Cirrus Aircraft (SEHK:2507): Reassessing Valuation After the Launch of Its Cirrus Next Upgrade Program

Cirrus Aircraft (SEHK:2507) just rolled out its Cirrus Next trade in and upgrade program, giving SR Series and Vision Jet owners a cleaner path into newer models without juggling overlapping aircraft ownership.

See our latest analysis for Cirrus Aircraft.

The launch of Cirrus Next lands on top of an already strong run, with a 7 day share price return of 13.13 percent and a year to date share price return of 180 percent. This suggests momentum is rebuilding after a softer 90 day share price return of negative 11.6 percent, while the 1 year total shareholder return of 183.4 percent underlines how firmly the market is repricing its growth prospects.

If this kind of strategic upgrade program has your attention, it might be worth scanning aerospace and defense stocks for other aviation and defense names quietly building similar momentum.

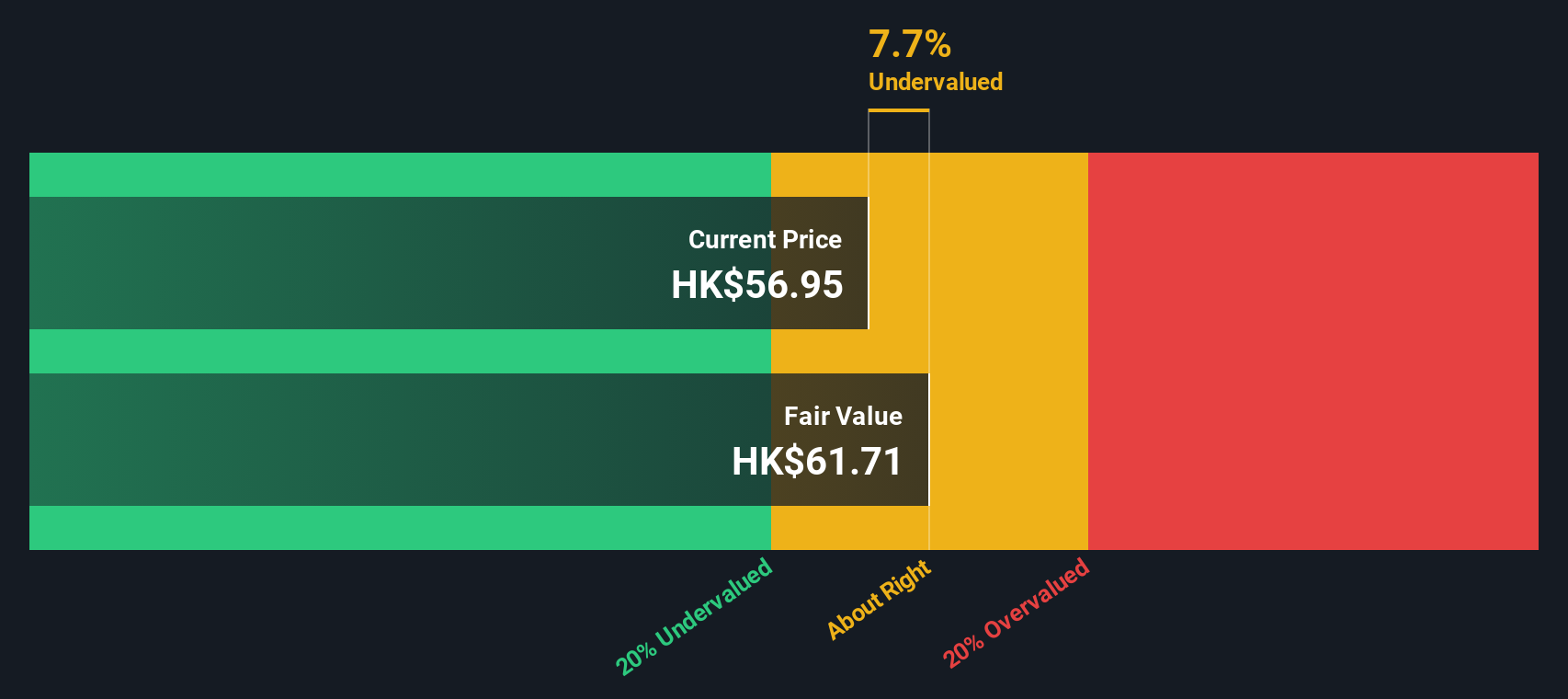

With the shares now trading close to analyst targets yet still showing a modest intrinsic discount, the real question is whether Cirrus remains mispriced value or if the market is already banking all that future growth.

Price-to-Earnings of 17.5x: Is it justified?

Cirrus Aircraft screens as modestly undervalued on earnings, with a 17.5x price-to-earnings multiple sitting below both peers and the stock's own implied fair ratio.

The price-to-earnings multiple compares what investors pay today for each dollar of current earnings, a core yardstick for established, profitable manufacturers like Cirrus. At 17.5x, the market is awarding the company a discount to the peer average of 20.4x and a much steeper discount to the broader Asian Aerospace and Defense average of 55.7x. Cirrus is growing faster than many incumbents.

This gap suggests investors are not fully pricing in recent profit acceleration and forecasts for double digit earnings growth, especially when set against the estimated fair P E ratio of 16.2x that our models imply the market could gravitate toward. While the current multiple is slightly above that fair level, the difference is small relative to the discount versus peers. This hints that the stock still trades more like a cautious cyclical than a structurally higher growth niche aircraft maker.

Against the industry backdrop, the contrast is stark. Cirrus trades at a fraction of the sector's 55.7x average, despite outpacing both the Hong Kong market and Aerospace and Defense industry in one year returns and earnings growth. That combination of faster expansion and a lower multiple is unusual in a momentum phase like this, and it creates the possibility that the valuation could compress upward if performance continues to surprise on the upside.

Explore the SWS fair ratio for Cirrus Aircraft

Result: Price-to-Earnings of 17.5x (UNDERVALUED)

However, downside risks remain, including potential delays or weaker than expected uptake of Cirrus Next and any cyclical slowdown in high end aircraft demand.

Find out about the key risks to this Cirrus Aircraft narrative.

Another View: Our DCF Take

Our DCF model also points to value, with Cirrus trading about 9.7 percent below an estimated fair value of roughly HK$62 per share. Both earnings and cash flow views suggest the stock may be underpriced. The question is whether the market is simply underestimating execution risk on that growth path.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cirrus Aircraft for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cirrus Aircraft Narrative

If you want to dig into the numbers yourself or challenge this view, you can build a personalised narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Cirrus Aircraft.

Looking for more investment ideas?

Before you move on, consider scanning a few targeted stock groups that fit real world themes institutional investors are watching closely.

- Review these 3582 penny stocks with strong financials that already reflect strong balance sheets and fundamentals instead of pure speculation.

- Explore these 27 AI penny stocks that apply artificial intelligence to support scalable, high-margin business models.

- Evaluate these 15 dividend stocks with yields > 3% that combine dividend income with the potential for sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报