Progyny (PGNY): Revisiting Valuation After a 10% Monthly Rally and 57% One-Year Share Price Surge

Progyny (PGNY) has quietly climbed about 10% over the past month and roughly 57% over the past year, prompting a closer look at what is driving sentiment around this fertility benefits specialist.

See our latest analysis for Progyny.

That recent 10.4% 1 month share price return, on top of a strong year to date share price gain, suggests momentum is rebuilding as investors refocus on Progyny’s growth and reassess past worries reflected in its weaker multi year total shareholder returns.

If Progyny’s move has you rethinking healthcare exposure, it could be a good moment to explore other specialised names using our healthcare stocks for fresh ideas.

With shares still trading below analyst targets yet up sharply over the past year, investors now face a key question: is Progyny undervalued relative to its growth, or is the market already pricing in its next leg higher?

Most Popular Narrative Narrative: 12.6% Undervalued

With Progyny last closing at $24.70 against a narrative fair value of $28.25, the current share price sits meaningfully below that long term view.

The analysts have a consensus price target of $28.25 for Progyny based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of $23.0.

Want to see what kind of revenue growth, margin lift, and future earnings power are needed to back this projection? The narrative spells out a detailed financial roadmap.

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent employer cost cutting or tougher competition from larger health insurers could curb benefit adoption and pressure Progyny’s growth and valuation thesis.

Find out about the key risks to this Progyny narrative.

Another View: Rich Multiples Signal a Different Risk

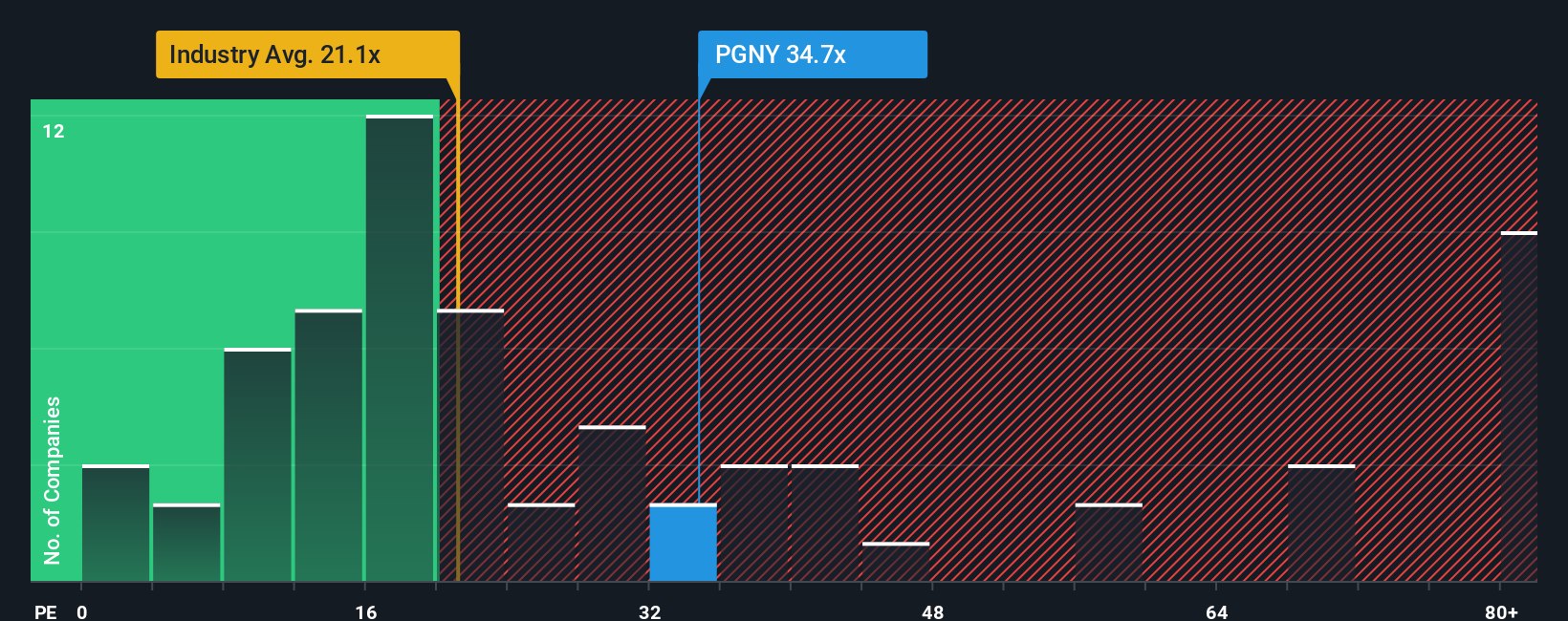

While the narrative fair value suggests upside, the price tag looks demanding on earnings. Progyny trades on a 37.6x P/E, well above both the US Healthcare sector at 22.2x and a 26.1x fair ratio our model points to, leaving less room for disappointment if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Progyny Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalised Progyny story in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Progyny.

Ready to act on your next idea?

Before the market moves without you, put Progyny in context by scanning fresh opportunities on Simply Wall St’s powerful screener and shaping your next smart move.

- Capture potential mispricings by scanning these 906 undervalued stocks based on cash flows that our models flag as trading below their estimated cash flow value.

- Tap into the innovation wave with these 27 AI penny stocks targeting companies harnessing artificial intelligence to transform entire industries.

- Strengthen your income stream through these 15 dividend stocks with yields > 3% offering yields above 3% with the fundamentals to support those payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报