Compass (COMP): Reassessing Valuation After Barclays Upgrade and HOUS Acquisition Optimism

Barclays has taken a more constructive view on Compass, upgrading the stock after highlighting expected benefits from its HOUS acquisition, an improved pitch to agents, and potential upside as existing home sales gradually recover.

See our latest analysis for Compass.

That backdrop helps explain why momentum in Compass shares has been building, with a 21.87% 1 month share price return, a 79.66% year to date share price return, and a striking 294.70% 3 year total shareholder return, even though the stock still trades at $10.42.

If Compass has caught your eye, it could be worth seeing what else is out there in real estate and beyond by exploring fast growing stocks with high insider ownership.

With shares hovering just below analyst targets yet still trading at a sizable intrinsic discount, is Compass a rare value play in a recovering housing cycle, or are investors already paying up for tomorrow’s growth?

Most Popular Narrative Narrative: 1.9% Overvalued

With Compass closing at $10.42 against a narrative fair value just above $10, the story leans toward only a slight premium to modeled fundamentals.

The analyst price target for Compass has been raised modestly, with fair value edging up to roughly $10.22 from about $10.06 as analysts factor in the accretive economics, scale advantages, and anticipated cost synergies from the Anywhere Real Estate acquisition.

Want to see what kind of revenue runway, margin lift, and future earnings multiple are needed to back this higher fair value story? The underlying projections connect ambitious top line growth, a step change in profitability, and a premium valuation that rivals some faster growing sectors. Curious how all those assumptions stack up over the next few years and what has to go right to justify them?

Result: Fair Value of $10.22 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated regulatory scrutiny on commissions, along with potential missteps integrating Anywhere Real Estate, could derail the margin expansion and growth profile underpinning this narrative.

Find out about the key risks to this Compass narrative.

Another Angle on Valuation

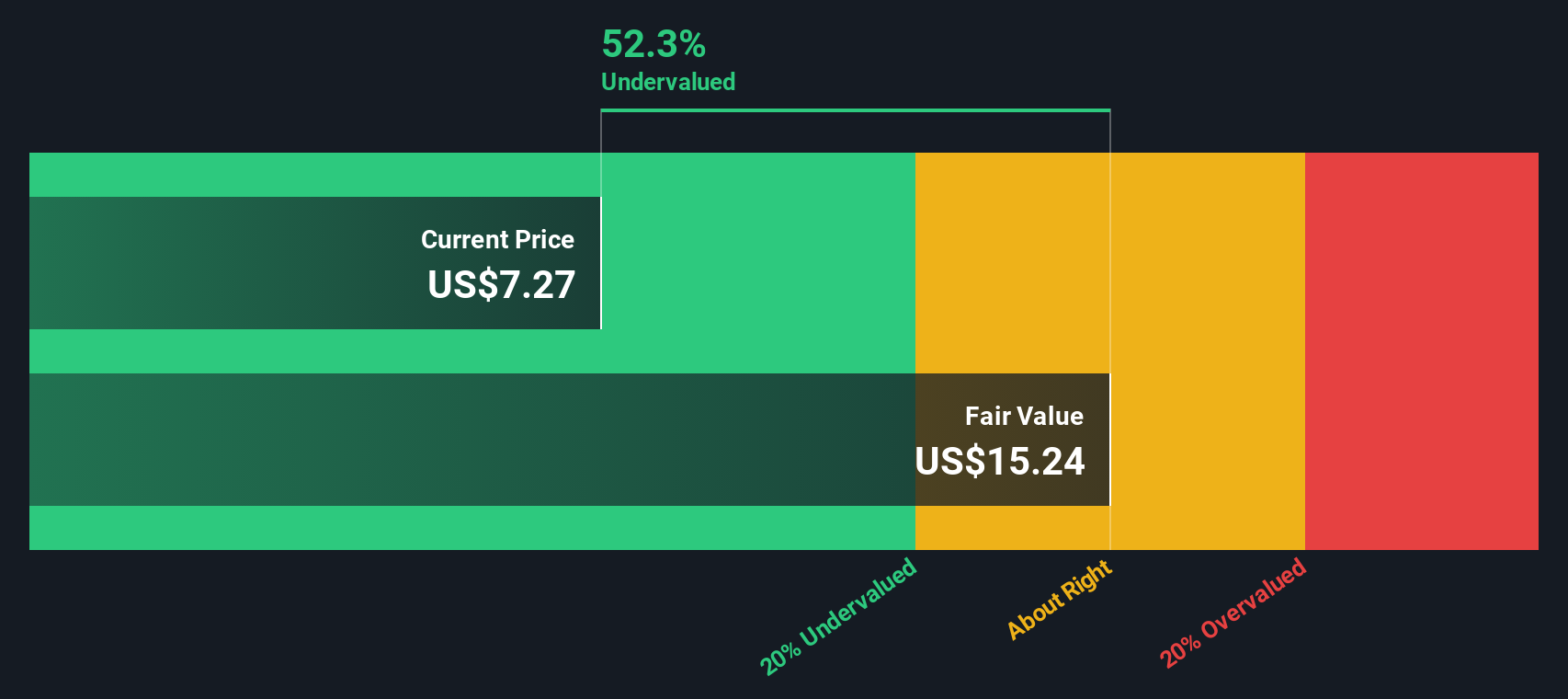

Analysts see Compass as roughly fairly priced, but our SWS DCF model suggests the stock is about 28.9% undervalued at $10.42 versus an estimated fair value of $14.65. Is the market underestimating the long term cash flow potential, or is it overestimating execution risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Compass Narrative

If you see the story differently or prefer digging into the numbers yourself, you can quickly craft a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Compass.

Looking for your next investing edge?

Do not stop with just one opportunity. Use the Simply Wall Street Screener to quickly spot clear, data driven ideas other investors might be missing today.

- Fuel your growth strategy by targeting companies priced below their cash flow potential through these 909 undervalued stocks based on cash flows before the crowd catches on.

- Capture the next wave of innovation by focusing on businesses harnessing machine learning and automation using these 27 AI penny stocks.

- Strengthen your income stream by pinpointing reliable payers with attractive yields via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报