Is Israel Land Development - Urban Renewal (TLV:ILDR) Weighed On By Its Debt Load?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Israel Land Development - Urban Renewal Ltd (TLV:ILDR) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Israel Land Development - Urban Renewal's Net Debt?

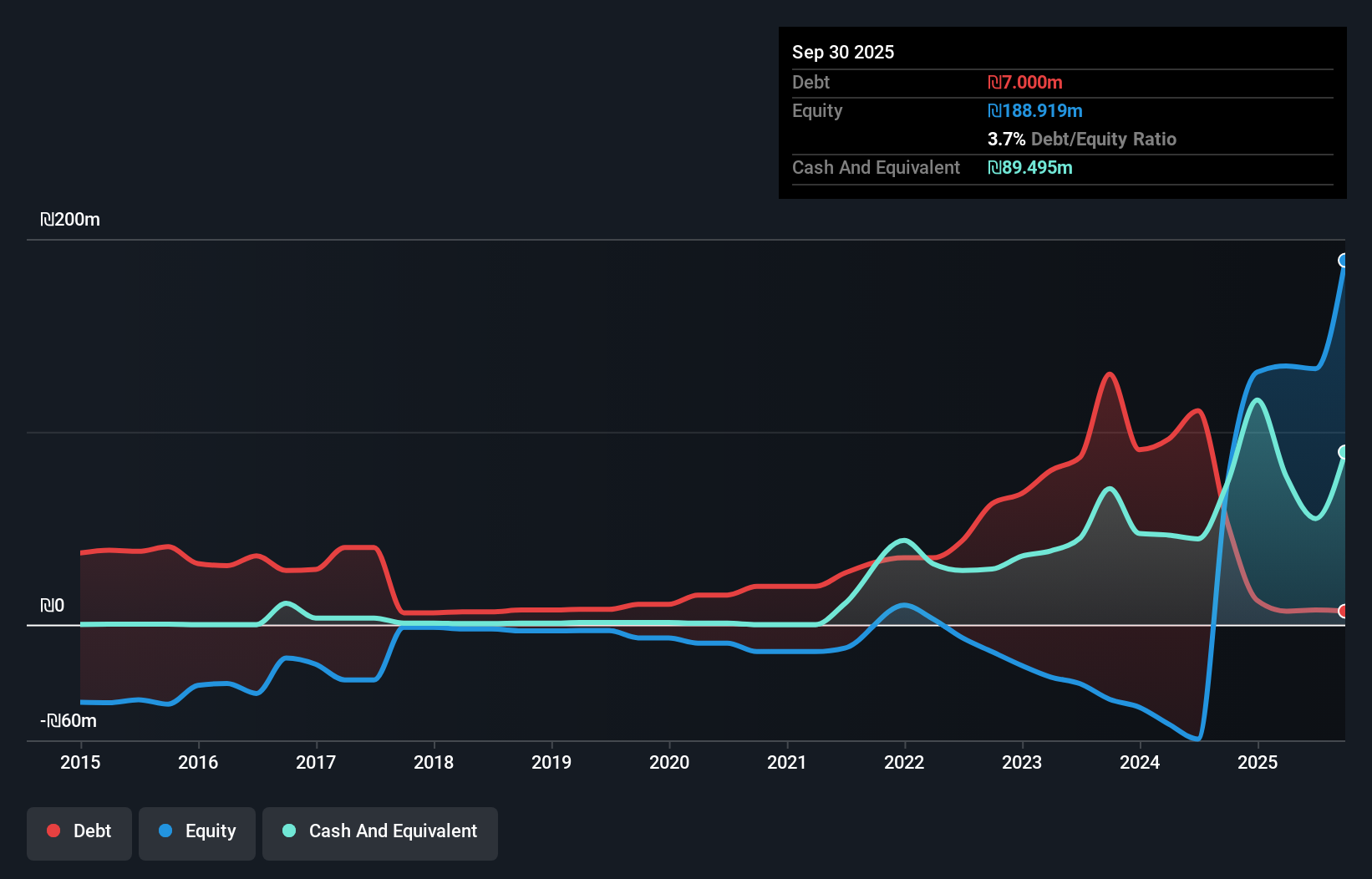

The image below, which you can click on for greater detail, shows that Israel Land Development - Urban Renewal had debt of ₪7.00m at the end of September 2025, a reduction from ₪52.3m over a year. However, it does have ₪89.5m in cash offsetting this, leading to net cash of ₪82.5m.

How Healthy Is Israel Land Development - Urban Renewal's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Israel Land Development - Urban Renewal had liabilities of ₪191.1m due within 12 months and liabilities of ₪44.6m due beyond that. Offsetting this, it had ₪89.5m in cash and ₪16.3m in receivables that were due within 12 months. So its liabilities total ₪129.9m more than the combination of its cash and short-term receivables.

Of course, Israel Land Development - Urban Renewal has a market capitalization of ₪869.9m, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Israel Land Development - Urban Renewal also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is Israel Land Development - Urban Renewal's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

View our latest analysis for Israel Land Development - Urban Renewal

In the last year Israel Land Development - Urban Renewal wasn't profitable at an EBIT level, but managed to grow its revenue by 56%, to ₪68m. With any luck the company will be able to grow its way to profitability.

So How Risky Is Israel Land Development - Urban Renewal?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Israel Land Development - Urban Renewal had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through ₪68m of cash and made a loss of ₪6.3m. But at least it has ₪82.5m on the balance sheet to spend on growth, near-term. With very solid revenue growth in the last year, Israel Land Development - Urban Renewal may be on a path to profitability. Pre-profit companies are often risky, but they can also offer great rewards. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 2 warning signs we've spotted with Israel Land Development - Urban Renewal (including 1 which is potentially serious) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报