IMAX (IMAX): Valuation Check After Investor Day Targets and Expanded Wanda Film Partnership

IMAX (IMAX) has been getting fresh attention after its investor day, where management laid out growth targets above what many on Wall Street were expecting, along with an expanded China partnership with Wanda Film.

See our latest analysis for IMAX.

The upbeat investor day and fresh content partnerships seem to be feeding into a clear trend, with an 11.66% 1 month share price return and a 163.52% 5 year total shareholder return suggesting momentum is still building rather than fading.

If IMAX’s recent run has you rethinking where growth could come from next, this is a good moment to explore high growth tech and AI stocks as potential next wave entertainment and tech plays.

With IMAX stock already up sharply and trading only modestly below Street targets, yet still screening at an estimated intrinsic discount, the key question now is simple: is there still an opportunity to invest, or is future growth already reflected in the current price?

Most Popular Narrative Narrative: 1% Undervalued

With IMAX last closing at $38.50 against a narrative fair value near $38.81, the current price sits almost exactly where the story says it should.

Fair value has risen slightly, increasing from approximately $37.18 to about $38.81 per share, reflecting modestly stronger growth assumptions. The future P/E has increased slightly, from roughly 37.8x to about 39.4x forward earnings, implying a modest expansion in the valuation multiple applied to IMAX.

Want to see how mid single digit revenue growth, sharply rising margins, and a richer future earnings multiple all line up behind that tiny valuation gap? The full narrative reveals the mix of box office momentum and long term profitability assumptions that keep fair value closely aligned with today’s price.

Result: Fair Value of $38.81 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained streaming gains, as well as any slowdown in blockbuster or local language tentpoles, could quickly pressure IMAX’s box office leverage and expansion thesis.

Find out about the key risks to this IMAX narrative.

Another View: Multiples Paint a Richer Picture

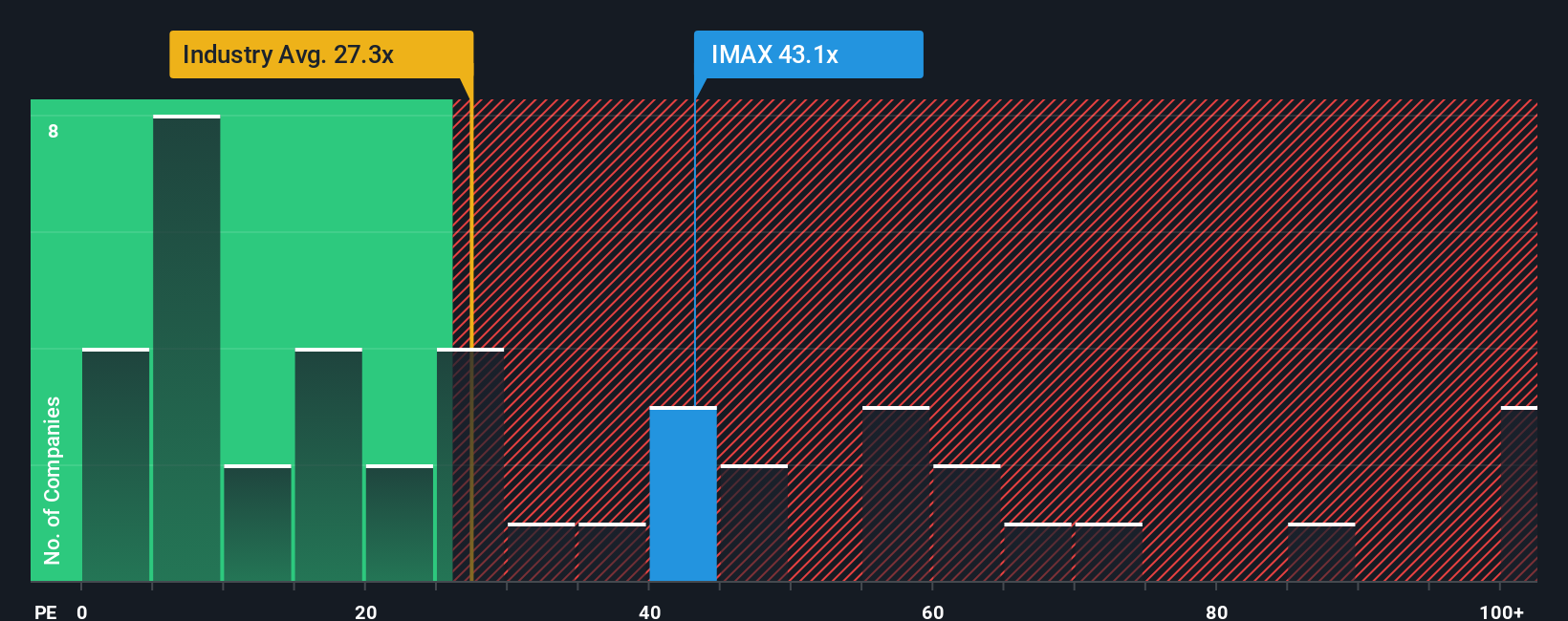

Step away from narrative fair value and the earnings multiple sends a tougher message. At about 52.4 times earnings versus a fair ratio near 19.9 times, and above both industry and peer averages, IMAX looks fully priced, raising the question of how much future upside is already baked in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IMAX Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes with Do it your way.

A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next potential opportunity with targeted stock ideas built from data, not guesswork, using the Simply Wall Street Screener.

- Identify potential mispriced opportunities by scanning these 906 undervalued stocks based on cash flows that still trade below what their cash flows suggest they are worth.

- Focus on the next wave of innovation by targeting these 27 AI penny stocks positioned at the heart of artificial intelligence developments.

- Strengthen your income strategy by focusing on these 15 dividend stocks with yields > 3% that may offer relatively stable payouts above mainstream yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报