Dentsu Soken (TSE:4812): Assessing Valuation After Board-Approved 2026 Organizational Restructuring Plan

Restructuring move puts Dentsu Soken in focus

Dentsu Soken (TSE:4812) just signed off on a sizable internal shake up, with its board approving an organizational restructuring effective January 1, 2026, a move that naturally draws investor attention.

See our latest analysis for Dentsu Soken.

The 35.4% year to date share price return and 35.7% one year total shareholder return suggest momentum has been building, and this restructuring looks like the next deliberate step in that growth story rather than a sudden course correction.

If this kind of transformation has you thinking more broadly about opportunities, it could be a good moment to explore fast growing stocks with high insider ownership as a source of other fast moving ideas.

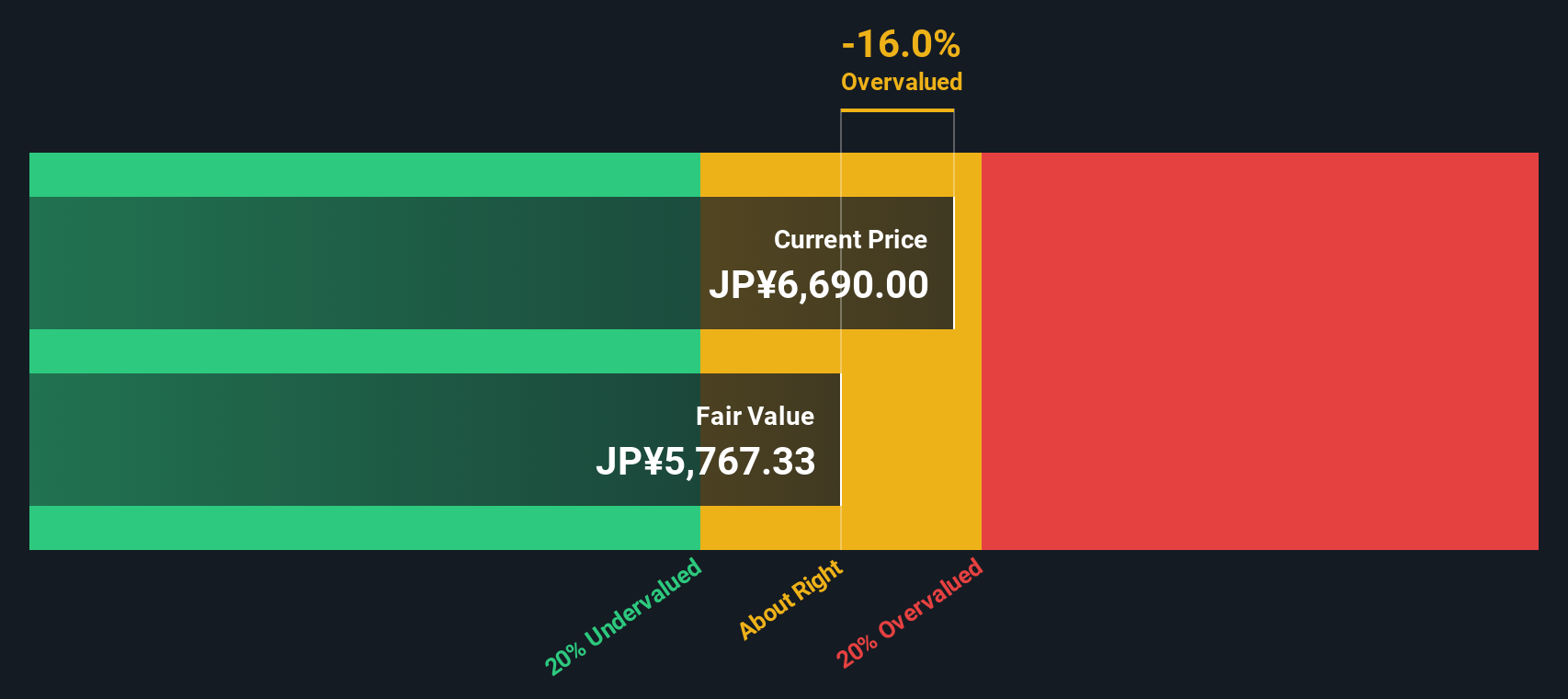

Yet with the share price sitting just shy of analyst targets and the stock trading at a premium to some intrinsic value estimates, investors now face a key question: is there still upside here, or is future growth already priced in?

Price-to-Earnings of 30x: Is it justified?

On a price-to-earnings ratio of 30x versus a last close of ¥7,720, Dentsu Soken trades at a clear premium to both peers and the wider IT sector.

The price-to-earnings multiple compares the share price to earnings per share, making it a straightforward way to gauge how much investors are willing to pay for each unit of current profit. This is a particularly relevant lens for a profitable, established IT solutions provider.

At 30x earnings compared to the JP IT industry average of 17.2x and a peer average of 22.5x, the market is effectively paying a sizeable markup for Dentsu Soken's growth profile, despite our DCF model suggesting the stock is trading above an estimated fair value of ¥6,198.73 and above an estimated fair price-to-earnings ratio of 27x that the market could gravitate toward over time.

This premium is not marginal, with the current multiple sitting well above both sector benchmarks and our model derived fair ratio, highlighting how optimistic sentiment has become around this name.

Explore the SWS fair ratio for Dentsu Soken

Result: Price-to-Earnings of 30x (OVERVALUED)

However, sustained premium valuations could falter if revenue growth slows or restructuring fails to deliver tangible margin expansion and earnings acceleration.

Find out about the key risks to this Dentsu Soken narrative.

Another Way to Look at Value

Our DCF model points to an estimated fair value of ¥6,198.73 per share, meaning Dentsu Soken looks overvalued on this lens as well, not just on earnings multiples. The gap is not extreme, but it does raise the question: how much optimism is already in the price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dentsu Soken for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dentsu Soken Narrative

If you see the numbers differently or want to dig into the details yourself, you can easily build a custom view in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Dentsu Soken.

Looking for more investment ideas?

Ready for your next move? In minutes, you can uncover fresh opportunities that match your style and avoid watching the best ideas run without you.

- Target higher income potential by scanning these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow while markets stay unpredictable.

- Capitalize on market mispricing by reviewing these 901 undervalued stocks based on cash flows that trade below what their cash flows suggest they are really worth.

- Position yourself on the frontier of innovation by checking out these 28 quantum computing stocks before the crowd fully prices in their long term potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报