Asian Growth Companies With High Insider Ownership For December 2025

As December 2025 unfolds, Asian markets are capturing global attention with their robust performance, particularly as investors anticipate potential interest rate adjustments from major economies like the U.S. and Japan. Amidst this backdrop, growth companies with high insider ownership in Asia stand out as potentially attractive opportunities, offering a unique blend of strategic alignment and long-term commitment that can be appealing to investors navigating today's complex market environment.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| Knowmerce (KOSDAQ:A473980) | 30% | 33.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's uncover some gems from our specialized screener.

Xi'an Bright Laser TechnologiesLtd (SHSE:688333)

Simply Wall St Growth Rating: ★★★★★☆

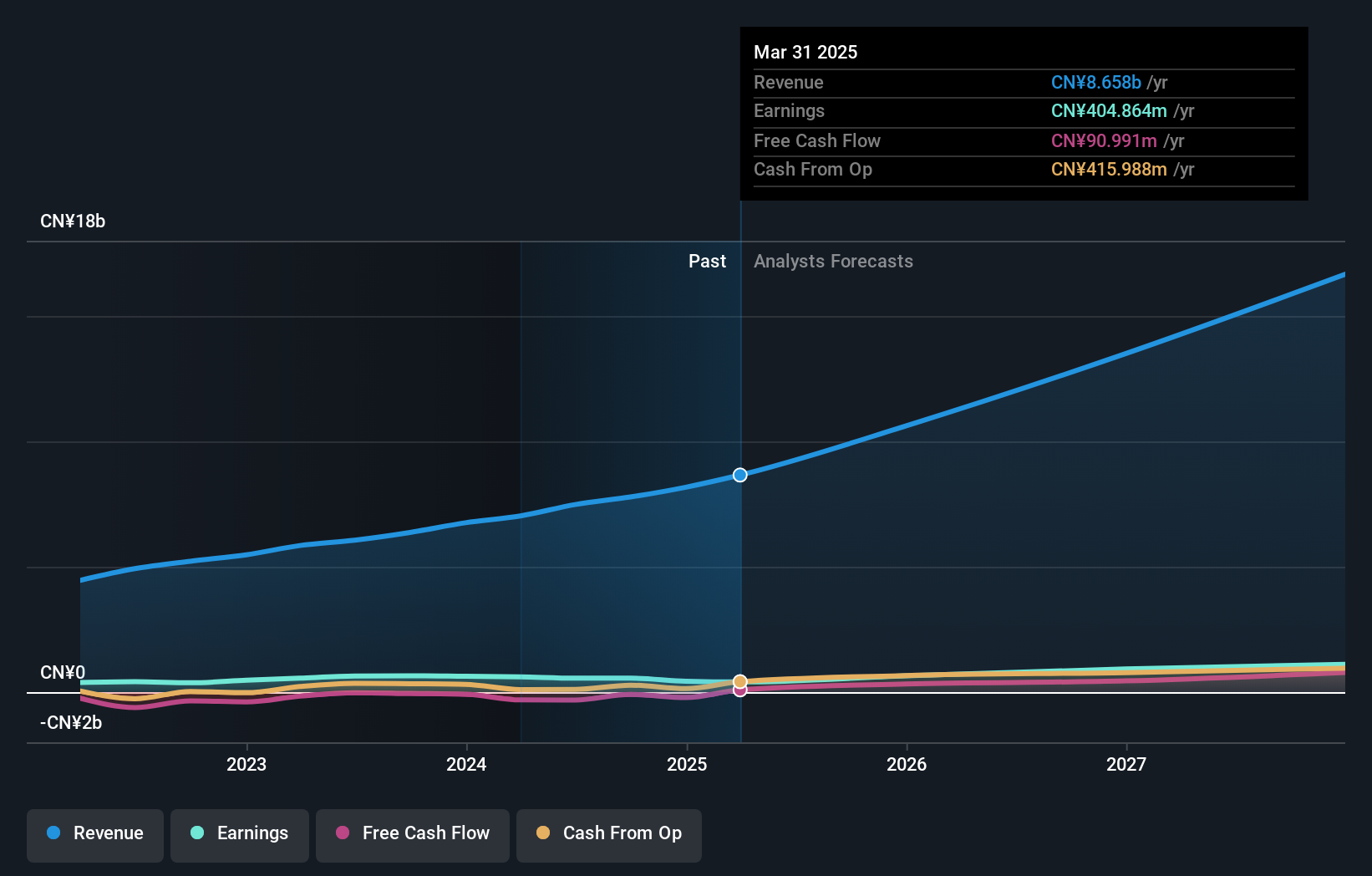

Overview: Xi'an Bright Laser Technologies Co., Ltd. offers metal additive manufacturing solutions in China and has a market cap of CN¥22.63 billion.

