European Stocks Estimated Below Fair Value In December 2025

As European markets show mixed returns with the STOXX Europe 600 Index inching higher on hopes of interest rate cuts, investors are keenly observing economic indicators such as inflation and GDP revisions. In this environment, identifying undervalued stocks can be a strategic move, as these equities may offer potential for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Stellantis (BIT:STLAM) | €10.28 | €20.10 | 48.9% |

| Sanoma Oyj (HLSE:SANOMA) | €9.39 | €18.44 | 49.1% |

| Ottobock SE KGaA (XTRA:OBCK) | €69.25 | €138.11 | 49.9% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.465 | €4.88 | 49.4% |

| Mo-BRUK (WSE:MBR) | PLN307.00 | PLN600.79 | 48.9% |

| KB Components (OM:KBC) | SEK41.75 | SEK83.21 | 49.8% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.39 | €0.77 | 49.7% |

| Esautomotion (BIT:ESAU) | €3.10 | €6.14 | 49.5% |

| Allegro.eu (WSE:ALE) | PLN30.70 | PLN60.35 | 49.1% |

| Allcore (BIT:CORE) | €1.345 | €2.68 | 49.8% |

Let's uncover some gems from our specialized screener.

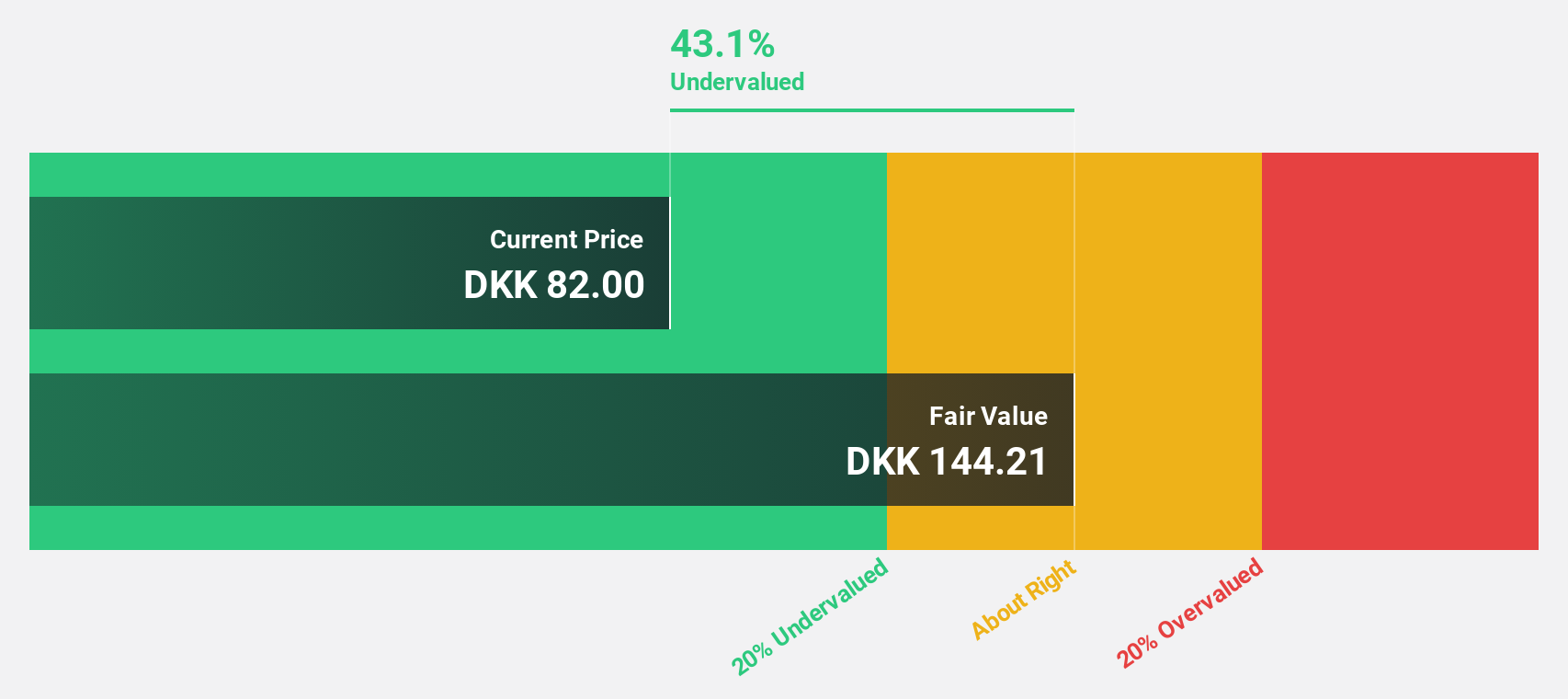

Trifork Group (CPSE:TRIFOR)

Overview: Trifork Group AG offers information technology and business services across Switzerland, Denmark, the United Kingdom, the Netherlands, the United States, and internationally with a market cap of DKK1.69 billion.

Operations: The company's revenue segments include Trifork - Run at €66.35 million, Trifork - Build at €144.97 million, and Trifork - Inspire at €6.66 million.

Estimated Discount To Fair Value: 44.2%

Trifork Group appears undervalued based on cash flows, trading 44.2% below its estimated fair value of DKK156.63, with a current price of DKK87.4. Despite a forecasted annual earnings growth of 21.47%, recent strategic alliances and contracts, such as the LoftHOME pilot training kit and the Shared Public Treatment Platform in Denmark, highlight potential for revenue expansion beyond the Danish market's average growth rate. However, one-off items have impacted recent financial results.

