Incyte (INCY): Evaluating Valuation After Strong Year-to-Date Gains and a Recent Pullback

Incyte (INCY) has been quietly rewarding patient shareholders, with the stock up about 39% year to date despite a modest pullback over the past month. That mix of recent weakness and longer term strength creates an interesting entry point for investors watching this mid cap biotech name.

See our latest analysis for Incyte.

That recent 1 month share price return of negative 8.8 percent, including a sharp 1 day drop, looks more like a breather within a broader upswing, given the roughly 39 percent year to date share price gain and solid longer term total shareholder returns.

If Incyte has you thinking more broadly about healthcare opportunities, it could be a good moment to scan healthcare stocks for other names with similar potential.

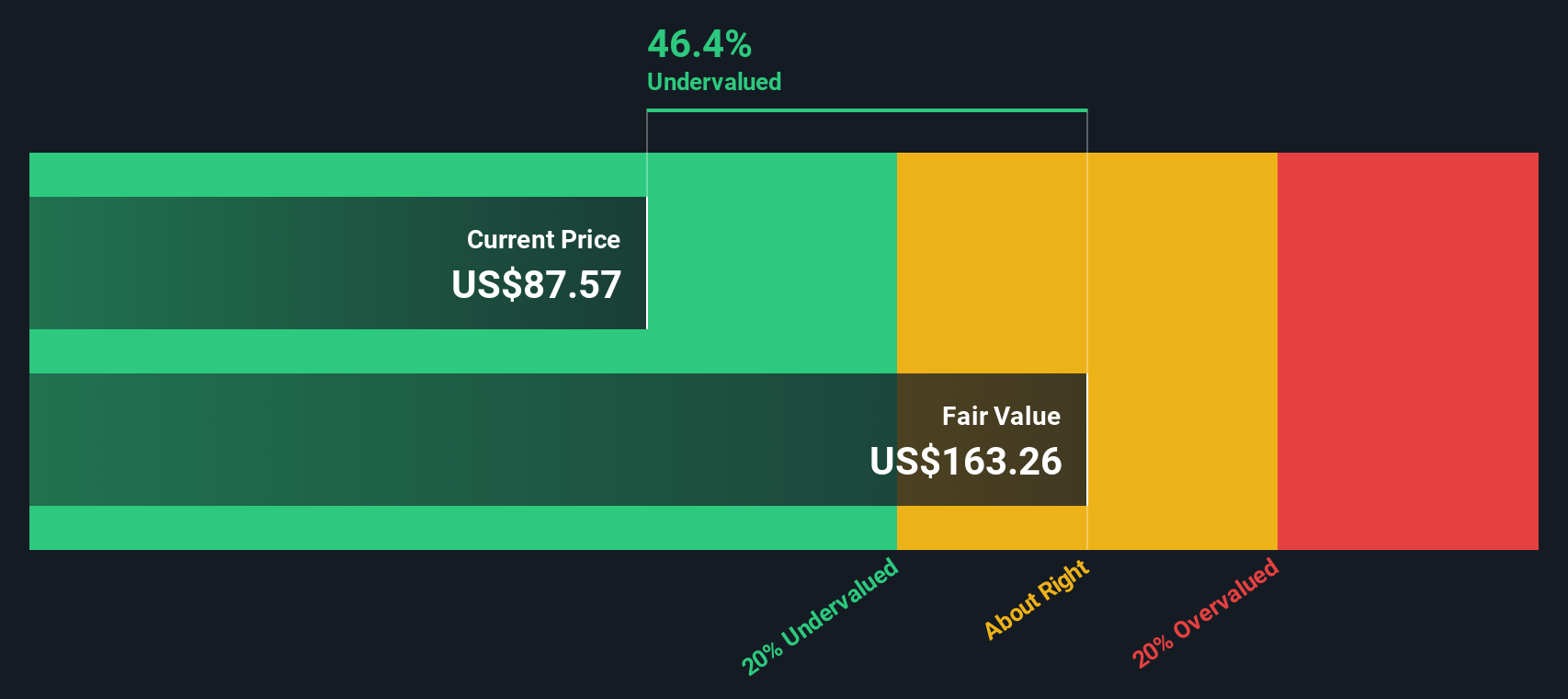

With shares trading just below analyst targets yet at a hefty discount to some intrinsic value estimates, investors now face a key question: Is Incyte still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 1% Overvalued

With Incyte last closing at $96.70 against a narrative fair value of about $95.57, expectations for steady growth are finely balanced, not euphoric.

The upcoming launches and label expansions of innovative therapies like Opzelura (ruxolitinib cream), povorcitinib, and Niktimvo in high value indications such as atopic dermatitis, vitiligo, hidradenitis suppurativa (HS), and GVHD, along with a late stage pipeline of targeted drugs, position Incyte to benefit from heightened demand for advanced immunology and oncology treatments as global populations age, which may support sustained revenue growth and future earnings.

Want to see the revenue and margin roadmap behind this stance, including how profit expansion and a lower future earnings multiple work together? The full narrative reveals the numbers driving that delicate fair value call.

Result: Fair Value of $95.57 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks around Jakafi dependence and potential R&D setbacks mean competitive pressures could quickly challenge assumptions behind that "about right" valuation.

Find out about the key risks to this Incyte narrative.

Another Lens On Value

While the narrative view calls Incyte about fairly priced, our DCF model is far more optimistic, putting fair value near $165.52, roughly 42 percent above the current share price. If that cash flow outlook is right, is the market still underestimating how durable Incyte’s pipeline could be?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Incyte Narrative

If you prefer to dig into the numbers yourself and challenge these assumptions, you can build a customized view of Incyte in minutes: Do it your way.

A great starting point for your Incyte research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop at a single stock. Use the Simply Wall Street Screener to uncover fresh opportunities that match your goals before the market moves without you.

- Capture potential high reward setups by scanning these 3581 penny stocks with strong financials that pair speculative upside with underlying financial strength.

- Position your portfolio for the next wave of innovation by targeting these 27 AI penny stocks pushing the boundaries of automation and intelligent software.

- Lock in quality at sensible prices by focusing on these 902 undervalued stocks based on cash flows that may be trading below their long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报