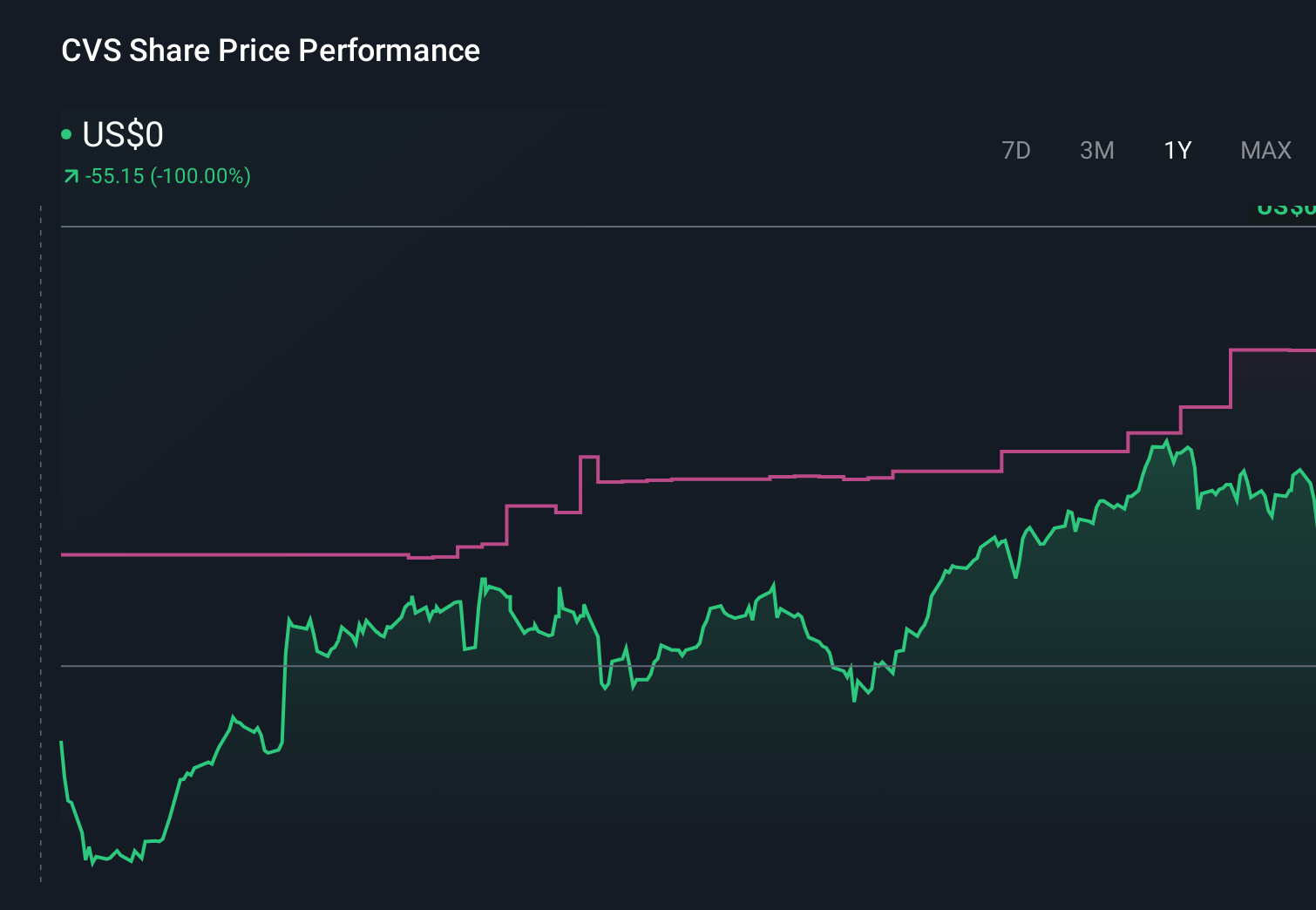

- After a choppy few years, CVS is up 76.9% year to date and 47.9% over the last 12 months, even though the last month was slightly negative at -0.9% and the last week only inched ahead by 0.8%.

- Part of this renewed interest comes from CVS leaning harder into its integrated healthcare model, combining retail pharmacies, insurance, and care delivery to capture more of the patient journey. At the same time, headlines around drug pricing, pharmacy competition, and shifting reimbursement dynamics are reshaping how investors think about the risks and rewards of its strategy.

