3 Global Growth Companies With High Insider Ownership Expecting Up To 77% Earnings Growth

As global markets navigate a complex landscape marked by hopes for interest rate cuts and mixed economic signals, investors are closely watching indices like the Nasdaq Composite and Russell 2000, which have shown resilience amid these conditions. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal confidence from those closest to the business, potentially aligning well with investor interests during periods of market uncertainty.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Here we highlight a subset of our preferred stocks from the screener.

Circuit Fabology Microelectronics EquipmentLtd (SHSE:688630)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Circuit Fabology Microelectronics Equipment Co., Ltd. (ticker: SHSE:688630) operates in the microelectronics equipment sector with a market capitalization of approximately CN¥16.53 billion.

Operations: Unfortunately, the revenue segments for Circuit Fabology Microelectronics Equipment Co., Ltd. (ticker: SHSE:688630) are not provided in the text you shared.

Insider Ownership: 28.9%

Earnings Growth Forecast: 35.3% p.a.

Circuit Fabology Microelectronics Equipment Ltd. demonstrates strong growth potential with its revenue forecasted to increase by 31% annually, outpacing the broader Chinese market. Its earnings are expected to grow significantly at 35.3% per year, surpassing market averages. Despite high-quality earnings and substantial insider ownership, the company's share price has been highly volatile recently. Recent financial results showed a healthy rise in revenue to CNY 933.5 million and net income of CNY 198.81 million for the nine months ending September 2025.

- Click to explore a detailed breakdown of our findings in Circuit Fabology Microelectronics EquipmentLtd's earnings growth report.

- Our expertly prepared valuation report Circuit Fabology Microelectronics EquipmentLtd implies its share price may be too high.

