3 Asian Dividend Stocks Yielding Up To 8.9%

As global markets navigate a landscape marked by fluctuating interest rates and mixed economic signals, investors are increasingly looking towards Asia for opportunities. In this context, dividend stocks in the region can offer a blend of income and potential stability amid market uncertainties.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.86% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.60% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.93% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.71% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.05% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.09% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.82% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.83% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.42% | ★★★★★★ |

Click here to see the full list of 1029 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

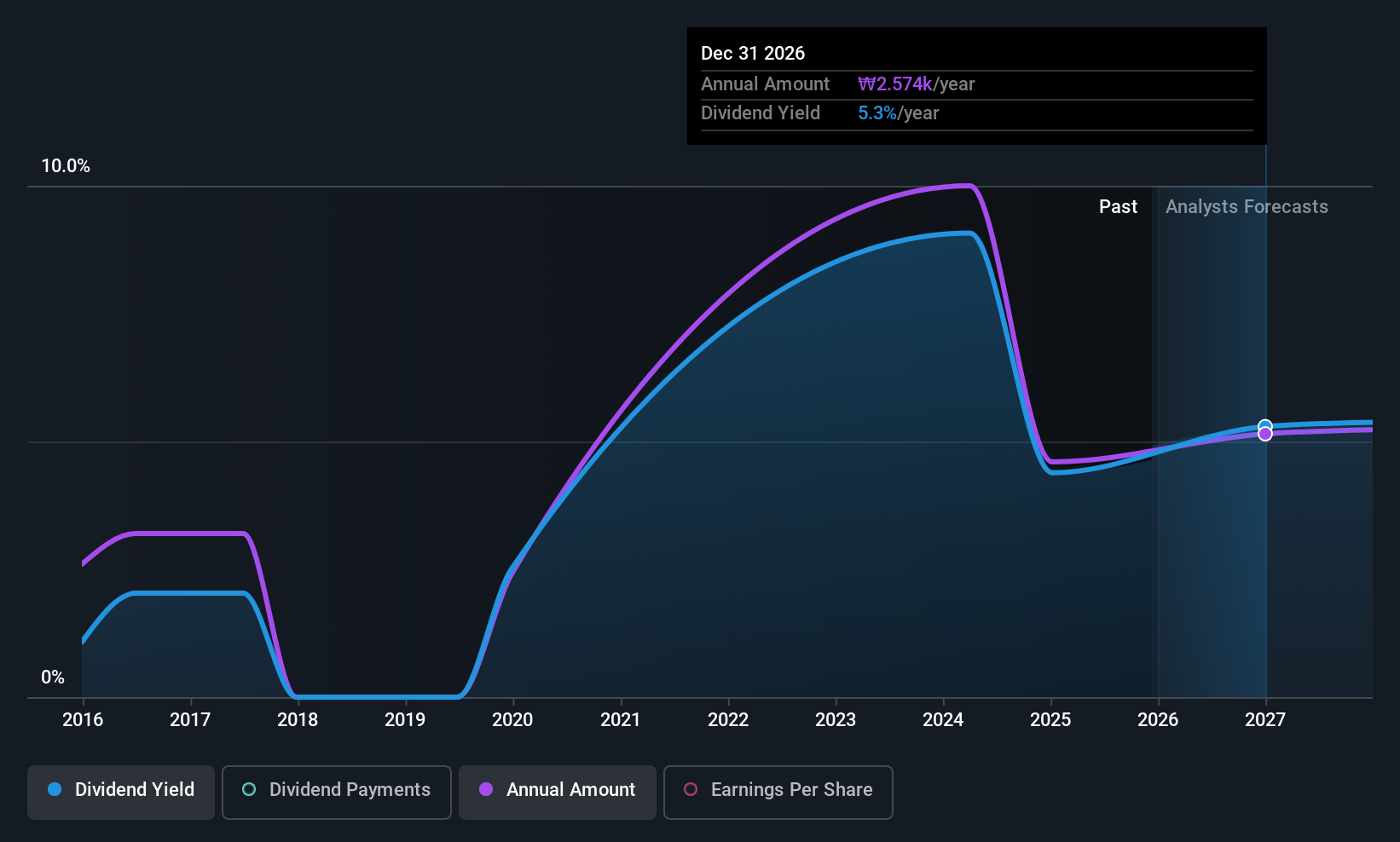

Hanatour Service (KOSE:A039130)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanatour Service Inc. offers travel and related services across South Korea, Northeast and Southeast Asia, the United States, and Europe with a market cap of ₩765.98 billion.

Operations: Hanatour Service Inc.'s revenue is primarily derived from its Travel segment, which accounts for ₩536.16 billion, followed by the Hotel segment at ₩30.81 billion.

Dividend Yield: 4.7%

Hanatour Service recently announced a share repurchase program worth KRW 39.65 billion, aimed at boosting shareholder value. However, the company also reported a decrease in its annual dividend to KRW 1,200 per share. Despite having a high payout ratio of 94.7%, indicating dividends are not well covered by earnings, the cash payout ratio is more sustainable at 31.6%. The dividend yield of 4.65% remains attractive within the Korean market but has been historically volatile and unreliable over the past decade.

- Take a closer look at Hanatour Service's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Hanatour Service is trading beyond its estimated value.

