Has Jabil’s 469.9% Five Year Surge Left Any Value on the Table in 2025?

- Wondering if Jabil at around $225 is still a smart buy or if the easy money has already been made? This article will walk through whether the current price lines up with its underlying value.

- The stock has been on a tear, climbing 7.3% over the last week, 57.8% year to date, and 68.2% over the past year, with a 469.9% gain over five years that has clearly reset market expectations.

- Behind these moves, investors have been reacting to Jabil sharpening its focus on higher margin, design rich manufacturing for secular growth areas such as cloud, 5G infrastructure, and electric vehicles, while streamlining lower return operations. The market has also been rewarding the company for ongoing buybacks and portfolio simplification, which together signal management's confidence in long term cash generation.

- Right now Jabil only scores 2/6 on our valuation checks. The key question is whether traditional valuation tools like discounted cash flow and multiples are missing something deeper about the story, and we will finish by looking at a more nuanced way to judge whether today's price still makes sense.

Jabil scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Jabil Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present.

For Jabil, the latest twelve month Free Cash Flow stands at about $912 Million. Analysts and internal estimates see this rising over time, with Free Cash Flow projected to reach roughly $2.1 Billion by 2035, based on a two stage Free Cash Flow to Equity approach that blends explicit forecasts with more moderate long term growth assumptions. Simply Wall St projects cash flows out to 10 years, then discounts each year back to today using a required rate of return.

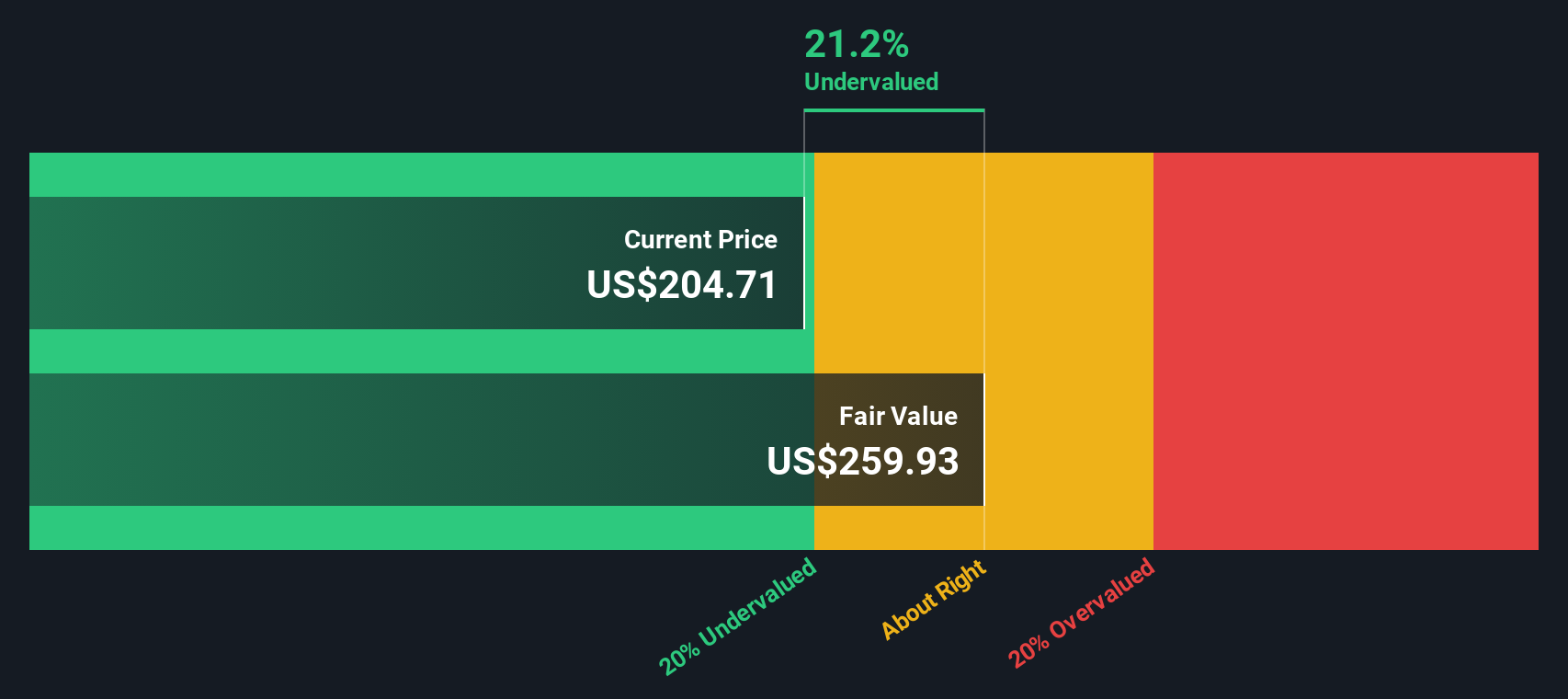

On this basis, the DCF model arrives at an intrinsic value of about $258.47 per share. Compared with the current market price around $225, this implies Jabil is trading at roughly a 12.8% discount to its estimated fair value. This suggests the shares are still modestly undervalued rather than priced for perfection.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Jabil is undervalued by 12.8%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Jabil Price vs Earnings