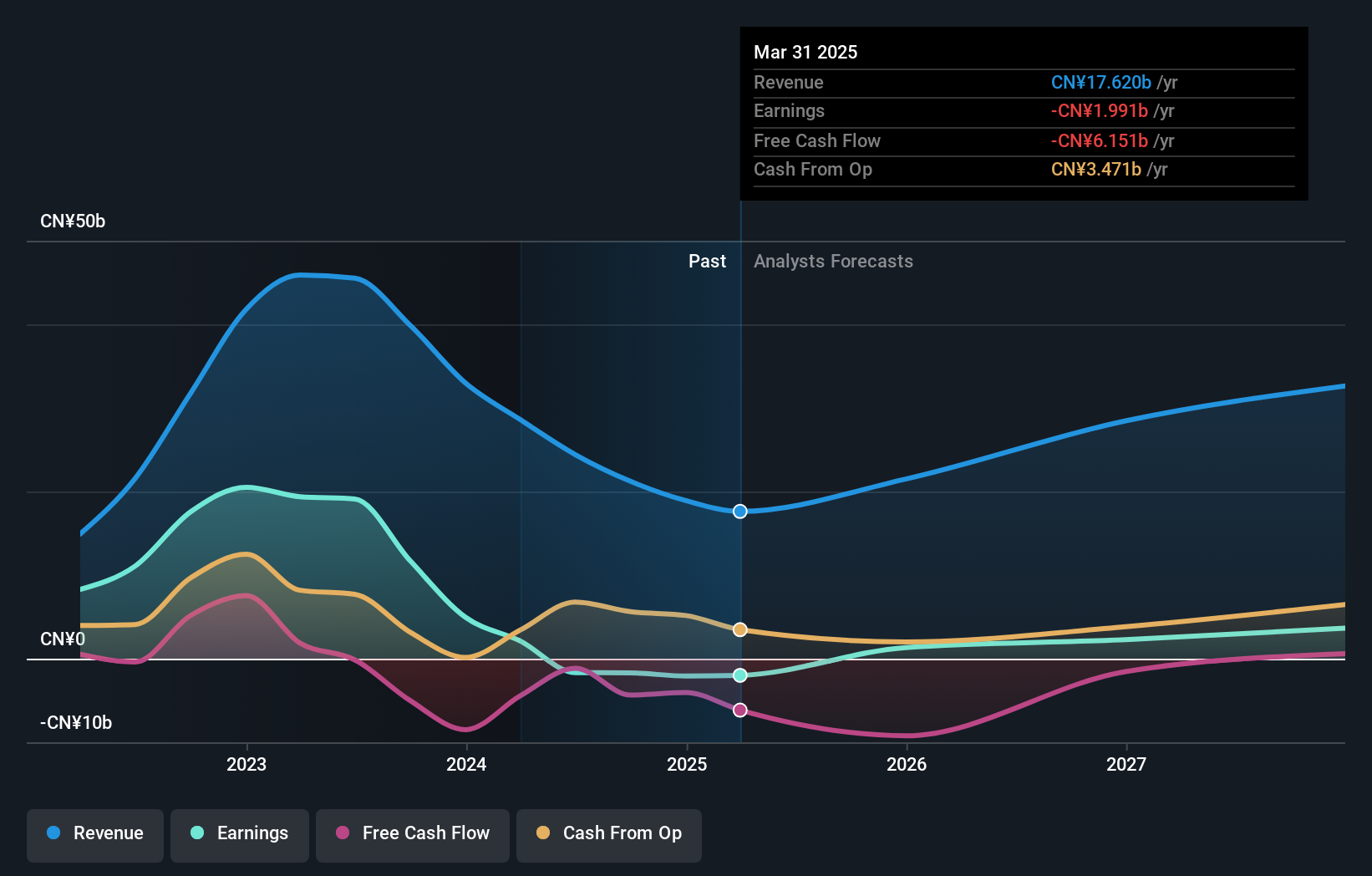

Ganfeng Lithium Group (SZSE:002460)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ganfeng Lithium Group Co., Ltd. is a Chinese company that manufactures and sells lithium products, with a market capitalization of approximately CN¥121.58 billion.

Operations: Ganfeng Lithium Group Co., Ltd. generates its revenue primarily through the manufacturing and sale of lithium products in China.

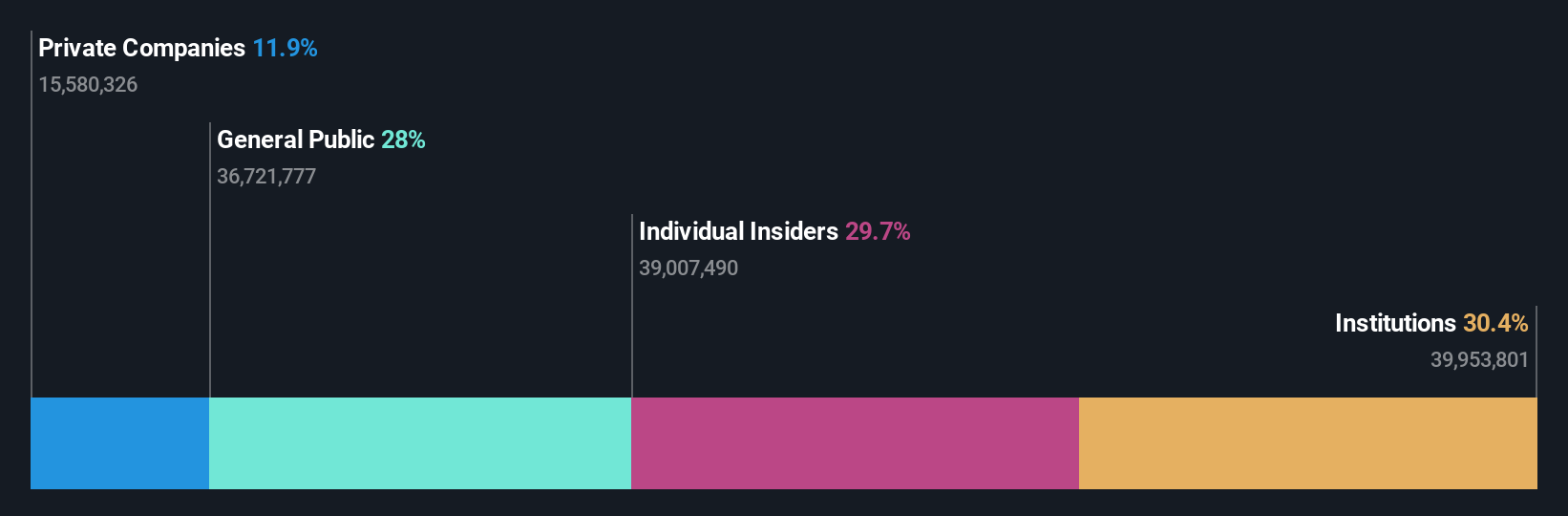

Insider Ownership: 27.1%

Earnings Growth Forecast: 45.9% p.a.

Ganfeng Lithium Group is poised for significant growth, with revenue projected to expand by 22% annually, surpassing the Chinese market average. The company is expected to become profitable within three years. Recent earnings showed a positive turnaround, reporting a net income of CNY 25.52 million compared to a loss previously. Despite high insider ownership and strategic initiatives like the Consolidated Project in Argentina, which aims for efficient lithium production, share price volatility remains a concern.

- Unlock comprehensive insights into our analysis of Ganfeng Lithium Group stock in this growth report.

- Upon reviewing our latest valuation report, Ganfeng Lithium Group's share price might be too optimistic.