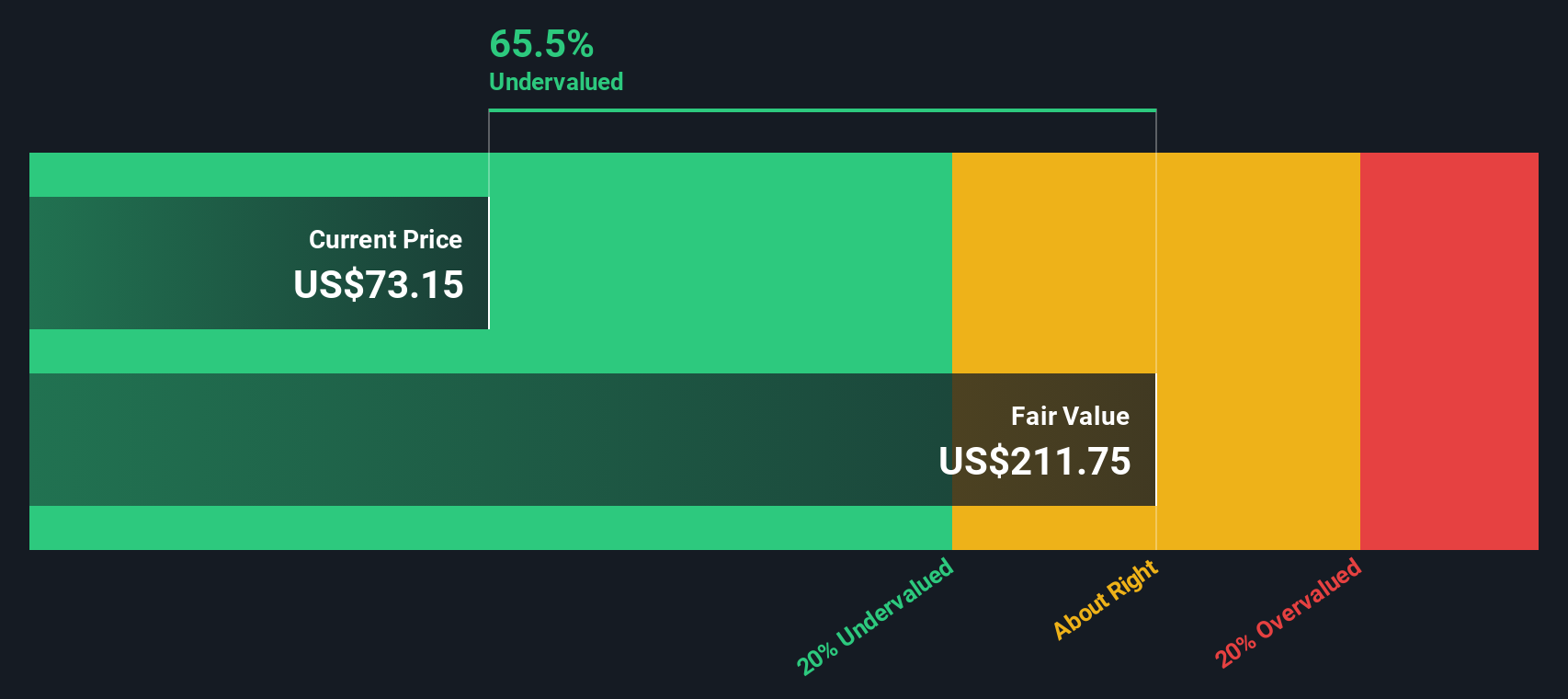

- On our valuation framework, CVS scores a solid 5/6, suggesting it screens as undervalued on most of the metrics we track. Next, we will break down those different valuation approaches and then finish with a more holistic way of thinking about what CVS is really worth.

Approach 1: CVS Health Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and discounting them back to today, using a rate that reflects risk and the time value of money.

For CVS Health, the latest twelve month Free Cash Flow stands at roughly $6.1 Billion. Analyst and extrapolated forecasts see this growing to around $11.9 Billion by 2029, with a 10 year path that climbs from about $7.8 Billion in 2026 to more than $17.3 Billion by 2035. These figures are based on a 2 stage Free Cash Flow to Equity framework that extends analyst estimates with Simply Wall St projections.

