Asian Growth Companies With High Insider Ownership To Watch

As global markets navigate the complexities of economic slowdown and shifting monetary policies, Asian economies continue to capture investor attention with their unique growth opportunities. In this environment, companies in Asia that demonstrate strong insider ownership can offer insights into potential long-term value creation, as insiders often have a vested interest in the company's success.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 118.4% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's review some notable picks from our screened stocks.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meituan is a technology-driven retail company operating in China, Hong Kong, Macao, Taiwan, and internationally with a market cap of HK$594.62 billion.

Operations: The company's revenue is primarily derived from its Core Local Commerce segment, which generated CN¥262.69 billion, and its New Initiatives segment, contributing CN¥99.69 billion.

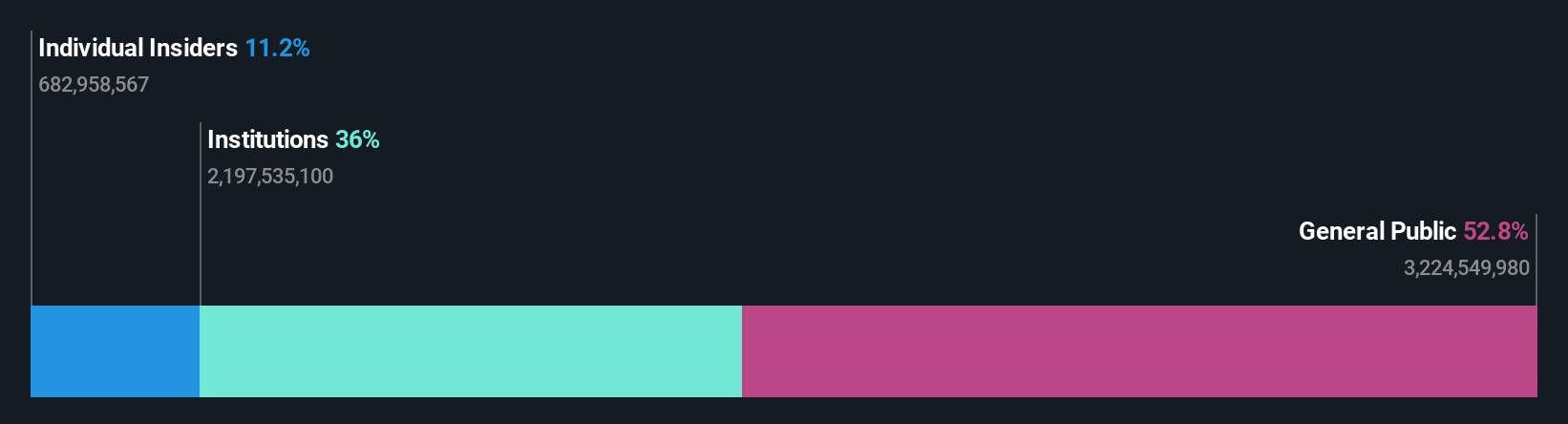

Insider Ownership: 11.2%

Meituan's recent earnings report highlights a challenging period, with a net loss of CNY 18.63 billion despite increased sales of CNY 95.49 billion for Q3 2025. However, the company is expected to achieve profitability within three years, with revenue growth forecasted at 11.4% annually, outpacing the Hong Kong market's average. Trading significantly below its estimated fair value and with high insider ownership, Meituan remains positioned for potential long-term growth despite current setbacks.

- Click to explore a detailed breakdown of our findings in Meituan's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Meituan shares in the market.

Joinn Laboratories(China)Co.Ltd (SHSE:603127)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Joinn Laboratories(China)Co.,Ltd. offers preclinical and non-clinical services across the United States, China, and other international markets, with a market capitalization of approximately CN¥20.45 billion.

Operations: Joinn Laboratories focuses on delivering preclinical and non-clinical services across various regions, including the United States, China, and other international markets.