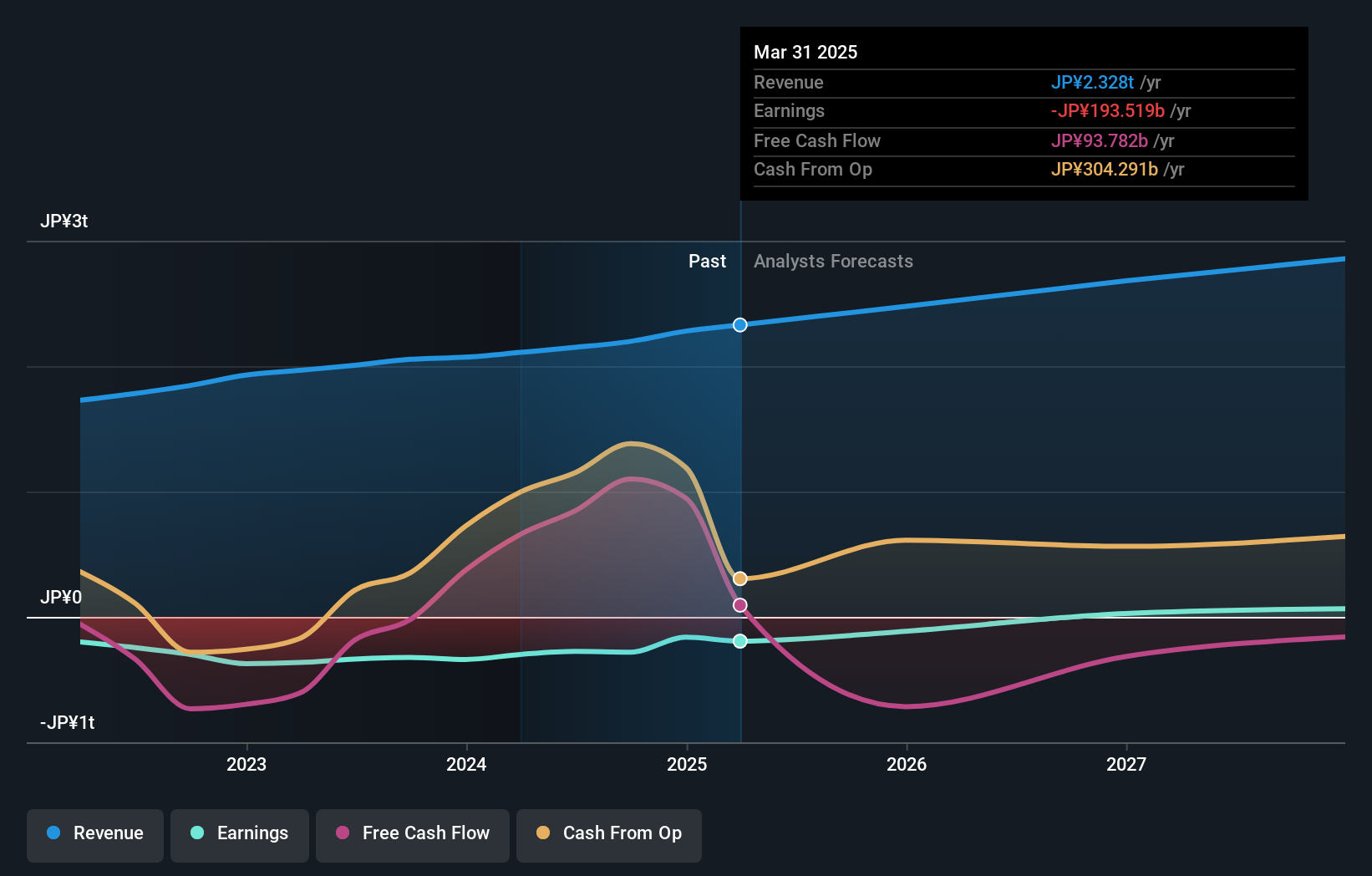

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications globally with a market cap of ¥2.04 trillion.

Operations: The company's revenue is primarily derived from Internet Services at ¥1.36 billion, Fin Tech at ¥923 million, and Mobile services at ¥481 million.

Insider Ownership: 27.6%

Earnings Growth Forecast: 77% p.a.

Rakuten Group is experiencing a transformative phase, with revenue projected to grow at 6.6% annually, outpacing the Japanese market average. Despite a forecasted low return on equity of 12.5%, the company is expected to achieve profitability within three years, indicating robust profit growth potential. Recent financial activities include an impairment loss of ¥27 billion and early redemption of bonds worth ¥19.2 billion, reflecting strategic financial restructuring efforts amid its undervaluation concerns.

- Click here and access our complete growth analysis report to understand the dynamics of Rakuten Group.

- The valuation report we've compiled suggests that Rakuten Group's current price could be quite moderate.

Turning Ideas Into Actions

- Click this link to deep-dive into the 862 companies within our Fast Growing Global Companies With High Insider Ownership screener.

- Interested In Other Possibilities? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报