Operations: Xi'an Bright Laser Technologies Co., Ltd.'s revenue is primarily derived from providing metal additive manufacturing solutions in China.

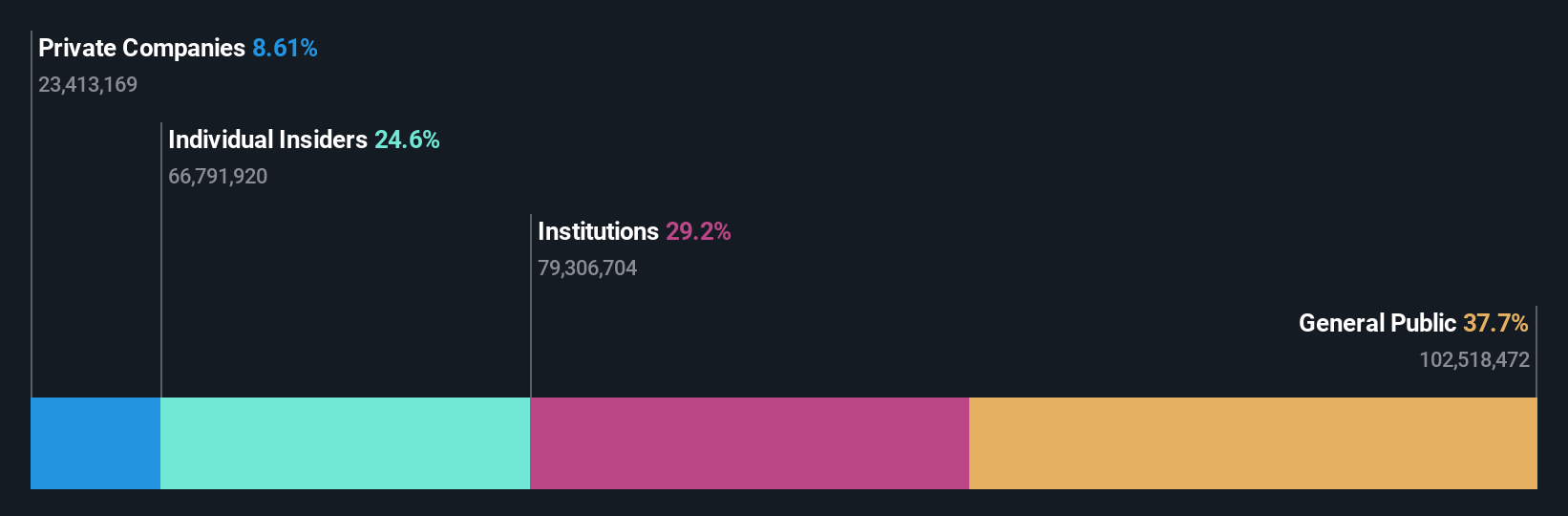

Insider Ownership: 24.6%

Revenue Growth Forecast: 33.2% p.a.

Xi'an Bright Laser Technologies has demonstrated robust growth with its earnings rising by 80.6% over the past year and forecasted to grow at 41.49% annually, outpacing the Chinese market. Revenue is also expected to increase significantly at 33.2% per year. Recent earnings reports show substantial improvements, with net income reaching CNY 155.75 million for the first nine months of 2025, indicating strong operational performance despite a forecast of low future return on equity at 8.7%.

- Dive into the specifics of Xi'an Bright Laser TechnologiesLtd here with our thorough growth forecast report.

- Our expertly prepared valuation report Xi'an Bright Laser TechnologiesLtd implies its share price may be too high.

Shenzhen Megmeet Electrical (SZSE:002851)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Megmeet Electrical Co., LTD is an electrical automation company in China with a market cap of CN¥40.94 billion.

Operations: Shenzhen Megmeet Electrical Co., LTD generates revenue through its electrical automation operations in China.

Insider Ownership: 33.1%

Revenue Growth Forecast: 25.6% p.a.

Shenzhen Megmeet Electrical shows promising growth potential with earnings forecasted to rise significantly at 58.1% annually, surpassing the Chinese market average. Despite a volatile share price and lower profit margins (2.6%) compared to last year, revenue is projected to grow robustly at 25.6% per year. Recent executive changes and amendments to company bylaws may impact future governance, while net income for the first nine months of 2025 decreased to CNY 212.62 million from CNY 411.15 million last year, reflecting current challenges.

- Unlock comprehensive insights into our analysis of Shenzhen Megmeet Electrical stock in this growth report.

- Our valuation report here indicates Shenzhen Megmeet Electrical may be overvalued.