Insider Ownership: 39.5%

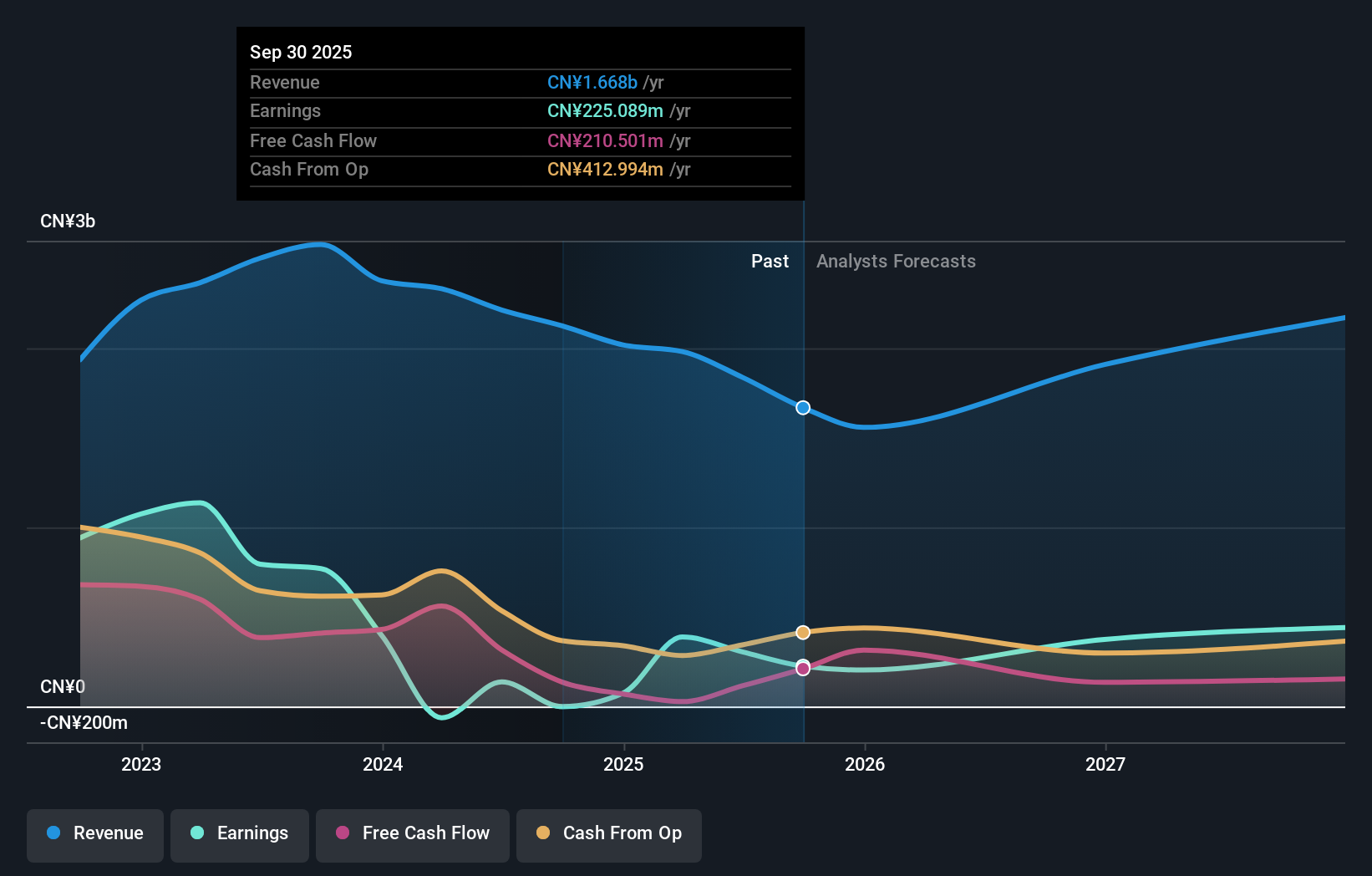

Joinn Laboratories (China) Co. Ltd. showcases a promising growth trajectory with earnings expected to increase significantly at 35.7% annually, surpassing the Chinese market's average. Despite recent insider selling and high share price volatility, the company's profitability turnaround this year marks a positive shift. Recent bylaw amendments may streamline governance and enhance operational efficiency. Although revenue growth is forecasted at 15% per year, it remains above the market average, underlining its potential as an evolving growth entity in Asia.

- Delve into the full analysis future growth report here for a deeper understanding of Joinn Laboratories(China)Co.Ltd.

- Upon reviewing our latest valuation report, Joinn Laboratories(China)Co.Ltd's share price might be too optimistic.

Puya Semiconductor (Shanghai) (SHSE:688766)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Puya Semiconductor (Shanghai) Co., Ltd. focuses on the research, development, design, and sale of non-volatile memory chips and memory-based derivative chips globally, with a market capitalization of CN¥20.20 billion.

Operations: The company's revenue primarily comes from its Integrated Circuit segment, generating CN¥1.87 billion.

