Palomar Holdings (PLMR): Evaluating Valuation After Strong Premium Growth and Book Value Expansion

Palomar Holdings (PLMR) is drawing fresh attention after another period of strong business execution, with rapid growth in premiums and a meaningfully stronger balance sheet that underscores its expansion in niche insurance markets.

See our latest analysis for Palomar Holdings.

Despite a softer patch recently, with a negative 30 day share price return and the stock now at $115.43, Palomar still carries strong momentum when you zoom out. This is highlighted by a powerful three year total shareholder return above 120 percent that reflects investors steadily repricing its growth and balance sheet strength.

If Palomar’s run has you thinking about what else is quietly compounding in the background, this is a good moment to scan stable growth stocks screener (None results) for other resilient compounders.

With book value compounding at an exceptional pace and the shares still trading at a steep discount to analyst targets, is Palomar quietly undervalued today, or is the market already baking in years of future growth?

Most Popular Narrative Narrative: 27.9% Undervalued

With Palomar last closing at $115.43 against a narrative fair value of $160, the valuation story leans optimistic and hinges on ambitious growth assumptions.

Ongoing investment in proprietary technology, data analytics, and advanced underwriting disciplines is improving risk assessment and pricing accuracy, already reflected in strong combined ratios and low loss ratios. This is expected to enhance underwriting profitability and expand net margins over time.

Want to see what kind of revenue surge and margin trajectory this valuation is banking on? The narrative presents an earnings roadmap and a future profit multiple that aligns with leading peers in the market. Curious which financial levers matter most and how they compare with the wider insurance space? Follow through to explore the full set of projections behind that $160 fair value.

Result: Fair Value of $160 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and Palomar’s heavy exposure to catastrophe risks could quickly pressure premium growth, reinsurance costs, and the valuation upside in this narrative.

Find out about the key risks to this Palomar Holdings narrative.

Another Lens on Valuation

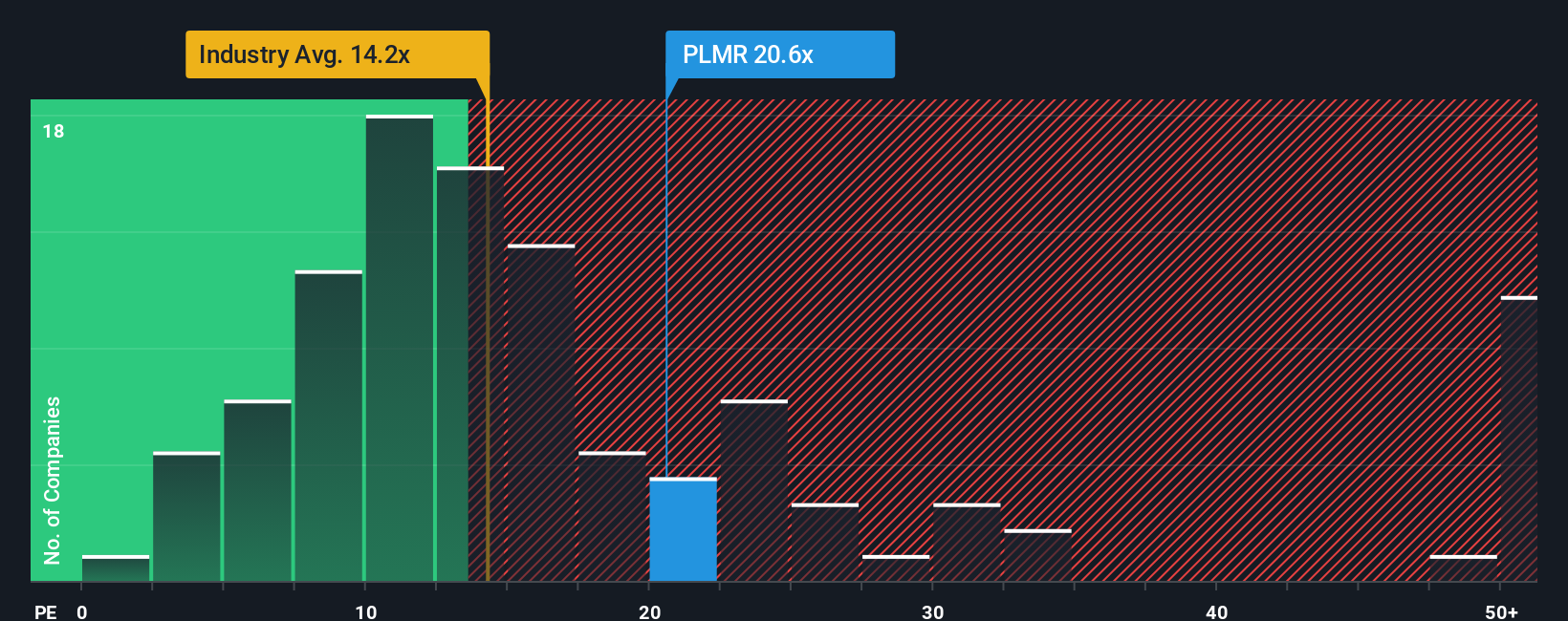

Multiples tell a different story. Palomar trades at about 17.4 times earnings versus a 16.2 fair ratio, 12.8 for the insurance industry, and 16.8 for peers, implying the stock looks expensive based on today’s numbers. Is this a justified quality premium or a valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Palomar Holdings Narrative

If you see the story differently, or simply prefer digging into the numbers yourself, you can build a bespoke view in minutes: Do it your way.

A great starting point for your Palomar Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing move?

Do not stop with Palomar. Lock in your edge by hunting for fresh opportunities across sectors using the Simply Wall Street Screener before the market catches up.

- Capture early-stage upside by scanning these 3593 penny stocks with strong financials that already show financial strength rather than speculation alone.

- Ride structural growth by targeting these 27 AI penny stocks positioned at the heart of transformative artificial intelligence trends.

- Lock in potential mispricings with these 908 undervalued stocks based on cash flows where current cash flows suggest the market has not yet recognized their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报