Websol Energy System Limited (NSE:WEBELSOLAR) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

The Websol Energy System Limited (NSE:WEBELSOLAR) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 31% in that time.

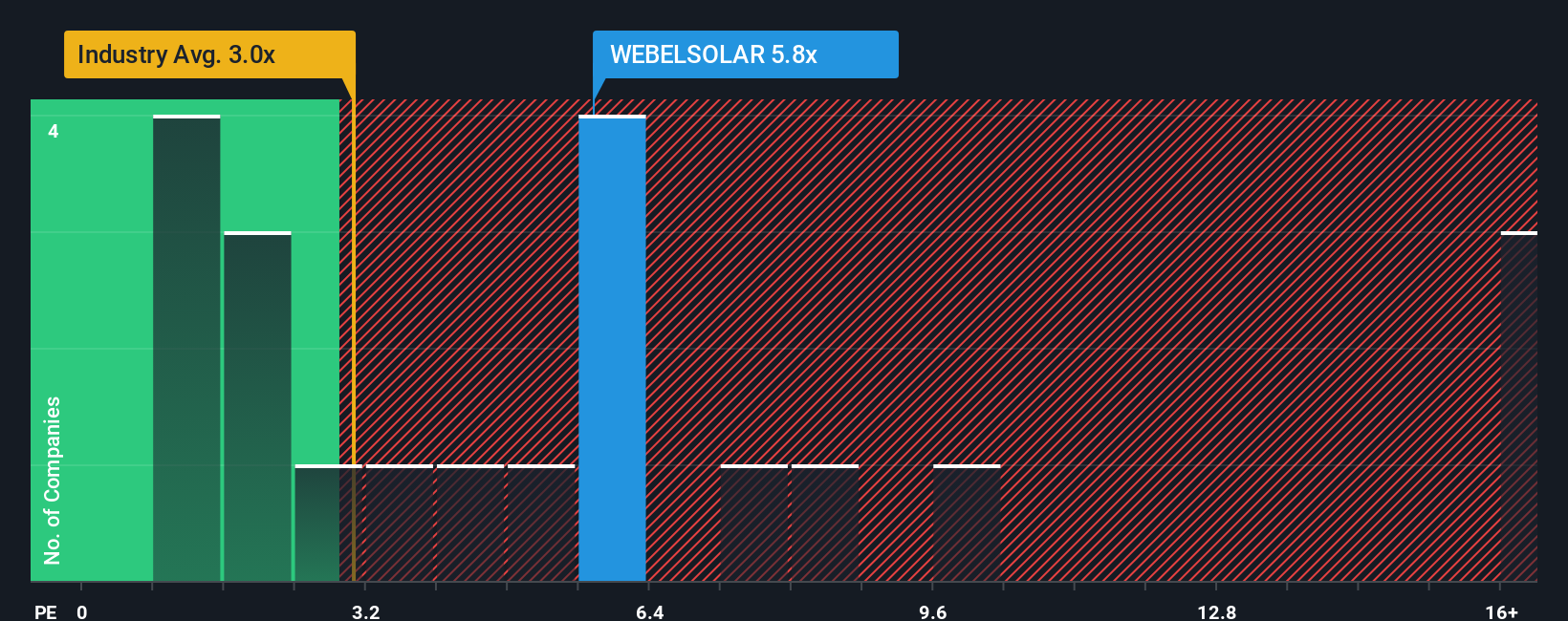

Although its price has dipped substantially, Websol Energy System's price-to-sales (or "P/S") ratio of 5.8x might still make it look like a sell right now compared to the wider Semiconductor industry in India, where around half of the companies have P/S ratios below 4.6x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Websol Energy System

How Websol Energy System Has Been Performing

With revenue growth that's exceedingly strong of late, Websol Energy System has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Websol Energy System, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Websol Energy System would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 152%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 27%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Websol Energy System is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Websol Energy System's P/S

Despite the recent share price weakness, Websol Energy System's P/S remains higher than most other companies in the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that Websol Energy System can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Websol Energy System has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If these risks are making you reconsider your opinion on Websol Energy System, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报