How Investors Are Reacting To Beiersdorf (XTRA:BEI) NIVEA’s ₦3bn Nigeria Real Madrid-Linked Reward Push

- Earlier this month, Beiersdorf Nigeria launched NIVEA’s largest-ever consumer engagement campaign, a ₦3.00 billion reward program with cash prizes, SUVs, travel experiences and other benefits designed to deepen loyalty in a challenging macroeconomic backdrop.

- The promotion’s link to NIVEA’s extended five-year partnership with Real Madrid highlights how the brand is tying high-profile sports marketing to on-the-ground incentives in a key African growth market.

- We’ll now examine how this record ₦3.00 billion Nigerian reward rollout could influence Beiersdorf’s broader investment narrative around emerging market expansion.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Beiersdorf Investment Narrative Recap

To own Beiersdorf, you generally need to believe that its science-based brands can sustain pricing power while expanding in faster-growing regions. The ₦3.00 billion NIVEA campaign in Nigeria reinforces that emerging markets remain central to the growth story, but it does not materially change the near term catalyst, which is execution on premium innovation, or the key risk of rising marketing and digital investment outpacing sales growth.

The recently announced share buyback of up to €500 million is the most relevant backdrop to this Nigerian push, as it signals confidence in the brand portfolio while the company steps up spending on consumer engagement. How well Beiersdorf balances return of capital with heavier investment in markets like Nigeria will be crucial for margins and for how investors interpret the emerging market expansion pillar of the thesis.

Yet beneath the surface, investors should be aware that higher marketing and digital costs could still...

Read the full narrative on Beiersdorf (it's free!)

Beiersdorf's narrative projects €11.0 billion revenue and €1.2 billion earnings by 2028. This requires 3.8% yearly revenue growth and about a €318 million earnings increase from €882.0 million today.

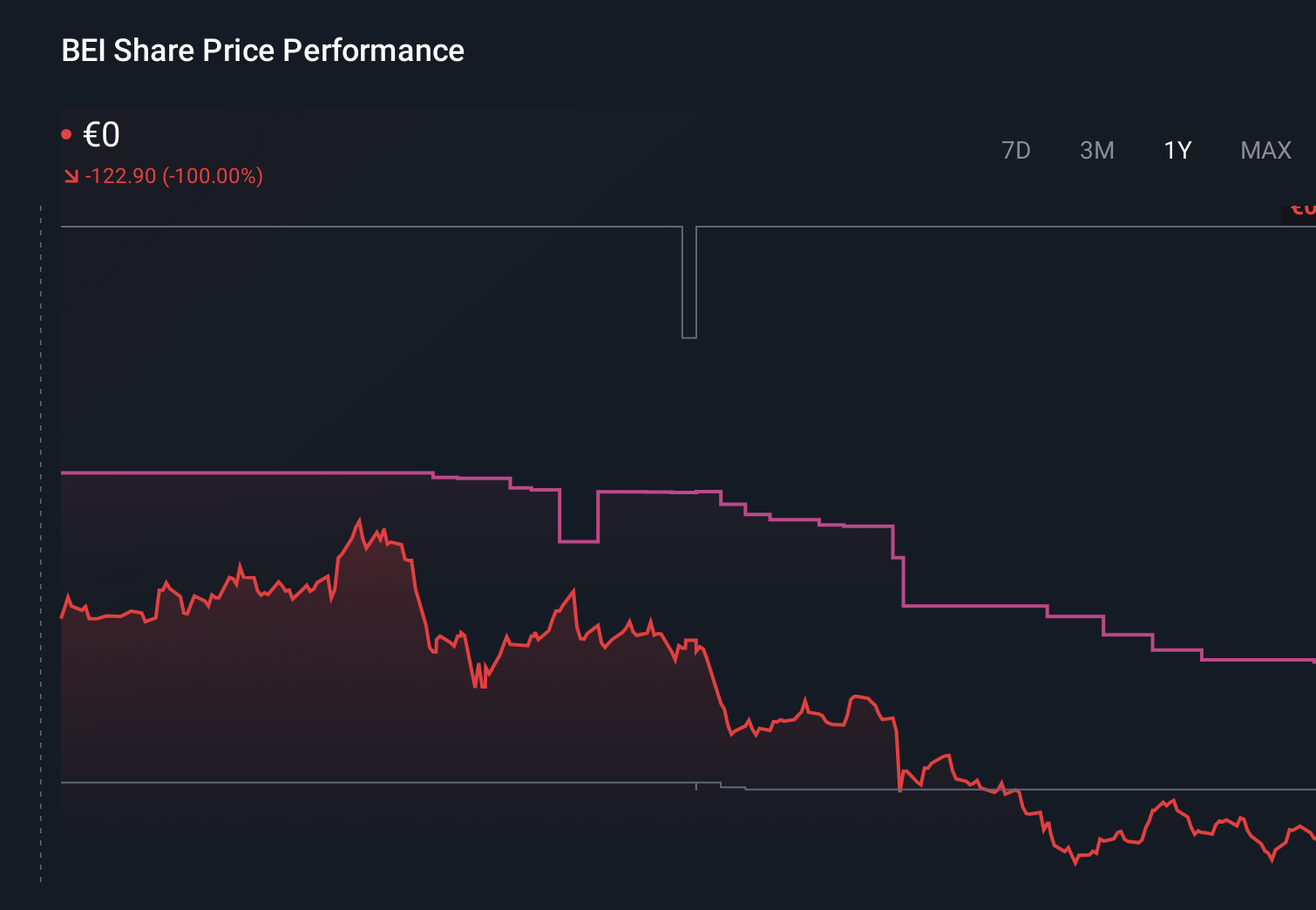

Uncover how Beiersdorf's forecasts yield a €116.58 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see Beiersdorf’s fair value between €96.95 and €163.77 across 4 independent views, underlining how far opinions can spread. You can weigh those against the risk that rising marketing and digital spend outpaces revenue growth, with clear implications for future profitability and capital allocation priorities.

Explore 4 other fair value estimates on Beiersdorf - why the stock might be worth as much as 80% more than the current price!

Build Your Own Beiersdorf Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beiersdorf research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Beiersdorf research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beiersdorf's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报