Kinik (TWSE:1560)

Simply Wall St Growth Rating: ★★★★★☆

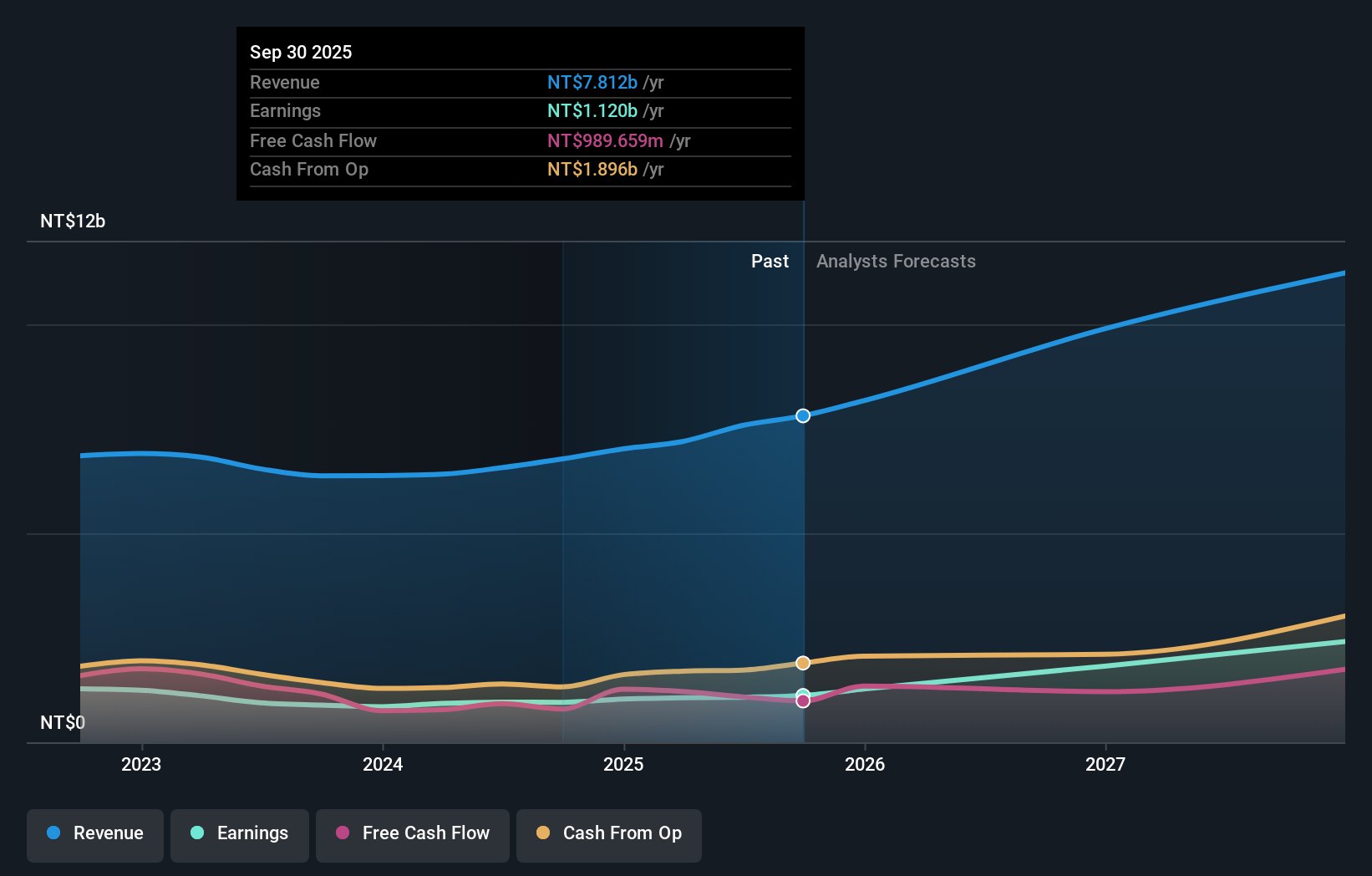

Overview: Kinik Company is engaged in the production and sale of abrasives, cutting tools, and reclaimed wafers both in Taiwan and internationally, with a market cap of NT$53.05 billion.

Operations: The company's revenue is derived from two main segments: the Electronics Sector, contributing NT$3.71 billion, and the Traditional Sectors, accounting for NT$4.10 billion.

Insider Ownership: 15.8%

Revenue Growth Forecast: 16.8% p.a.

Kinik demonstrates solid growth potential, with earnings projected to increase significantly at 34.2% annually, outpacing the Taiwanese market average. The company's revenue is also expected to grow faster than the market at 16.8% per year. Recent financial results show a rise in sales to TWD 2.09 billion for Q3 2025, up from TWD 1.86 billion a year ago, and net income increased to TWD 328.44 million from TWD 285.35 million last year, indicating strong performance momentum despite no significant insider trading activity recently noted.

- Take a closer look at Kinik's potential here in our earnings growth report.

- The analysis detailed in our Kinik valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Gain an insight into the universe of 642 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Want To Explore Some Alternatives? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报