EQT (OM:EQT): Revisiting Valuation After Recent Gains and Three-Year Shareholder Returns

EQT (OM:EQT) has quietly added another month of gains, with the stock up around 3 % over the past month and roughly 6 % year to date, outpacing many European financial names.

See our latest analysis for EQT.

With the share price now at SEK 327.9 and a 30 day share price return of 2.76 % feeding into a 6.05 % year to date gain, EQT’s three year total shareholder return of 43.21 % suggests momentum is still broadly intact rather than fading.

If EQT’s run has you thinking about what else might be compounding steadily in the background, it could be a good time to explore fast growing stocks with high insider ownership.

But with EQT trading only slightly below analyst targets and growing earnings at a healthy clip, is the market underestimating its long term compounding potential, or already pricing in most of its future growth?

Most Popular Narrative: 12% Undervalued

With EQT last closing at SEK 327.9 against a narrative fair value of around SEK 372.6, the prevailing view is that markets are not fully recognizing its earnings power yet.

The firm's global diversification, especially its push into fast-growing Asian markets (e.g., India, Japan) and the U.S., positions it to benefit as more capital is funneled into private assets in these regions, supporting sustained AUM growth and higher future earnings.

Curious how ambitious revenue growth, rising margins and a richer earnings multiple combine to justify that upside gap? The full narrative unpacks the math behind this conviction.

Result: Fair Value of $372.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on fundraising momentum and smooth execution, with tougher capital raising or integration missteps potentially undermining the long term growth story.

Find out about the key risks to this EQT narrative.

Another View on Valuation

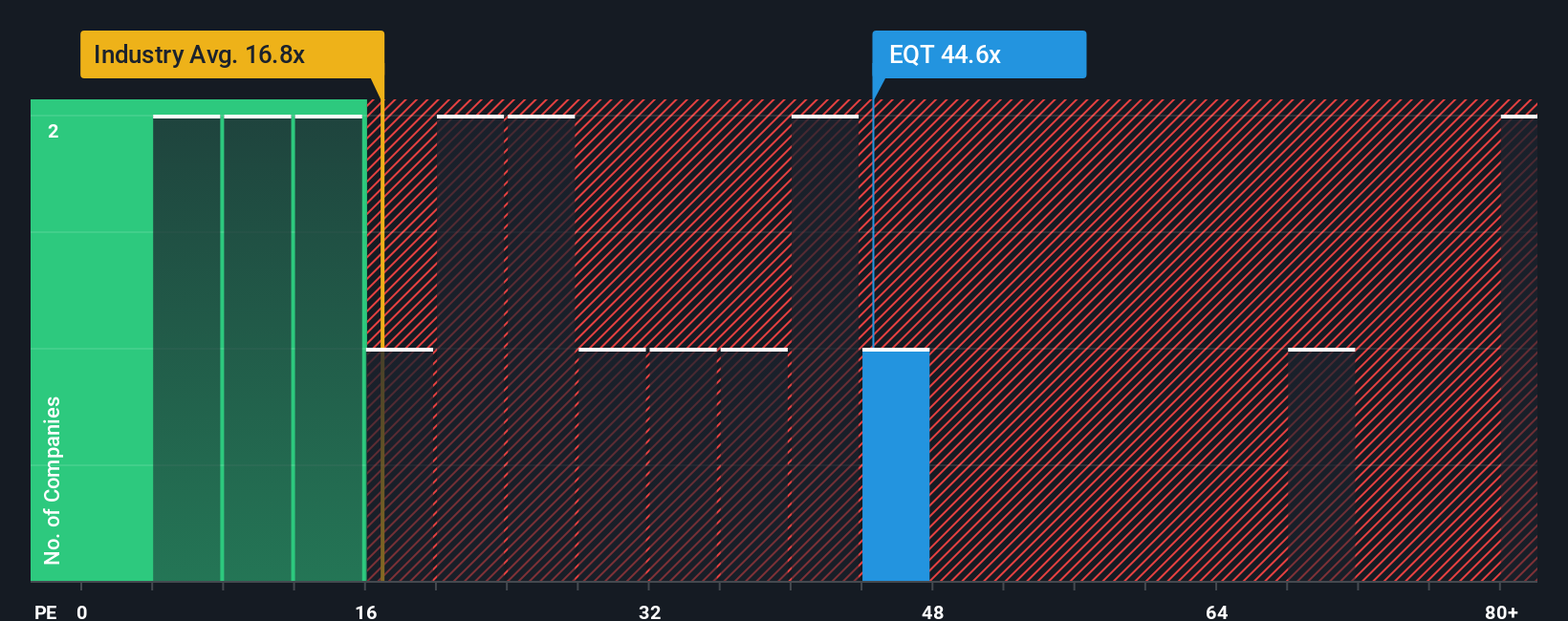

While the narrative framing suggests EQT is modestly undervalued, its 41.8x price to earnings ratio tells a tougher story. That is almost double the Swedish Capital Markets average of 21.9x and well above a fair ratio of 28.1x, implying limited margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EQT Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalised view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding EQT.

Looking for more investment ideas?

Put your research to work and look for your next opportunity with the Simply Wall Street Screener before others find the most compelling setups.

- Look for potential multi baggers early by scanning these 3593 penny stocks with strong financials that already show the financial strength to keep compounding.

- Position your portfolio in the productivity trend with these 27 AI penny stocks that support real world, revenue generating AI solutions.

- Look for a margin of safety by reviewing these 909 undervalued stocks based on cash flows where prices are compared with their projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报