Here's Why We Think White Pearl Technology Group (STO:WPTG B) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in White Pearl Technology Group (STO:WPTG B). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is White Pearl Technology Group Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Commendations have to be given in seeing that White Pearl Technology Group grew its EPS from kr0.50 to kr2.58, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. This could point to the business hitting a point of inflection.

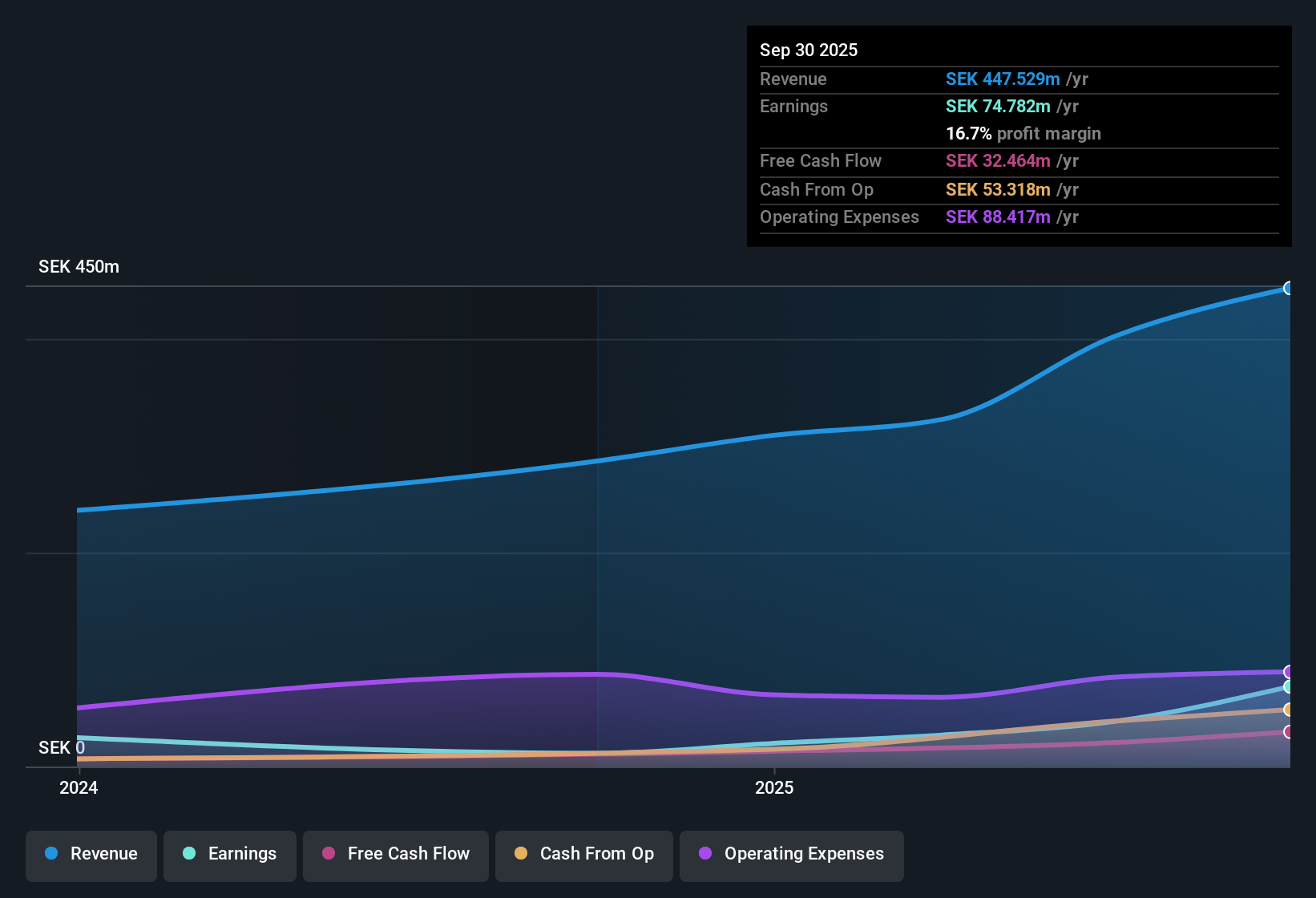

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of White Pearl Technology Group shareholders is that EBIT margins have grown from 7.4% to 18% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

See our latest analysis for White Pearl Technology Group

Since White Pearl Technology Group is no giant, with a market capitalisation of kr547m, you should definitely check its cash and debt before getting too excited about its prospects.

Are White Pearl Technology Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insiders in White Pearl Technology Group both added to and reduced their holdings over the preceding 12 months. All in all though, their acquisitions outweighed the amount of shares they sold off. When you weigh that up, it is a mild positive, indicating increased alignment between shareholders and management. It is also worth noting that it was Independent Director Arne Nabseth who made the biggest single purchase, worth kr265k, paying kr17.69 per share.

Should You Add White Pearl Technology Group To Your Watchlist?

White Pearl Technology Group's earnings per share have been soaring, with growth rates sky high. Growth investors should find it difficult to look past that strong EPS move. And may very well signal a significant inflection point for the business. If that's the case, you may regret neglecting to put White Pearl Technology Group on your watchlist. It is worth noting though that we have found 4 warning signs for White Pearl Technology Group (1 shouldn't be ignored!) that you need to take into consideration.

Keen growth investors love to see insider activity. Thankfully, White Pearl Technology Group isn't the only one. You can see a a curated list of Swedish companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报