When all those projected cash flows are discounted back to today, the DCF model points to an intrinsic value of about $238.58 per share. With the DCF implying the shares trade at a 67.2% discount to that value, the stock currently screens as materially undervalued on this cash flow basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CVS Health is undervalued by 67.2%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

Approach 2: CVS Health Price vs Sales

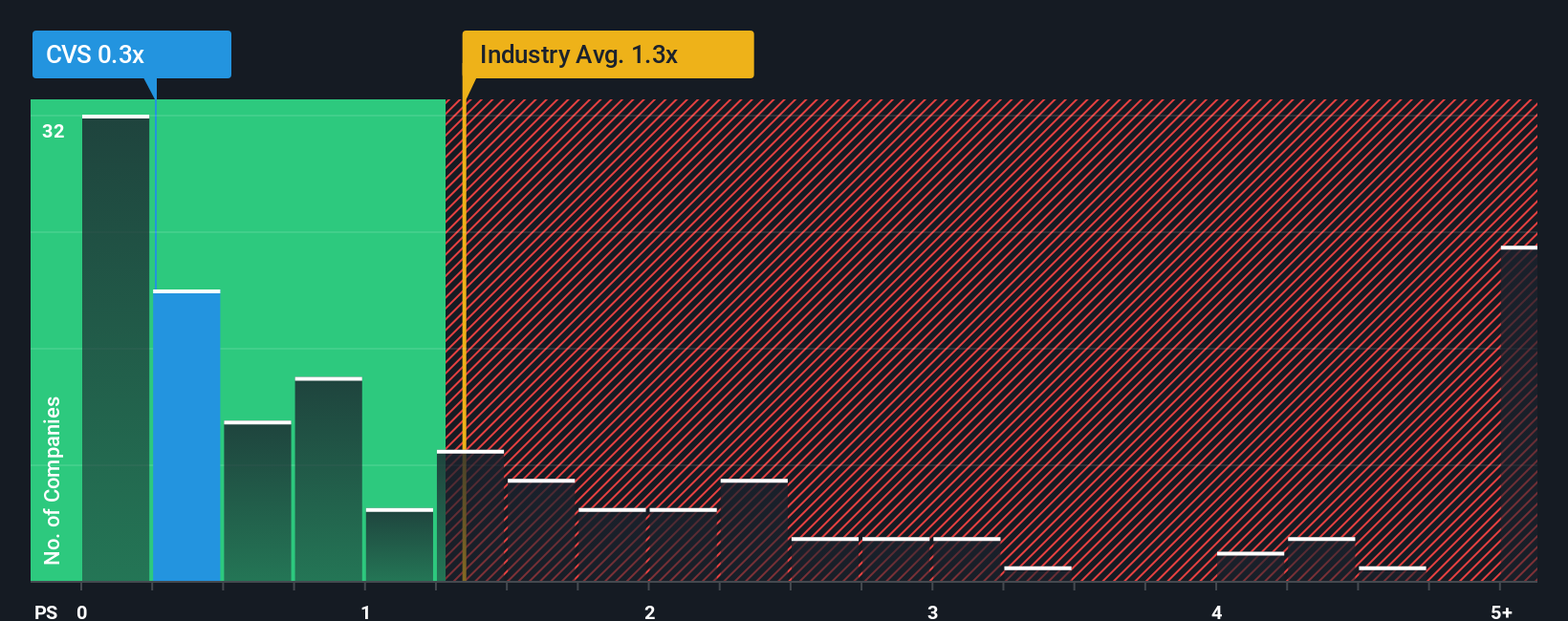

For companies like CVS Health that are profitable but operate with a complex mix of segments, the Price to Sales multiple is a useful way to value the whole business on the revenue it generates, smoothing out short-term earnings noise.

In general, investors are willing to pay a higher sales multiple when they expect faster growth and view the business as lower risk, while slower, riskier names usually trade on a lower Price to Sales ratio. CVS currently trades on a very low 0.25x Price to Sales multiple, compared with the broader Healthcare industry at about 1.28x and a peer group average of roughly 4.63x. On simple comparisons, this makes CVS look extremely cheap.

Simply Wall St introduces a Fair Ratio for Price to Sales, which estimates what multiple CVS should trade on after adjusting for its growth outlook, profitability, industry position, size, and risk profile. This tailored yardstick is more informative than blunt peer or industry comparisons because it incorporates whether CVS deserves a discount or premium. For CVS, the Fair Ratio is around 1.28x, well above the current 0.25x, which suggests the stock appears meaningfully undervalued on a sales basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CVS Health Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St's Community page that lets you pair your view of a company's story with concrete forecasts for revenue, earnings, margins and a resulting fair value. You can then compare that fair value to the current price to decide whether to buy, hold or sell, while the numbers automatically update as new news or earnings arrive. For CVS Health, for example, one optimistic Narrative might lean into Medicare Advantage margin recovery, digital integration and value based care to justify a higher fair value. A more cautious Narrative could focus on reimbursement pressure, retail headwinds and policy risk to arrive at a much lower fair value. This gives you a dynamic, side by side view of how different perspectives on the same business translate into very different investment decisions.

Do you think there's more to the story for CVS Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报