Fanuc (TSE:6954) Valuation After Nvidia AI Robotics Partnership and Recent Share Price Surge

Fanuc (TSE:6954) just surged after unveiling a collaboration with Nvidia to build industrial robots that blend AI with physical hardware, placing the company squarely in the middle of the physical AI narrative.

See our latest analysis for Fanuc.

That surge fits into a broader upswing, with a 7 day share price return of 17.25 percent and a 90 day gain of 41.82 percent. The 1 year total shareholder return of 50.93 percent shows momentum has been building rather than fading.

If this physical AI story has you thinking bigger, it could be a good moment to scout other high growth tech names through high growth tech and AI stocks.

But with Fanuc now trading above analyst targets and its Nvidia partnership fuelling rich expectations, is the stock still mispriced relative to its long term AI upside, or are markets already baking in years of growth?

Price-to-Earnings of 35x: Is it justified?

On a trailing price to earnings multiple of 35x at a last close of ¥5,907, Fanuc now trades at a clear premium to peers and its own implied fair multiple.

The price to earnings ratio compares what investors pay for each unit of current earnings, making it a straightforward yardstick for a profitable, established manufacturer like Fanuc. At 35x, the market is effectively assigning a growth and quality premium to its cash generative robotics and factory automation franchise, even though consensus forecasts call for only mid single digit earnings growth.

Relative to the estimated fair price to earnings ratio of 25.2x, that premium looks stretched. This suggests investors are pricing in a stronger or more durable profit trajectory than the SWS fair ratio implies. The gap is even more striking against the wider Japanese machinery industry, where the average multiple stands at just 12.6x. This underscores how aggressively the market is capitalising Fanuc’s earnings compared with sector peers.

Explore the SWS fair ratio for Fanuc

Result: Price-to-Earnings of 35x (OVERVALUED)

However, stretched valuation and reliance on Nvidia optimism mean that any AI slowdown or weaker than expected factory automation demand could quickly reverse recent gains.

Find out about the key risks to this Fanuc narrative.

Another angle on value

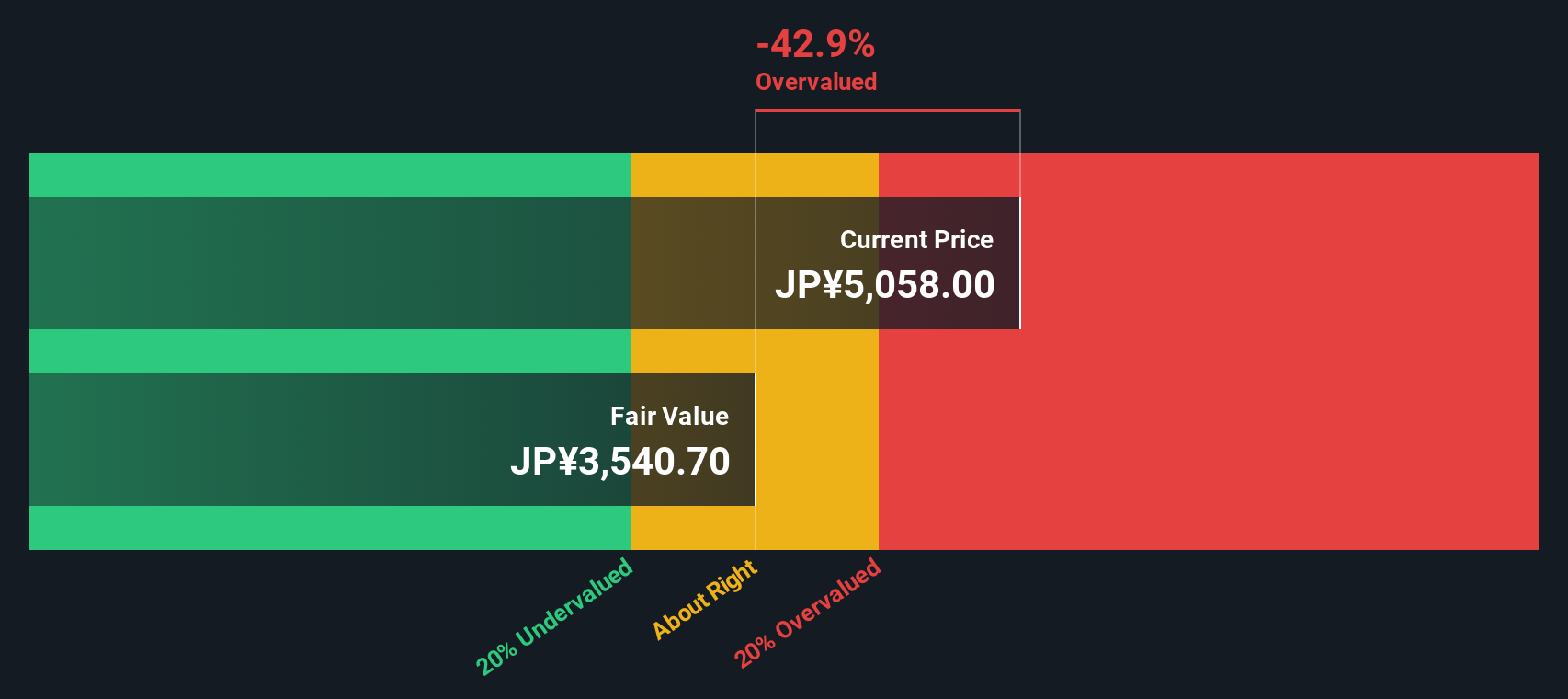

Our DCF model paints an even starker picture, with Fanuc’s fair value sitting at around ¥3,706 per share, well below the current ¥5,907. If both earnings multiples and cash flow point to overvaluation, is the market overreaching on the physical AI story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fanuc for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fanuc Narrative

If you see this differently or want to dig into the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Fanuc research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next move?

Before you move on, lock in your next smart idea by scanning other opportunities that could balance, amplify, or complement a focused bet on Fanuc.

- Explore potential mispricings by targeting companies that look inexpensive on future cash flows through these 902 undervalued stocks based on cash flows.

- Enhance your passive income plan by focusing on reliable payers using these 15 dividend stocks with yields > 3%.

- Position yourself at the forefront of financial innovation with carefully selected digital asset ideas from these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报