Reassessing Oki Electric Industry (TSE:6703)’s Valuation After Its Projection Assembly System Expansion in Southeast Asia

Oki Electric Industry (TSE:6703) just pushed its Projection Assembly System into Thailand and Indonesia, extending a proven Japanese factory tool into Southeast Asia and quietly opening a fresh growth channel for its digital manufacturing business.

See our latest analysis for Oki Electric Industry.

The timing of this rollout lines up neatly with the market’s growing optimism, with Oki’s share price now at ¥1,945 after an 87.6% year to date share price return and a 109.8% one year total shareholder return, suggesting investors are treating its global manufacturing DX push as a credible growth driver rather than a one off story.

If this expansion theme has you thinking bigger, it might be worth exploring fast growing stocks with high insider ownership as a way to uncover other fast moving, founder backed growth stories on your radar.

Yet with the share price now hovering near analyst targets and trading at a premium to some intrinsic value estimates, the real debate is whether Oki remains a compelling growth story or if the market has already fully reflected its next potential move higher.

Price to Earnings of 15.8x: Is it justified?

Oki Electric Industry trades on a price to earnings ratio of 15.8x, slightly above peers and the broader Japanese electronic industry at its last close of ¥1,945.

The price to earnings ratio compares a company’s share price with its earnings per share, making it a simple way to see how much investors are paying for today’s profits. For a diversified electronics and systems business like Oki, it is a widely used yardstick because earnings quality and cyclicality matter as much as top line growth.

Here, the market is assigning Oki a modest premium to both its peer group and the Japanese electronic industry average of 15.1x, even though recent earnings growth has been weak and margins have compressed. At the same time, that 15.8x multiple still sits below an estimated fair price to earnings ratio of 19.9x, which suggests investors could push the valuation higher if Oki delivers on its forecast profit growth.

Compared with the industry, Oki’s current valuation looks slightly expensive in simple relative terms. However, the fair ratio framework points to room for re rating if the company can translate its digital manufacturing and systems strategy into sustained earnings momentum, bringing the traded multiple closer to the level implied by fundamentals.

Explore the SWS fair ratio for Oki Electric Industry

Result: Price to Earnings of 15.8x (ABOUT RIGHT)

However, lingering margin pressure and a slight premium to analyst targets mean that any stumble on execution could swiftly challenge the current growth narrative.

Find out about the key risks to this Oki Electric Industry narrative.

Another View on Value

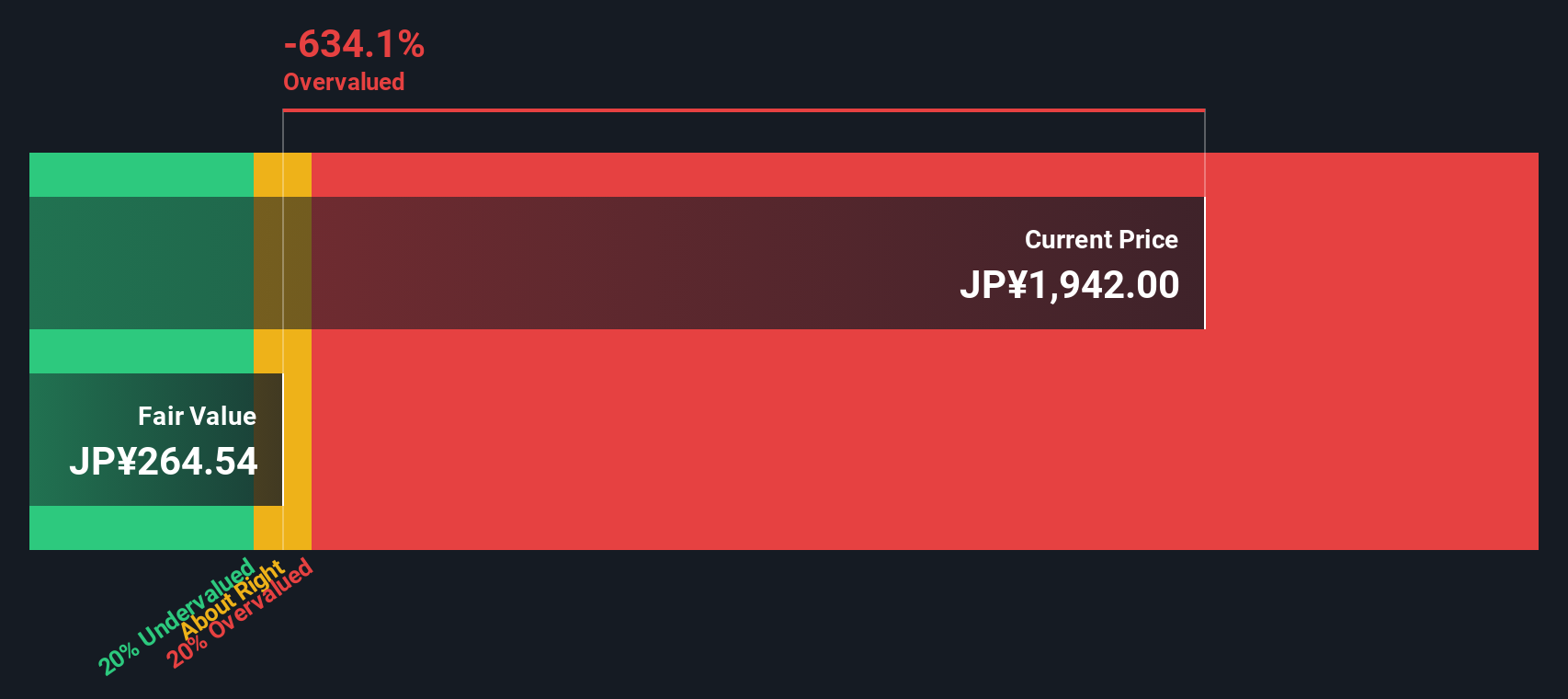

While the price to earnings ratio suggests Oki still has room to rerate toward a higher fair ratio, our DCF model points the other way, implying the shares are trading well above an estimated fair value of ¥264.04 and could already be pricing in very optimistic assumptions.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Oki Electric Industry for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Oki Electric Industry Narrative

If you see the story differently or want to dig into the numbers yourself, you can quickly build a custom view in under three minutes: Do it your way.

A great starting point for your Oki Electric Industry research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your next smart idea by using the Simply Wall St Screener to uncover focused opportunities that most investors are still overlooking.

- Target resilient income by reviewing these 15 dividend stocks with yields > 3% and uncovering companies that could strengthen your portfolio’s cash flow through market cycles.

- Position early in powerful AI themes by scanning these 27 AI penny stocks and spotting businesses building real advantages from machine learning and automation.

- Capitalize on market mispricing by examining these 909 undervalued stocks based on cash flows that may offer upside based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报