Hilltop Holdings (HTH) Valuation Check After Steady Double-Digit Shareholder Returns

Hilltop Holdings (HTH) has been quietly rewarding patient investors, with the stock gaining about 23% this year and roughly 10% over the past year, despite only modest revenue growth and weaker earnings.

See our latest analysis for Hilltop Holdings.

The recent 4.9% 1 month share price return, together with a 10.1% 1 year total shareholder return, suggests steady, if unspectacular, momentum as investors slowly re rate Hilltop at around $34.63.

If Hilltop’s steady climb has you thinking about what else might be quietly compounding, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings under pressure but the share price grinding higher, the key question now is simple: is Hilltop still flying under the radar as a value opportunity, or is the market already baking in its future growth?

Most Popular Narrative: 2% Undervalued

With Hilltop closing at $34.63 against a narrative fair value of $35.33, the story leans slightly optimistic on what this bank is really worth.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.5x on those 2028 earnings, up from 13.1x today. This future PE is greater than the current PE for the US Banks industry at 11.3x.

Curious why a slow growing regional bank might deserve a premium multiple usually reserved for faster moving sectors? The narrative leans on shrinking profits, steady top line expansion, and a surprisingly rich future earnings multiple to bridge today’s price to tomorrow’s fair value. Want to see exactly how those moving parts are combined to reach that target?

Result: Fair Value of $35.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent mortgage headwinds and intensifying Texas competition could pressure margins and loan growth, which could quickly erode the case for a premium valuation.

Find out about the key risks to this Hilltop Holdings narrative.

Another View: Market Ratios Flash a Caution Signal

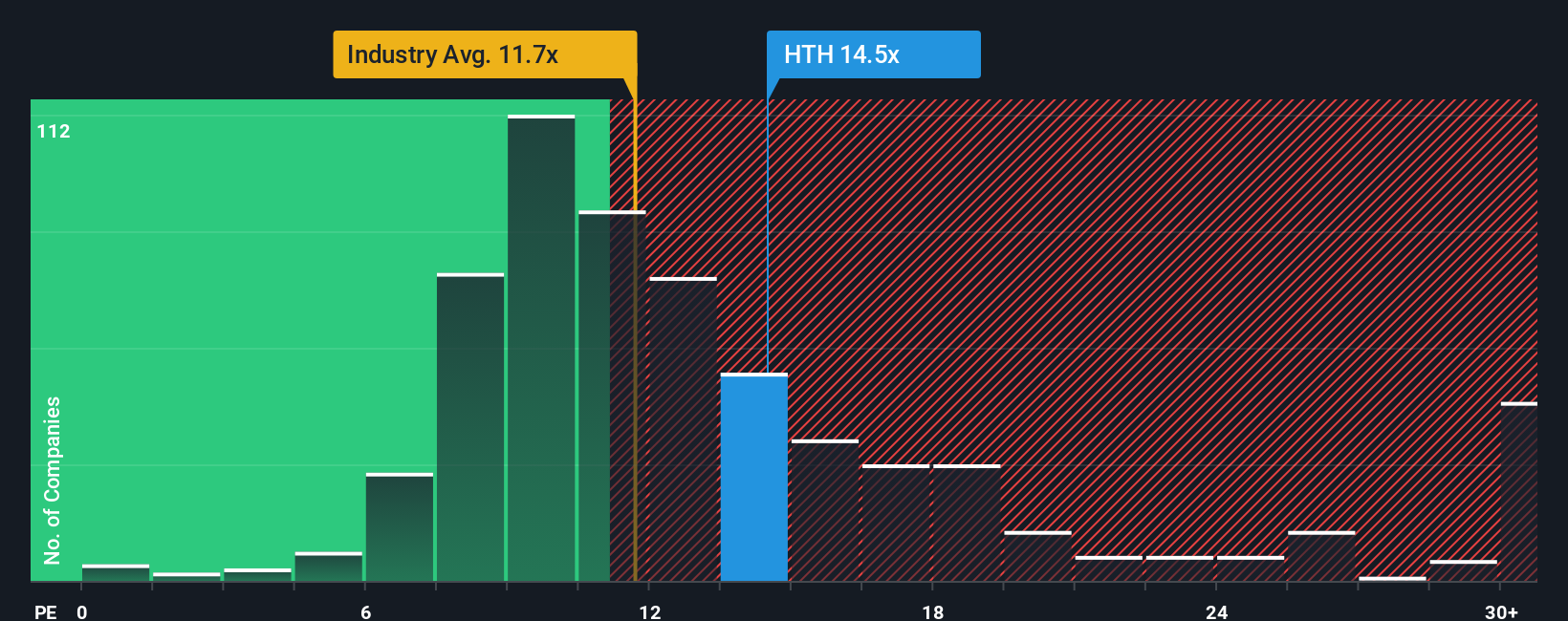

While the narrative fair value suggests Hilltop is about 2 percent undervalued, the earnings multiple paints a tougher picture. The stock trades on a price to earnings ratio of 13.3 times versus a banks industry average of 11.6 times and a fair ratio of 8.5 times, implying the market already prices in more strength than current forecasts support.

In practical terms, that gap leaves less room for error and more downside risk if earnings slip back toward the declines analysts expect over the next three years. If sentiment turns or growth disappoints, Hilltop’s valuation could drift back toward that lower fair ratio.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hilltop Holdings Narrative

If you see the story differently or would rather test your own assumptions against the numbers, you can build a full narrative in minutes: Do it your way.

A great starting point for your Hilltop Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with Hilltop. Use the Simply Wall St Screener now to uncover fresh opportunities before other investors rush into the market ahead of you.

- Capture potential mispricings by scanning these 909 undervalued stocks based on cash flows that may be trading below what their future cash flows truly justify.

- Ride the next wave of innovation by targeting these 27 AI penny stocks positioned to benefit from breakthroughs in artificial intelligence and automation.

- Strengthen your income strategy by focusing on these 15 dividend stocks with yields > 3% that combine robust business models with attractive, consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报