Coca-Cola Consolidated (COKE): Assessing Valuation After Its New $1.35 Billion Financing Deal

Coca-Cola Consolidated (COKE) just lined up a $1.35 billion loan agreement, a sizable financing move that should reshape its debt profile and give management more room to maneuver strategically.

See our latest analysis for Coca-Cola Consolidated.

The financing news lands after a strong run in the stock, with Coca-Cola Consolidated’s share price at $164.51 and a 30 day share price return of 19.40 percent, backed by a powerful 5 year total shareholder return of 554.40 percent that suggests momentum is still very much alive.

If this kind of sustained strength has your attention, it could be a good moment to compare it with other consumer facing names and explore fast growing stocks with high insider ownership.

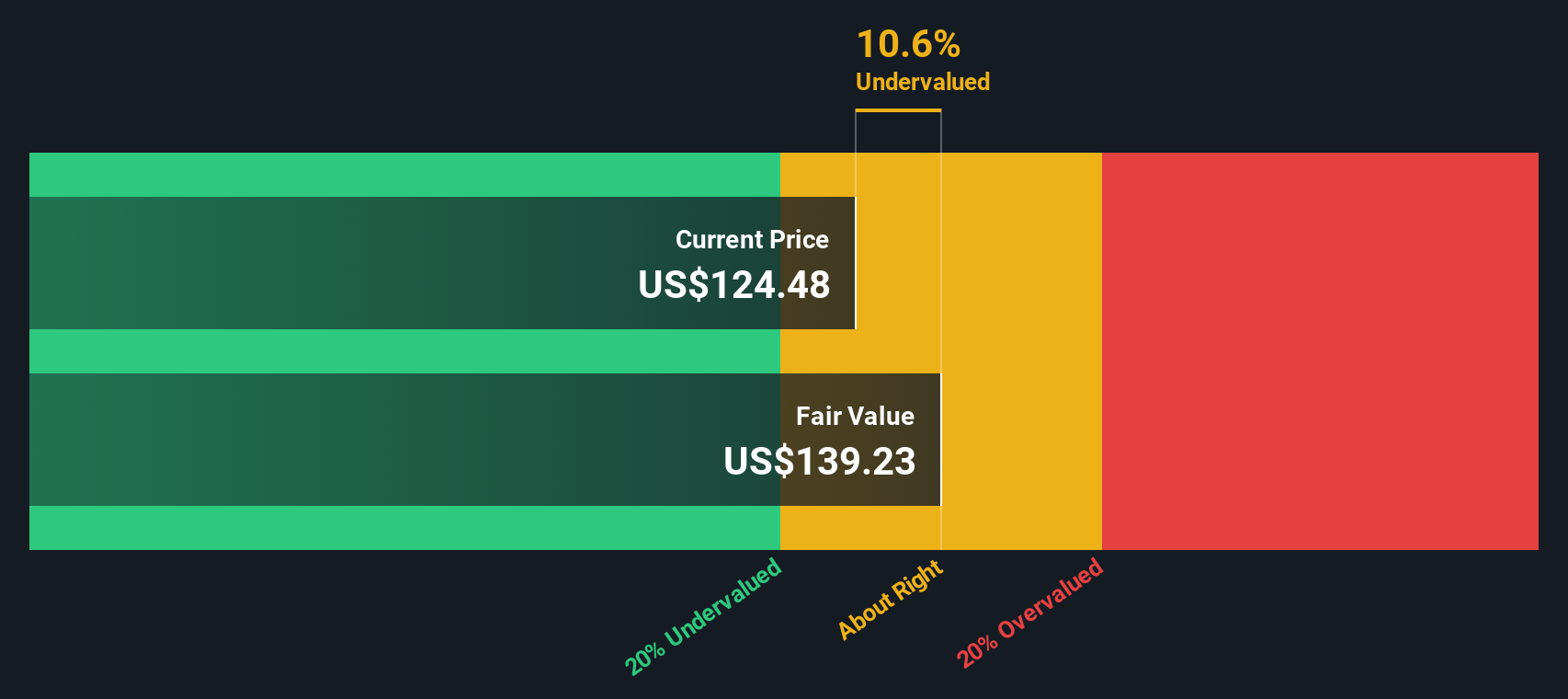

With that kind of track record and fresh financing firepower, the key question now is whether Coca-Cola Consolidated’s shares still trade below their true value or if the market has already priced in years of future growth.

Price-to-Earnings of 22.9x: Is it justified?

Coca-Cola Consolidated trades on a 22.9x price-to-earnings multiple, slightly below close peers but above the broader global beverage pack, at a last close of $164.51.

The price-to-earnings ratio compares what investors pay today with the company’s current earnings power, a key lens for a mature yet still growing beverage bottler like COKE. For a business delivering high quality earnings and steadily expanding profit margins, a richer multiple can reflect expectations that recent performance is not a one off.

Relative to similar companies, COKE looks modestly cheap, with its 22.9x multiple undercutting the 25.2x peer average, hinting that the market has not fully matched the company’s strong execution. Yet on a wider stage it screens as expensive, because that same 22.9x multiple stands well above the 17.5x global beverage average, implying investors are already paying a premium for its faster earnings growth and strong returns.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-earnings of 22.9x (ABOUT RIGHT)

However, rising input costs or a slowdown in consumer demand could compress margins and challenge assumptions that COKE can sustain its standout earnings momentum.

Find out about the key risks to this Coca-Cola Consolidated narrative.

Another View: Our DCF Take

While the earnings multiple suggests COKE is roughly fairly priced, our DCF model points to modest upside, with the shares trading about 4.1 percent below an estimated fair value of roughly $171 per share. Is the market underestimating how durable this cash flow story really is?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coca-Cola Consolidated for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coca-Cola Consolidated Narrative

If you see the numbers differently or want to test your own assumptions, you can quickly build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Coca-Cola Consolidated.

Looking for your next smart investment move?

Before the market’s next swing, sharpen your edge with fresh ideas from our screeners so you are targeting quality opportunities, not chasing yesterday’s winners.

- Capture potential upside early by scanning these 902 undervalued stocks based on cash flows that the market may be overlooking while their cash flows quietly compound in the background.

- Lock in reliable income streams by zeroing in on these 15 dividend stocks with yields > 3% that can help anchor your portfolio through volatile cycles.

- Position yourself at the frontier of digital finance by monitoring these 81 cryptocurrency and blockchain stocks riding real world adoption of blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报