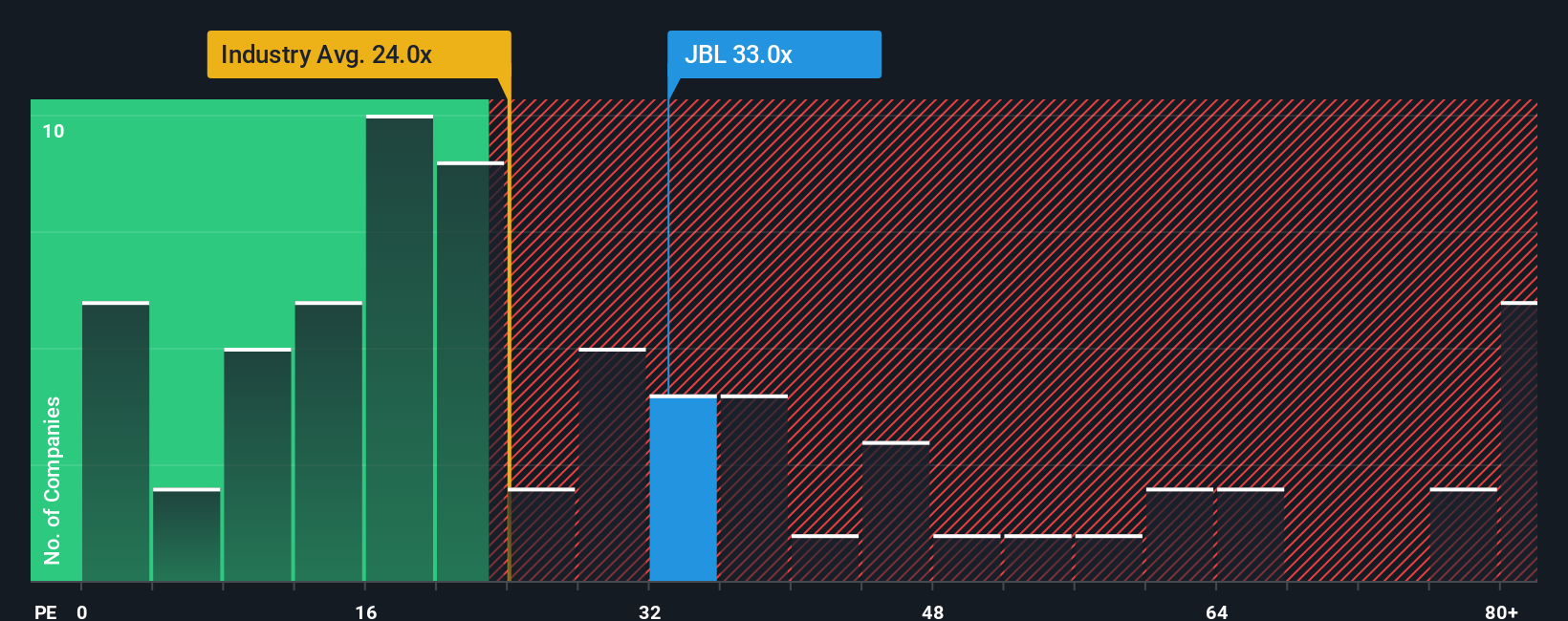

For consistently profitable companies like Jabil, the Price to Earnings ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current profits. A higher PE can be justified when a business has strong, durable growth prospects and relatively low risk, while slower or more volatile companies typically deserve a lower, more conservative multiple.

Jabil currently trades on a PE of about 36.7x. That is slightly below the peer average at roughly 37.9x, but well above the broader Electronic industry average of around 24.6x, which signals that the market is already pricing in superior growth and profitability compared with the typical player in the sector.

Simply Wall St also calculates a proprietary Fair Ratio, which estimates what PE Jabil should trade on after accounting for its earnings growth outlook, profit margins, industry, market cap and specific risks. This tailored Fair Ratio for Jabil is 31.2x, notably below today’s 36.7x. Because this metric adjusts for the company’s own fundamentals rather than just comparing against blunt industry or peer averages, it provides a more nuanced yardstick, and on this basis Jabil looks somewhat expensive at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1453 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Jabil Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to attach your own story about Jabil to the numbers by linking your view of its future revenue, earnings and margins to a forecast and then to a Fair Value that you can easily compare with today’s share price. All of this happens within the Narratives tool on Simply Wall St’s Community page that millions of investors use to decide whether to buy or sell. The tool updates dynamically as new news or earnings arrive. For example, one Jabil investor might build a bullish Narrative closer to the higher fair value estimate around $256, assuming sustained AI driven growth, margin expansion and successful execution in BESS and pharmaceuticals. A more cautious investor might anchor their Narrative nearer the lower end around $176, baking in weaker demand in EV and renewables, tariff risks and slower margin improvement. Each Narrative turns those beliefs into a living valuation you can track against the current price.

Do you think there's more to the story for Jabil? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报