RTL Group (ETR:RRTL) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies RTL Group S.A. (ETR:RRTL) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is RTL Group's Debt?

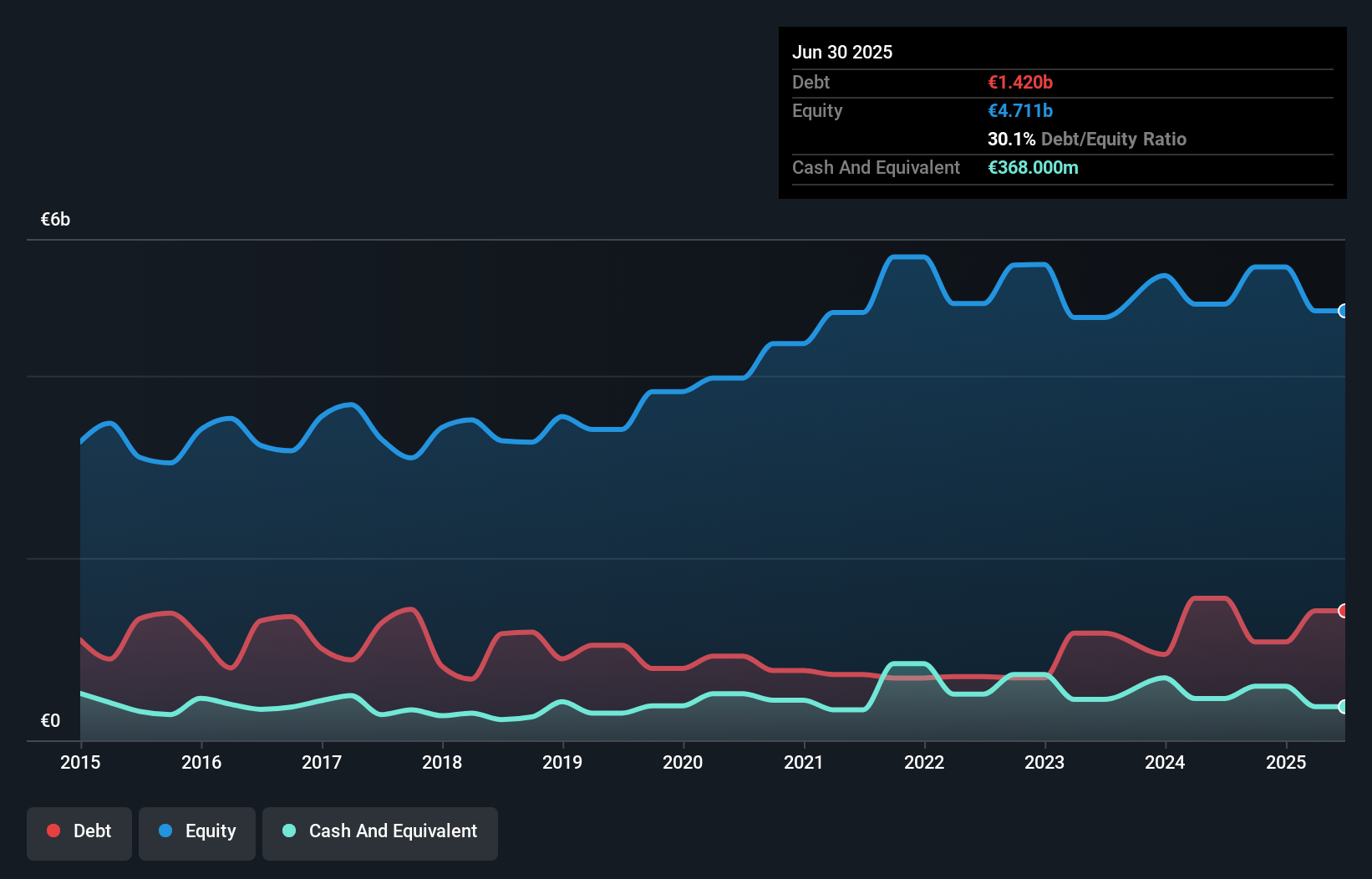

As you can see below, RTL Group had €1.42b of debt at June 2025, down from €1.56b a year prior. However, it also had €368.0m in cash, and so its net debt is €1.05b.

How Healthy Is RTL Group's Balance Sheet?

We can see from the most recent balance sheet that RTL Group had liabilities of €3.52b falling due within a year, and liabilities of €1.47b due beyond that. On the other hand, it had cash of €368.0m and €1.87b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €2.75b.

This deficit isn't so bad because RTL Group is worth €5.08b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

View our latest analysis for RTL Group

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a debt to EBITDA ratio of 1.8, RTL Group uses debt artfully but responsibly. And the fact that its trailing twelve months of EBIT was 9.9 times its interest expenses harmonizes with that theme. Shareholders should be aware that RTL Group's EBIT was down 39% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine RTL Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, RTL Group recorded free cash flow worth 72% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

RTL Group's struggle to grow its EBIT had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. For example its conversion of EBIT to free cash flow was refreshing. Looking at all the angles mentioned above, it does seem to us that RTL Group is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example RTL Group has 3 warning signs (and 1 which is concerning) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报