3 Promising Penny Stocks With Over $90M Market Cap

As the U.S. stock market experiences fluctuations with investors closely monitoring the Federal Reserve's impending decision on interest rates, many are seeking opportunities in less conventional areas of investment. Penny stocks, a term that might seem outdated but remains significant, often represent smaller or newer companies with potential for growth at accessible price points. These stocks can offer intriguing prospects when they possess strong financial health and solid fundamentals, presenting a unique chance for investors to explore promising opportunities within this niche segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.09 | $462.9M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.71 | $650.99M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8606 | $147.23M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.285 | $553.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.25 | $1.38B | ✅ 5 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.57 | $598.45M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.46 | $370.12M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.85 | $6.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.51 | $101.73M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 345 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Pyxis Oncology (PYXS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pyxis Oncology, Inc. is a clinical-stage company focused on developing therapeutics for the treatment of solid tumors, with a market cap of $260.26 million.

Operations: The company generated $2.82 million in revenue from its biotechnology startups segment.

Market Cap: $260.26M

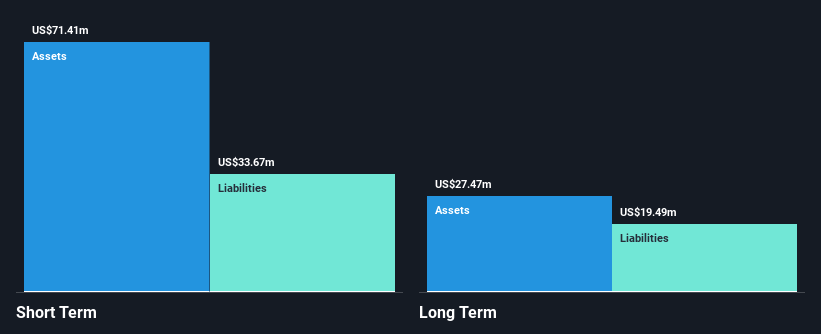

Pyxis Oncology, Inc. is a clinical-stage company with a market cap of US$260.26 million and minimal revenue of US$2.82 million, indicating it is pre-revenue. The company remains unprofitable, with losses increasing over the past five years by 9.7% annually and not expected to achieve profitability soon. Despite having no debt and sufficient short-term assets to cover liabilities, Pyxis's share price has been highly volatile recently. The company filed a shelf registration for US$350 million and a follow-on equity offering for US$150 million, suggesting ongoing capital needs as it continues its development efforts in oncology therapeutics.

- Get an in-depth perspective on Pyxis Oncology's performance by reading our balance sheet health report here.

- Gain insights into Pyxis Oncology's outlook and expected performance with our report on the company's earnings estimates.

Xtant Medical Holdings (XTNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xtant Medical Holdings, Inc. offers regenerative medicine products and medical devices for orthopedic and neurological surgeons both in the United States and internationally, with a market cap of $99.10 million.

Operations: The company generates revenue of $133.08 million from its development, manufacture, and marketing of orthopedic medical products and devices.