- According our earnings growth report, there's an indication that Trifork Group might be ready to expand.

- Get an in-depth perspective on Trifork Group's balance sheet by reading our health report here.

Hemnet Group (OM:HEM)

Overview: Hemnet Group AB (publ) operates a residential property platform in Sweden with a market cap of SEK16.67 billion.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, which generated SEK1.54 billion.

Estimated Discount To Fair Value: 45.7%

Hemnet Group is trading 45.7% below its estimated fair value of SEK326.24, with a current price of SEK177.3, indicating undervaluation based on cash flows. The company's earnings are expected to grow significantly at 21.2% annually, surpassing the Swedish market's average growth rate. Despite a slight decline in quarterly revenue and net income compared to last year, Hemnet's robust buyback program and high forecasted return on equity support its investment appeal amidst slower revenue growth projections.

- Insights from our recent growth report point to a promising forecast for Hemnet Group's business outlook.

- Navigate through the intricacies of Hemnet Group with our comprehensive financial health report here.

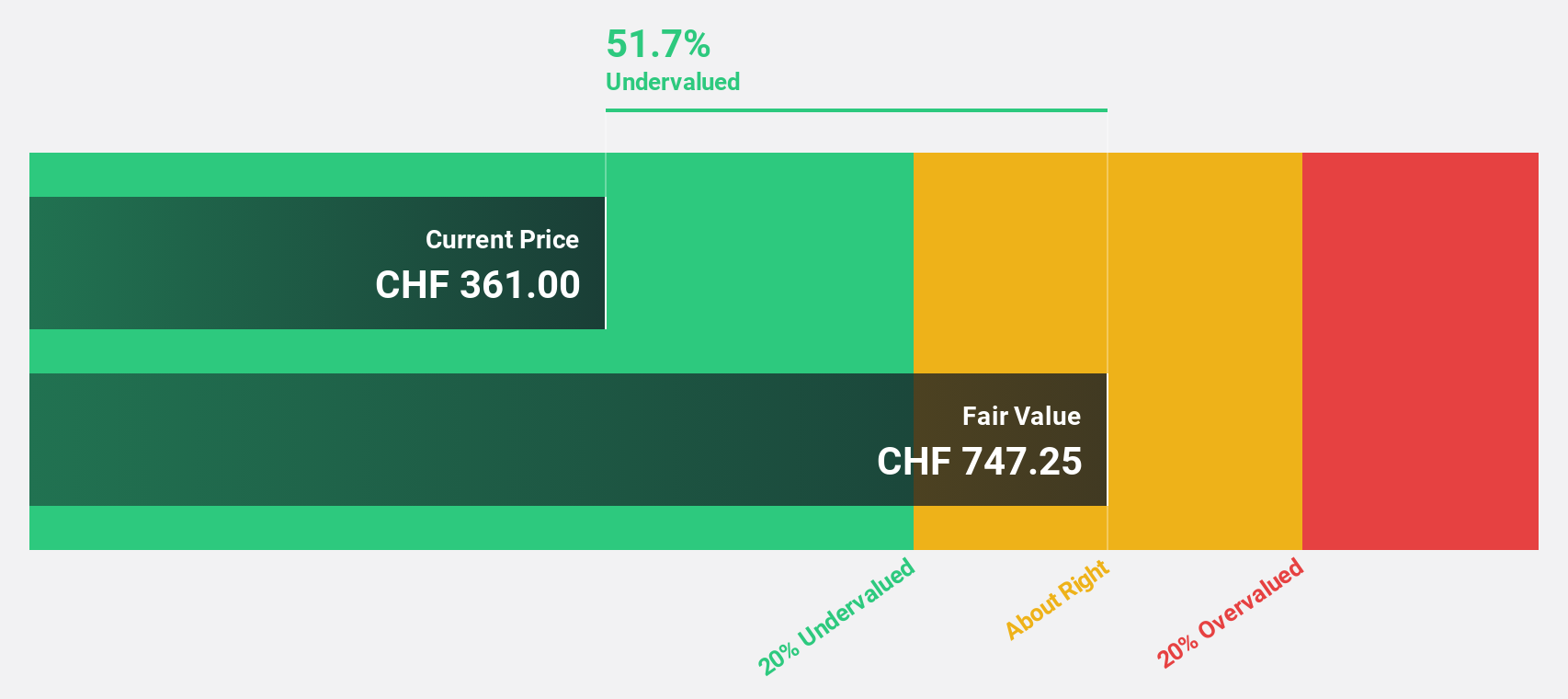

Bystronic (SWX:BYS)

Overview: Bystronic AG, with a market cap of CHF528.73 million, provides global sheet metal processing solutions focusing on cutting, bending, and automation through its subsidiaries.

Operations: Revenue Segments (in millions of CHF): Cutting: 653.40, Bending: 204.80, Automation: 102.60

Estimated Discount To Fair Value: 13.8%

Bystronic is trading at CHF256, below its estimated fair value of CHF297.05, indicating undervaluation based on cash flows. The company expects to become profitable within three years and forecasts revenue growth of 4.6% annually, outpacing the Swiss market average. Recent M&A discussions about acquiring Coherent Inc's business unit may enhance strategic positioning despite a slight sales decline and economic challenges impacting short-term performance.

- The growth report we've compiled suggests that Bystronic's future prospects could be on the up.

- Dive into the specifics of Bystronic here with our thorough financial health report.

Seize The Opportunity

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 192 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报