Kirby (KEX) Valuation Check as Inland Barge Weakness and Chemical Headwinds Pressure Near‑Term Earnings

Recent fund commentary has zeroed in on Kirby (KEX) as inland barge demand softens and key chemical customers remain under economic pressure, a mix that is squeezing pricing and near term earnings expectations.

See our latest analysis for Kirby.

Despite those headwinds, the latest share price of $112.08 leaves Kirby with a strong 90 day share price return of 27.55%, even as its 1 year total shareholder return sits slightly negative. This is a sign that momentum has picked up recently after a tougher stretch.

If Kirby’s setup has you thinking about where else cyclical recoveries might show up, this is a good moment to explore fast growing stocks with high insider ownership for other potential ideas.

With earnings expectations reset, but the share price rebounding sharply, investors are left with a key question: is Kirby still trading below its true earnings power, or has the recent rally fully priced in the recovery?

Most Popular Narrative Narrative: 10.6% Undervalued

With Kirby last closing at $112.08 versus a most popular narrative fair value of $125.33, the story leans toward upside that the recent rally has not fully erased.

Supply constraints and industry wide aging of the barge fleet are restraining new capacity growth, positioning Kirby to benefit from limited vessel availability, capacity consolidation, and rising charter rates over time, which should support steady revenue growth and expanding net margins.

Curious how modest growth assumptions can still back a richer earnings multiple than many shipping peers, while margins climb and share count trends quietly boost per share value? Read on.

Result: Fair Value of $125.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softness in petrochemical shipping and rising labor and maintenance costs could weaken utilization, crimp margins, and challenge the market’s current recovery narrative.

Find out about the key risks to this Kirby narrative.

Another Way To Look At Value

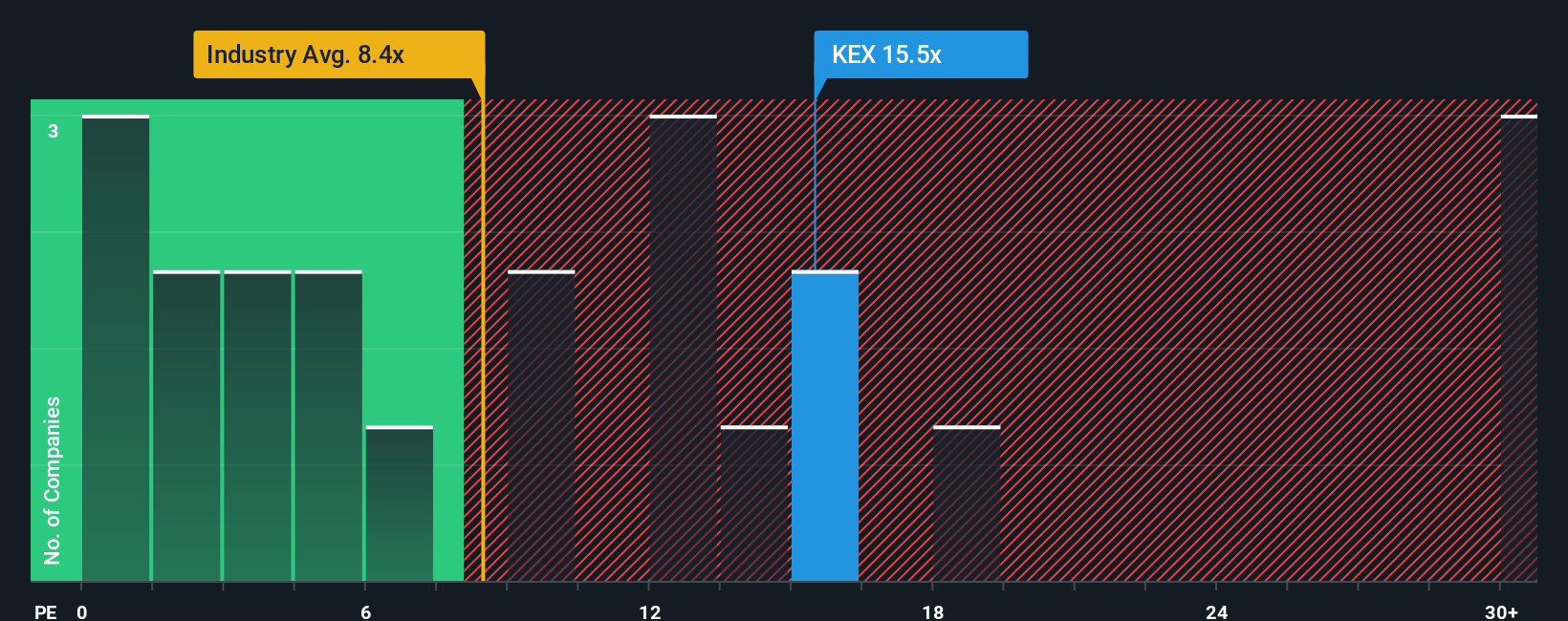

On earnings based valuation, Kirby looks far from cheap. Its price to earnings ratio of 19.9 times is well above the global shipping average of 10.1 times, its peer average of 13.9 times, and even its own fair ratio of 13.6 times, which suggests meaningful de rating risk if sentiment cools. Does that premium still feel comfortable after the recent run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kirby Narrative

If this perspective does not quite match your view, or you prefer to dive into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way

A great starting point for your Kirby research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall Street Screener now to uncover fresh opportunities before other investors catch on, and build a watchlist that truly reflects your strategy.

- Capture potential multi baggers early by scanning these 3582 penny stocks with strong financials, where small market caps meet surprisingly resilient fundamentals.

- Position yourself for the next wave of technological change by targeting these 27 AI penny stocks, shaping automation, data analysis, and intelligent software.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3%, which combine solid yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报