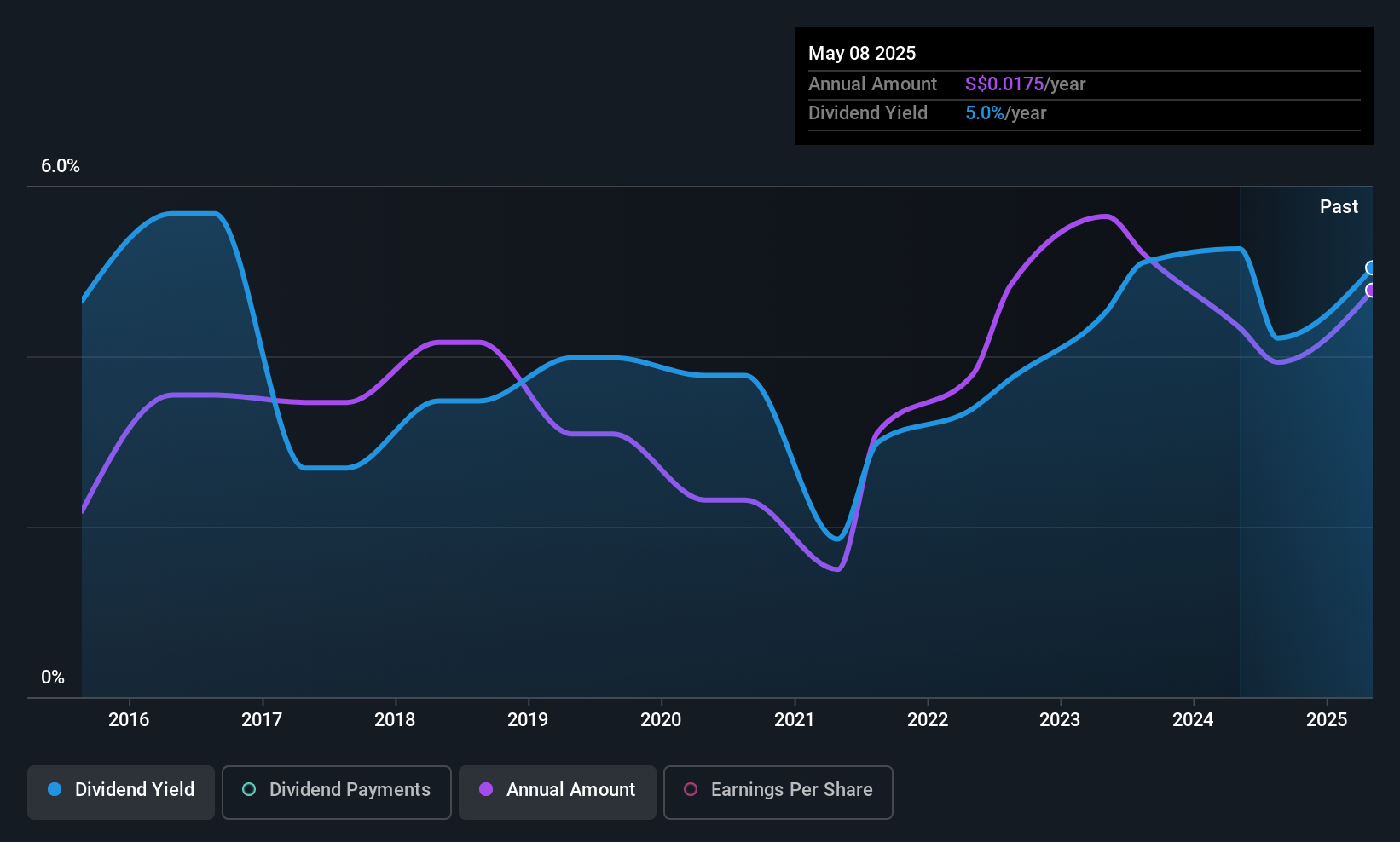

Nordic Group (SGX:MR7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Group Limited offers a diverse range of services including system integration, maintenance, repair, overhaul, precision engineering, and more within the engineering sector; it has a market capitalization of SGD175.24 million.

Operations: Nordic Group Limited's revenue is primarily derived from its Project Services segment, which generated SGD90.63 million, and its Maintenance Services segment, which contributed SGD81.99 million.

Dividend Yield: 3.9%

Nordic Group's dividend payments have been volatile over the past decade, though they have increased overall. The dividends are well covered by both earnings and cash flows, with payout ratios of 39.9% and 27.4%, respectively. Despite trading at a significant discount to its estimated fair value, the dividend yield is lower than top-tier payers in Singapore. Recent expansion into India aims to enhance regional presence and long-term growth but won't materially impact financials this year.

- Click here and access our complete dividend analysis report to understand the dynamics of Nordic Group.

- The valuation report we've compiled suggests that Nordic Group's current price could be quite moderate.

Samudera Shipping Line (SGX:S56)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samudera Shipping Line Ltd operates in the transportation of containerized and non-containerized cargo across Southeast Asia, the Indian Sub-continent, the Far East, and the Middle East, with a market capitalization of SGD527.28 million.

Operations: Samudera Shipping Line Ltd generates its revenue primarily from Container Shipping, which accounts for $549.06 million, followed by Bulk and Tanker at $28.03 million, and Logistics at $17.59 million.

Dividend Yield: 8.9%

Samudera Shipping Line's dividend yield ranks in the top 25% of Singapore's market, supported by a low payout ratio of 11.2%, indicating strong coverage by earnings. However, its dividend history is marked by volatility and unreliability over the past decade. Recent expansions in Japan and Singapore are unlikely to materially impact current financials but may enhance future growth prospects. The stock trades significantly below its estimated fair value, offering potential upside for investors seeking value opportunities.

- Unlock comprehensive insights into our analysis of Samudera Shipping Line stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Samudera Shipping Line is priced lower than what may be justified by its financials.

Make It Happen

- Discover the full array of 1029 Top Asian Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报