Teradata (TDC): Reassessing Valuation After Q3 Beats Forecasts and 2025 Outlook Is Reaffirmed

Teradata (TDC) just delivered a Q3 that cleared multiple hurdles at once, topping revenue and recurring revenue guidance while beating expectations on non GAAP earnings and free cash flow, and reaffirming its 2025 outlook.

See our latest analysis for Teradata.

The upbeat quarter seems to be reigniting interest in Teradata, with a 90 day share price return of 49.05% and a five year total shareholder return of 35.48%. This suggests momentum is rebuilding after a softer period.

If this kind of renewed optimism has your attention, it could be a good time to explore other high growth tech and AI names through high growth tech and AI stocks.

Yet with shares still below their five year peak, a rich intrinsic value estimate, and a price already above the average analyst target, is Teradata quietly undervalued here, or has the market fully priced in its next leg of growth?

Most Popular Narrative: 12.9% Overvalued

With Teradata last closing at $31.39 against a narrative fair value of $27.80, the story hinges on improving cash generation and profitability.

The analysts have a consensus price target of $24.444 for Teradata based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $22.0.

Curious how modest revenue shrinkage, stable margins, and a richer future earnings multiple still support a higher value than today’s price? Read the full narrative to see which carefully tuned growth, margin, and discount rate assumptions hold this valuation together.

Result: Fair Value of $27.80 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering revenue headwinds and intensifying competition from cloud hyperscalers could derail the margin and free cash flow gains that underpin this valuation narrative.

Find out about the key risks to this Teradata narrative.

Another View: Market Multiples Point To Value

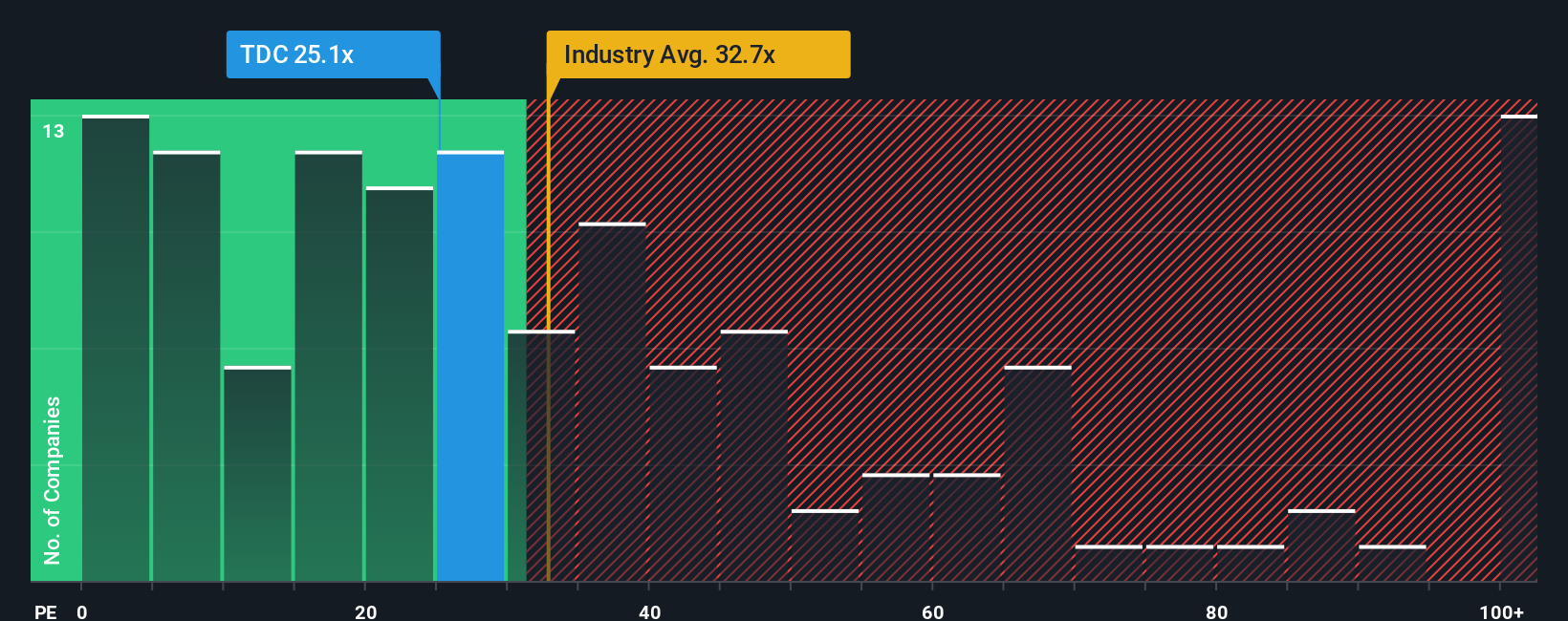

Step away from narrative fair value and Teradata suddenly looks different. On a price to earnings of 24.8 times versus a fair ratio of 26.4 times and a US Software average of 31.5 times, the market is actually pricing in a discount, not excess optimism. Is that a quiet opportunity or a value trap forming?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teradata Narrative

If you are not convinced by this view or would rather dive into the numbers yourself, you can build a personalized Teradata story in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Teradata.

Looking for more investment ideas?

Before you move on, lock in your next smart move by scanning fresh opportunities on Simply Wall Street, where targeted screeners keep you one step ahead.

- Capture underappreciated value by reviewing these 903 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow potential.

- Capitalize on accelerating innovation by assessing these 27 AI penny stocks positioned to benefit from real world adoption of artificial intelligence.

- Boost your income strategy by narrowing in on these 15 dividend stocks with yields > 3% that could strengthen the yield of your long term portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报