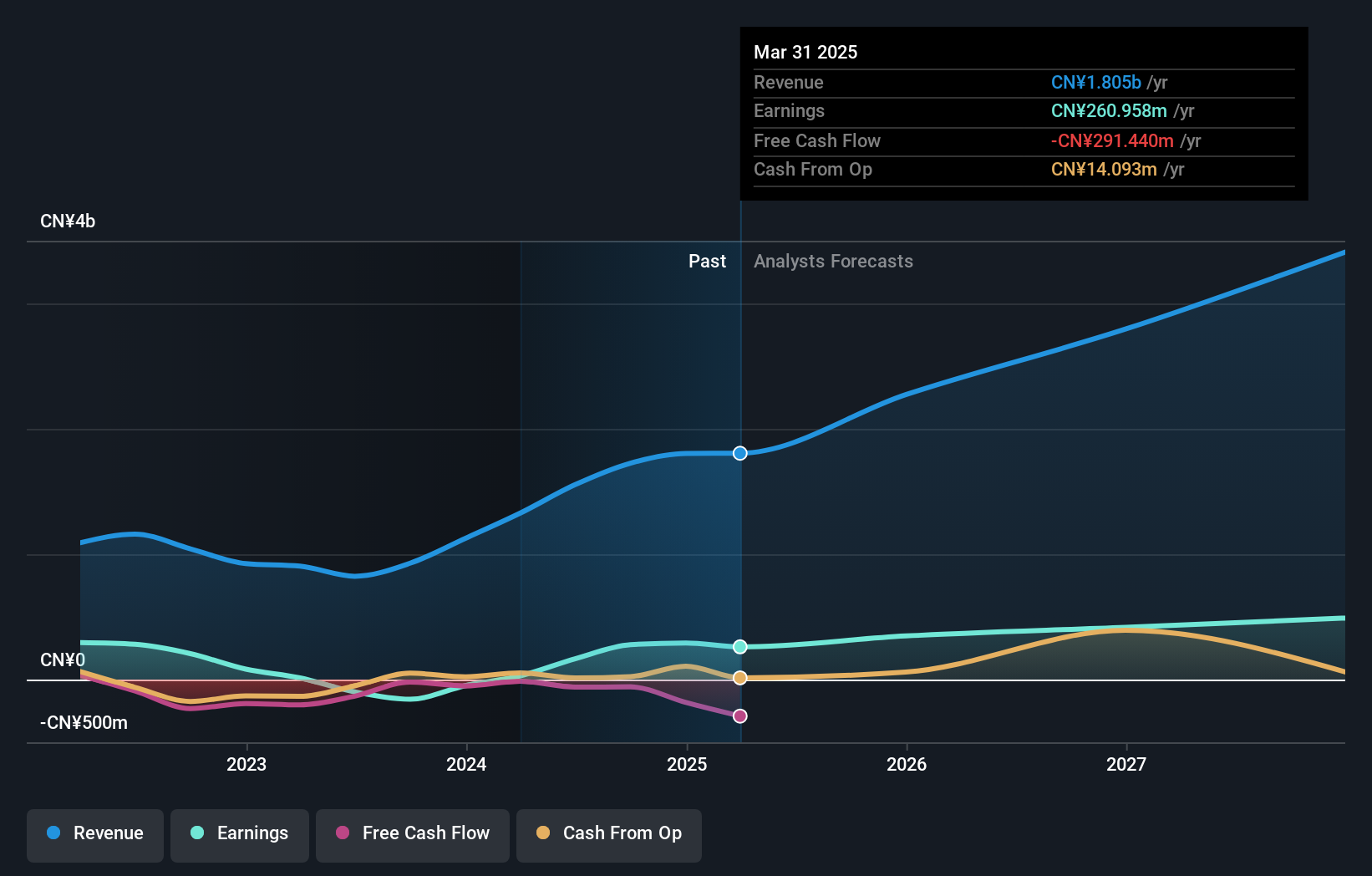

Insider Ownership: 23.7%

Puya Semiconductor (Shanghai) is positioned for robust growth with earnings projected to rise 53.6% annually, outpacing the Chinese market. Despite recent volatility and declining profit margins, its revenue is expected to grow significantly at 24.2% per year. While insider trading activity has been minimal, a recent acquisition of a 3.77% stake indicates investor interest. However, the dividend remains poorly covered by free cash flows, and return on equity forecasts are modest at 13.9%.

- Dive into the specifics of Puya Semiconductor (Shanghai) here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Puya Semiconductor (Shanghai) is trading beyond its estimated value.

Key Takeaways

- Explore the 639 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报