Market Cap: $99.1M

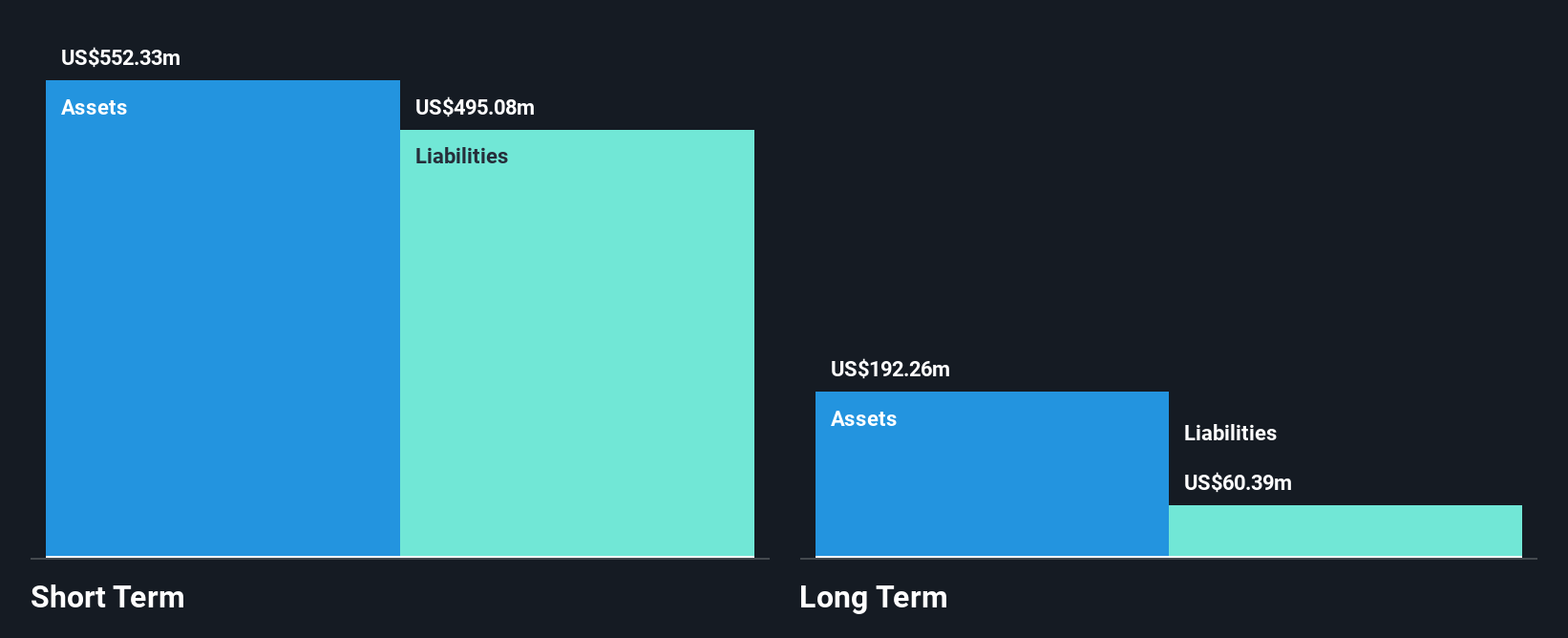

Xtant Medical Holdings, Inc., with a market cap of US$99.10 million, has shown signs of financial improvement by becoming profitable recently and maintaining high-quality earnings. The company's revenue for the third quarter was US$33.26 million, up from US$27.94 million the previous year, alongside a net income turnaround to US$1.31 million from a loss of US$5.02 million. Despite low return on equity at 3.5%, Xtant's debt is well-managed with operating cash flow covering liabilities effectively and short-term assets exceeding both short-term and long-term liabilities, suggesting solid financial health amidst its recent product launch initiatives like CollagenX.

- Navigate through the intricacies of Xtant Medical Holdings with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Xtant Medical Holdings' future.

Eventbrite (EB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eventbrite, Inc. operates a two-sided marketplace offering self-service ticketing and marketing tools for event creators globally, with a market cap of approximately $432.70 million.

Operations: The company's revenue is primarily generated from its Internet Software & Services segment, totaling $294.80 million.

Market Cap: $432.7M

Eventbrite, Inc. has been experiencing volatility with its weekly returns increasing over the past year. While unprofitable, it has reduced losses significantly over five years and maintains a strong cash position exceeding its debt. Recent earnings indicate improved profitability with net income of US$6.37 million in Q3 2025 compared to a loss previously. However, revenue guidance for fiscal 2025 was narrowed to US$290-293 million, reflecting challenges in growth. A definitive agreement for acquisition by Bending Spoons at approximately US$500 million is underway, potentially affecting its public trading status upon completion expected in early 2026.

- Take a closer look at Eventbrite's potential here in our financial health report.

- Understand Eventbrite's earnings outlook by examining our growth report.

Seize The Opportunity

- Jump into our full catalog of 345 US Penny Stocks here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报