NeoGenomics (NEO): Assessing Valuation After a Sharp Three‑Month Share Price Rebound

NeoGenomics (NEO) has quietly staged a sharp recovery in recent months, with shares up around 16% over the past month and more than 55% in the past 3 months, despite still weak longer term returns.

See our latest analysis for NeoGenomics.

Even after the recent bounce, the 1 year total shareholder return is still deeply negative and the year to date share price return remains in the red. This makes the past 3 months of strong share price momentum look more like a potential turn in sentiment than a victory lap.

If NeoGenomics has rekindled your interest in healthcare diagnostics, it could be worth scanning for other specialized names using our curated list of healthcare stocks.

With shares still well below long term highs but analysts seeing modest upside, the key question now is whether NeoGenomics is trading at a genuine discount or if the recent rally already reflects its future growth potential.

Most Popular Narrative: 11.1% Undervalued

With NeoGenomics last closing at $11.71 versus a narrative fair value of $13.17, the current setup frames a modest upside grounded in long term growth math.

Investments in new digital pathology capabilities, automation, and the integration of a unified LIMS are expected to generate material operating efficiencies and enable greater operating leverage. This is described as supporting potential future expansion in EBITDA margins and earnings growth. Successfully renegotiated managed care agreements and ongoing reimbursement initiatives are improving revenue predictability and mix, with test menu expansion (including new NGS and MRD offerings) enhancing revenue per patient and laying the foundation for long term, above market earnings growth.

Curious how steady top line growth, rising margins, and a richer test mix combine into that valuation call? The narrative presents an earnings path and a potential future multiple that might be unexpected. Want to see the exact assumptions behind it?

Result: Fair Value of $13.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that outlook hinges on stabilizing pharma demand and avoiding further product launch delays, any of which could quickly erode the anticipated earnings trajectory.

Find out about the key risks to this NeoGenomics narrative.

Another View: Multiples Paint a Richer Picture

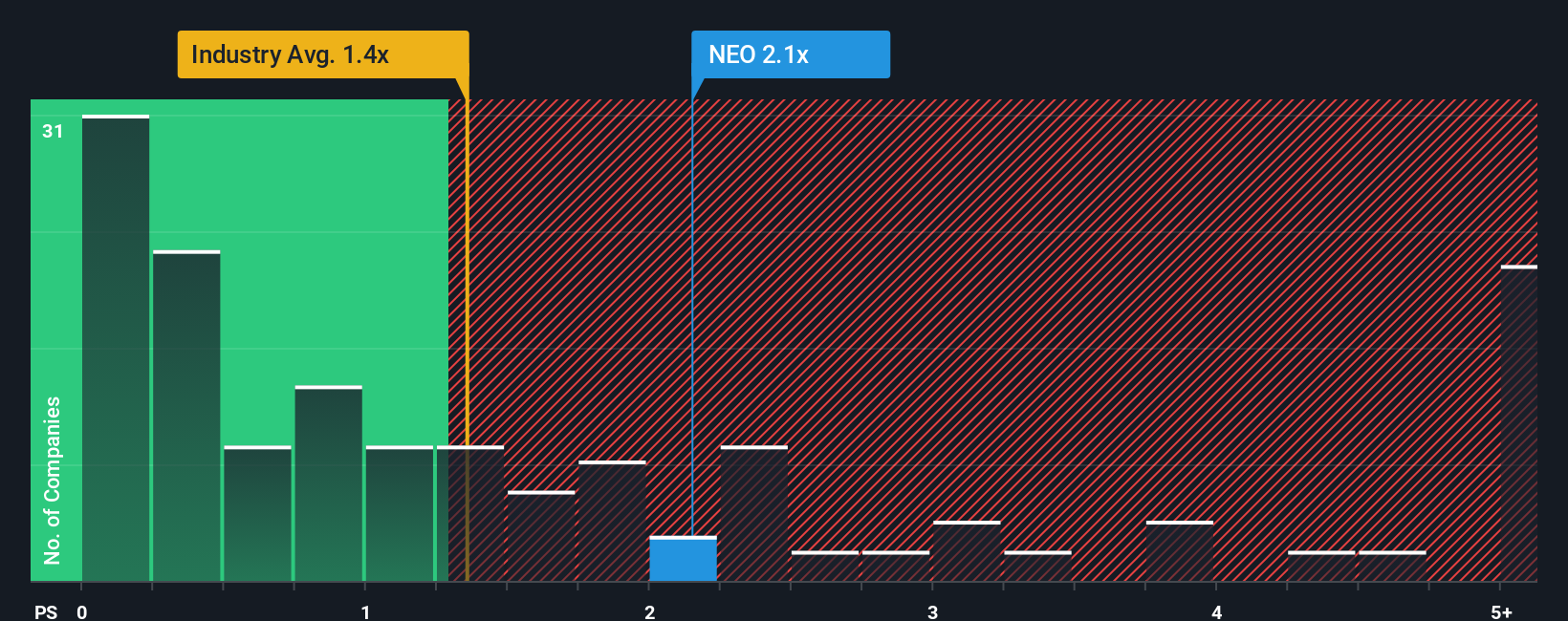

While the narrative fair value suggests upside, the price to sales angle is less generous. NeoGenomics trades at 2.1 times sales, well above the US Healthcare average of 1.2 and a fair ratio of 1.5, hinting at valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NeoGenomics Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes. Do it your way.

A great starting point for your NeoGenomics research is our analysis highlighting 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may wish to explore a wider field of stocks using the Simply Wall St Screener tools.

- Consider these 903 undervalued stocks based on cash flows that may be priced for pessimism yet supported by strong cash flow outlooks.

- Explore these 27 AI penny stocks that are involved in automation, machine learning, and data driven platforms.

- Review these 15 dividend stocks with yields > 3% that aim to pair yield with solid business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报