Casey’s (CASY) Valuation Check After Double-Digit Q1 2026 Growth and Ongoing Store Expansion

Casey's General Stores (CASY) just delivered an 11% revenue jump and 20% net income growth in fiscal Q1 2026, while quietly adding another store to its nearly 2,900 location footprint.

See our latest analysis for Casey's General Stores.

That steady store expansion and double digit earnings growth seem to be feeding into sentiment, with the share price up 43.68% year to date and a powerful 5 year total shareholder return of 237.83% pointing to sustained momentum rather than a short lived spike.

If this kind of durable performance has your attention, it might be a good time to widen the lens and explore fast growing stocks with high insider ownership for other under the radar growth stories.

With shares hovering near analysts’ targets after a multiyear surge and intrinsic value models suggesting a slight premium, is Casey’s still a smart entry point for new investors, or is the market already baking in years of future growth?

Most Popular Narrative Narrative: 4.2% Undervalued

With the narrative fair value sitting a touch above the last close, the story hinges on whether Casey's can keep compounding earnings at its current pace.

Progress toward converting and remodeling acquired stores for Casey's full food/kitchen model creates a future catalyst for gross margin expansion and synergy capture, with expected benefits becoming more pronounced in the following fiscal year and supporting multi-year EPS growth.

Want to see the engine behind that earnings ramp, from modest revenue growth to a premium future multiple that tops the sector, and the precise margin lift it bakes in? The narrative unpacks a carefully layered forecast across sales, profitability, and valuation that could reshape how you think about this convenience chain’s upside.

Result: Fair Value of $591.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued reliance on fuel driven traffic and slower than expected margin gains from newly acquired stores could quickly weaken the premium growth narrative.

Find out about the key risks to this Casey's General Stores narrative.

Another Angle on Valuation

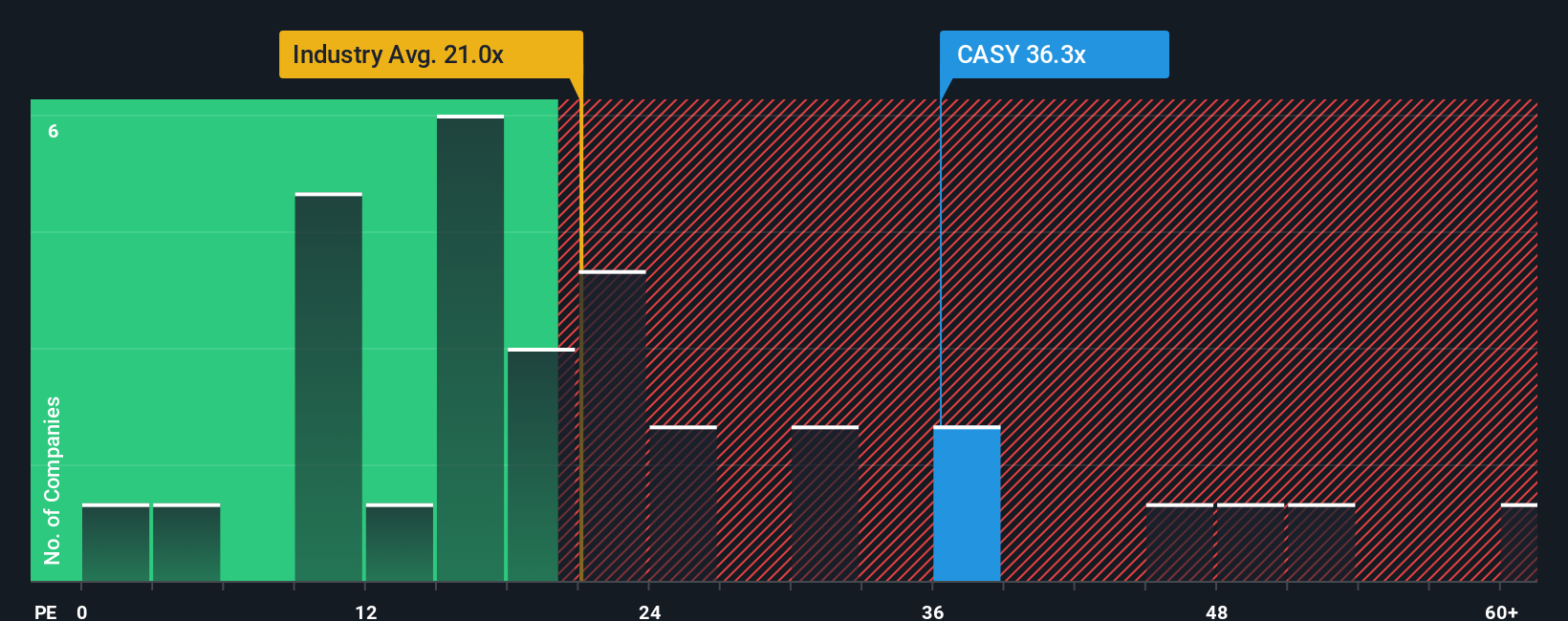

On earnings comparables, Casey's looks far less forgiving. The current P/E of about 36 times is well above both the US consumer retailing average of roughly 22 times and its own fair ratio of about 22 times. This implies investors are paying a steep premium that could unwind if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Casey's General Stores Narrative

If you see the story differently or want to test your own assumptions against the numbers, build a personalized narrative in minutes, Do it your way.

A great starting point for your Casey's General Stores research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before markets move on without you, lock in your next opportunity by using the Simply Wall Street Screener to pinpoint stocks that truly match your strategy.

- Target steady income by reviewing these 15 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash returns.

- Pursue aggressive upside by scanning these 3580 penny stocks with strong financials that pair smaller market caps with surprisingly strong financials.

- Position ahead of structural shifts by focusing on these 30 healthcare AI stocks that are transforming diagnostics, treatment pathways, and operational efficiency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报