Morgan Stanley Is Sweetening on MP Materials Stock Following ‘Historic Deal.’ Should You Buy MP Here?

In a decisive turn, Morgan Stanley (MS), has upgraded MP Materials (MP) to “Overweight,” citing a newly confirmed “historic deal” that transforms the company from a mining play into a cornerstone of U.S. critical-materials security.

MP is being repositioned as a strategic asset in a global supply-chain recalibration, with backing from the U.S. Department of Defense (DOD) and a high-stakes joint venture aimed at building a fully domestic “mine-to-magnet” supply chain.

The company is building a fully domestic mine-to-magnet chain, aiming to start commercial magnet production by late 2025 with capacity potentially reaching 7kt. The new joint venture with the DOD and Saudi miner Ma’aden adds operational flexibility at zero cost and could open an additional supply of heavy rare earths. However, supply-chain frictions persist, and execution remains the biggest risk.

It remains to be seen whether the company is truly delivering long-term value or whether this bullish consensus is simply short-term hype driven by national-security headlines.

About MP Materials Stock

Headquartered in Las Vegas, Nevada, MP Materials is a rare-earth materials and magnetics company. Founded in 2017, the firm owns and operates the Mountain Pass mine, the only scaled rare-earth mining and processing facility in the U.S.

The company’s products include rare-earth oxides, separated rare-earth metals, and permanent-magnet precursor materials, serving high-tech markets such as electric-vehicle motors, wind turbines, defense equipment, robotics, and other advanced technologies. MP Materials’ market cap stands at around $10.846 billion.

