Arcutis Biotherapeutics, Inc. (NASDAQ:ARQT) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, Arcutis Biotherapeutics, Inc. (NASDAQ:ARQT) shares have been powering on, with a gain of 28% in the last thirty days. The annual gain comes to 147% following the latest surge, making investors sit up and take notice.

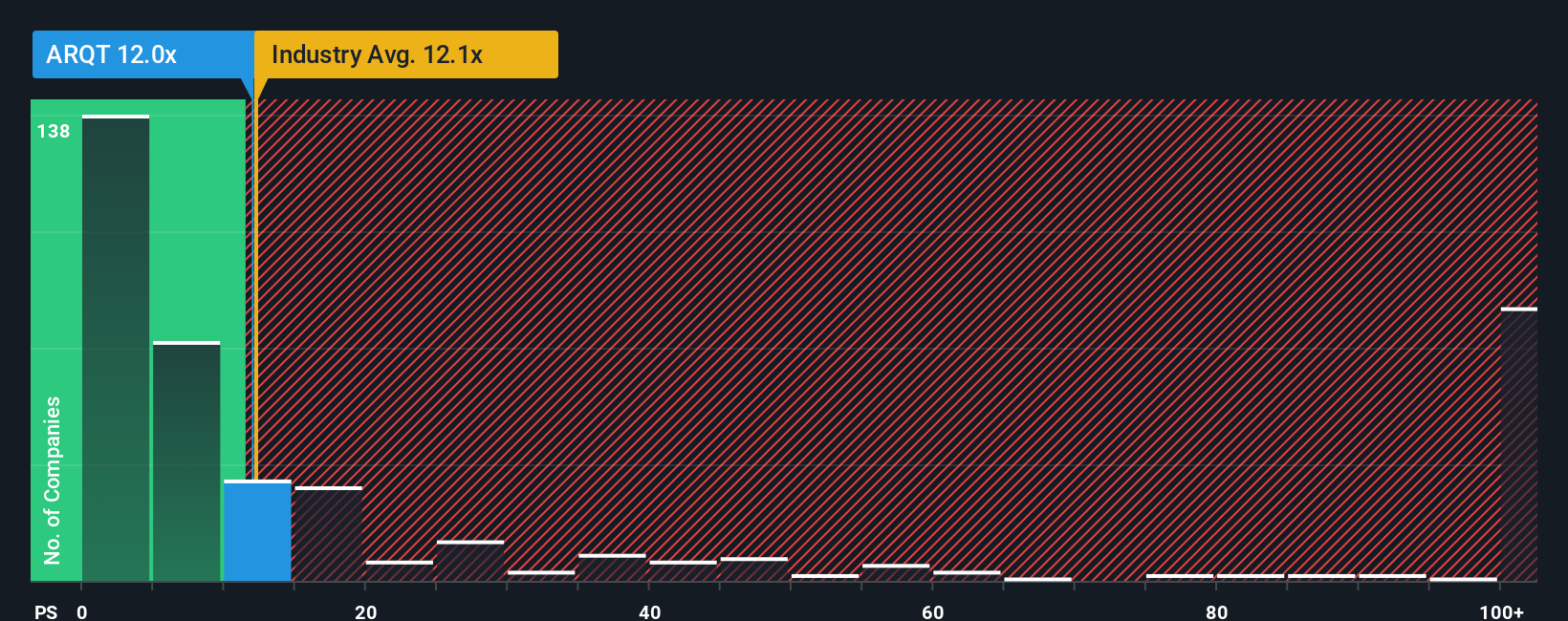

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Arcutis Biotherapeutics' P/S ratio of 12x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in the United States is also close to 12.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Arcutis Biotherapeutics

How Has Arcutis Biotherapeutics Performed Recently?

Recent times haven't been great for Arcutis Biotherapeutics as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Arcutis Biotherapeutics.Is There Some Revenue Growth Forecasted For Arcutis Biotherapeutics?

Arcutis Biotherapeutics' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 129% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 32% per annum over the next three years. That's shaping up to be materially lower than the 130% per year growth forecast for the broader industry.

With this information, we find it interesting that Arcutis Biotherapeutics is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Arcutis Biotherapeutics' P/S Mean For Investors?

Arcutis Biotherapeutics appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Arcutis Biotherapeutics' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Arcutis Biotherapeutics that you need to be mindful of.

If these risks are making you reconsider your opinion on Arcutis Biotherapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报