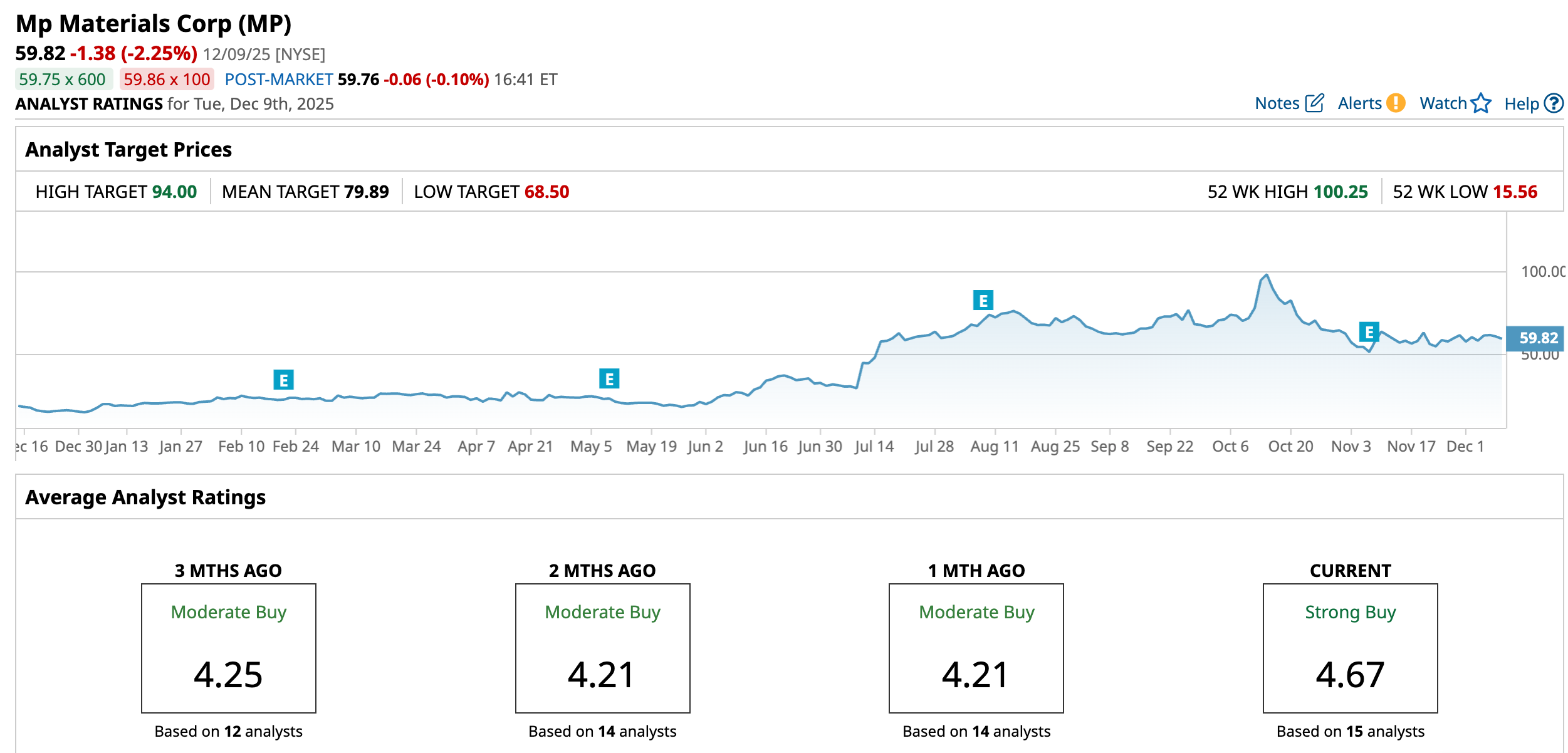

The stock has experienced a dramatic rebound in 2025, with its year-to-date (YTD) performance reflecting a surge of 283.46%, one of the strongest showings among rare-earth and mining peers. However, the stock is trading 40% below its 52-week high of $100.25, reached on Oct. 14. Nevertheless, shares are up 191.52% over the past year.

The sharp appreciation this year reflects major positive developments for MP. The company’s pivot from a pure miner to a vertically integrated rare-earth–to–magnet producer has resonated strongly with investors. A substantial catalyst was the deal with the DOD, which committed to making MP a central pillar of America’s domestic rare-earth and magnet supply chain.

Also, the company has delivered solid operational metrics, including record production of neodymium-praseodymium (NdPr) oxides and ramp-up of its magnetics business, which signals real progress toward its “mine-to-magnet” strategy.

The stock, evidently, trades at a premium valuation compared to industry peers and own historical average at 39.44 times price-to-sales forward.

A Solid Q3 Operational Performance

MP Materials released its third-quarter 2025 results on Nov. 6. The quarter was marked by a significant shift in its business model as the company continues transitioning from mostly selling rare-earth concentrates to producing separated rare-earth products and moving toward magnet manufacturing.

MP reported revenue of $53.6 million for Q3, a 15% year-over-year (YOY) decline, reflecting the decision to halt concentrate sales to China under new supply-chain alignments.

The company’s net loss came in at $41.8 million, compared to $25.5 million in the year-ago quarter. However, on a non-GAAP basis, loss per share was $0.10, compared to $0.12 in the prior-year quarter and better than the consensus estimate.

On the operational front, the company hit a milestone with record production of 721 metric tons of NdPr oxide, representing a 51% increase YOY. The rare-earth oxide (REO) production was the company’s second-highest quarterly at 13,254 metric tons. The results underscored the company’s strategy of shifting away from concentrate sales and toward higher-value, downstream rare-earth products.

Meanwhile, the Magnetics segment generated $21.9 million in revenue in Q3 2025 and reported $9.5 million in adjusted EBITDA. This marked the first significant revenue contribution from magnetics.

MP Materials reiterated that it expects to return to profitability in Q4 2025 and beyond, as its downstream and magnetics operations scale up and as pricing support under agreements with the U.S. government takes effect. It is targeting mid-2026 for commissioning a heavy rare-earth separation facility aimed at producing materials like dysprosium and terbium, which are critical for advanced magnet applications.

Analysts predict loss per share to be around $0.34 for fiscal 2025, an improvement of 41.4% YOY and improve by another 238.2% annually to an EPS of $0.47 in fiscal 2026.

What Do Analysts Expect for MP Materials Stock?

Morgan Stanley upgraded MP Materials to “Overweight” and lifted its price target to $71, highlighting its strengthening strategic position in the U.S. rare-earth supply chain.

Analysts continue to back the stock with a strong buy consensus as MP advances its fully domestic mine-to-magnet strategy, aiming to begin commercial magnet production by late 2025 for use in EVs, offshore wind turbines, and emerging humanoid robotics.

Apart from Morgan Stanley, BMO Capital, last month upgraded MP Materials to “Outperform.” While the firm trimmed its price target slightly to $75 from $76, it emphasized that U.S. dependence on foreign rare-earth supplies remains “blatantly apparent,” reinforcing MP’s long-term strategic value.

Also, Goldman Sachs initiated coverage on MP Materials with a “Buy” rating and a $77 price target. The firm emphasized MP’s role as the largest rare-earth producer in the Western Hemisphere, particularly its production of NdPr oxide essential for permanent magnets used in EVs, electronics, and defense applications. Goldman expects MP’s expansion into refining and magnet manufacturing to be a major strategic advantage.

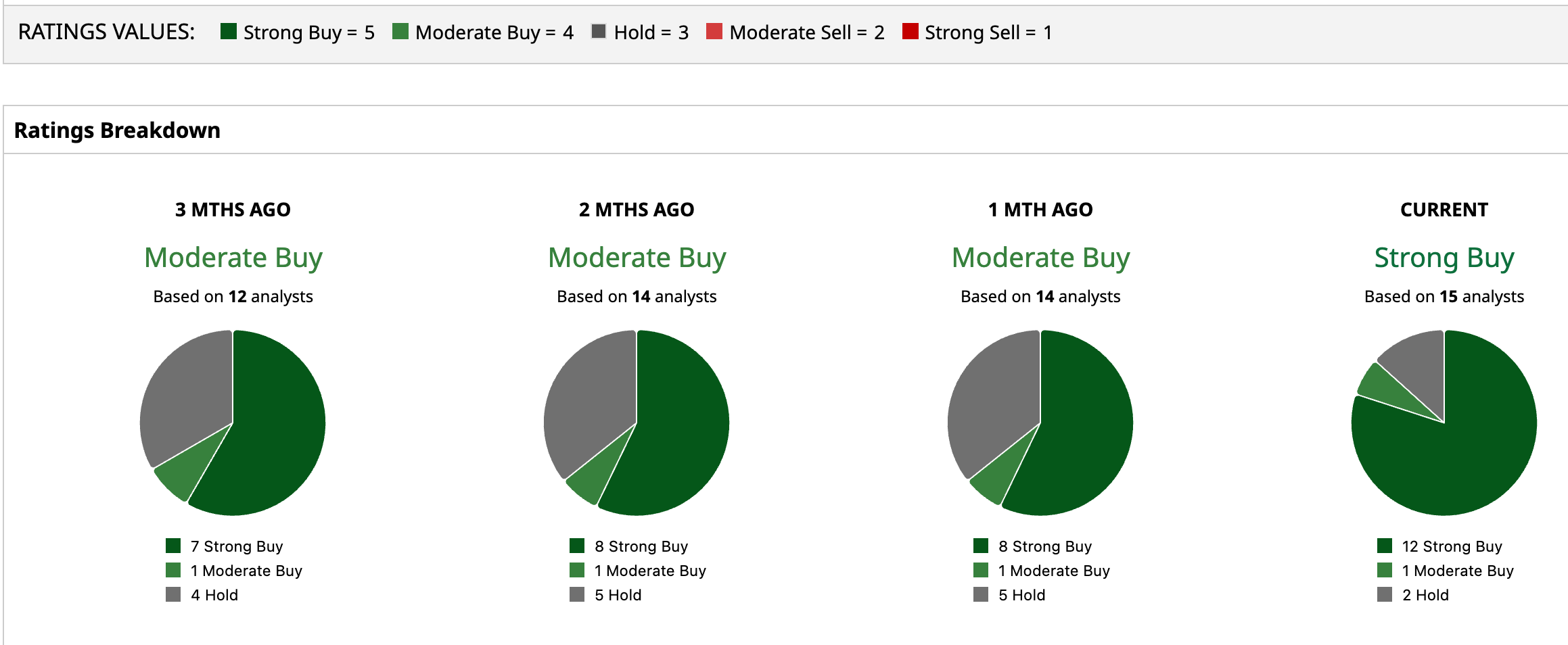

Overall, MP has a consensus “Strong Buy” rating. Of the 15 analysts covering the stock, 12 advise a “Strong Buy,” one suggests a “Moderate Buy,” and two analysts are on the sidelines, giving it a “Hold” rating.

The average analyst price target for MP is $79.89, indicating a potential upside of 39.43%. The Street-high target price of $94 suggests that the stock could rally as much as 57%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Nasdaq

Nasdaq 华尔街日报

华尔街日报