Will Perrone Robotics’ IP Lawsuits Cloud Nissan Motor’s (TSE:7201) Software-Led Margin Ambitions?

- Perrone Robotics has previously filed patent infringement lawsuits against several major automakers, including Nissan, in U.S. federal courts, alleging unauthorized use of its automated driving and robotics technologies in production vehicle software stacks.

- The cases highlight how core driver-assistance and autonomy features may rest on intellectual property claims from early robotics innovators, exposing Nissan’s software-defined vehicle ambitions to legal and licensing uncertainty.

- We’ll now examine how this alleged use of Perrone’s autonomous driving IP could influence Nissan’s investment narrative, particularly around software-led margin improvement.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Nissan Motor Investment Narrative Recap

Nissan’s appeal rests on a belief that its EV transition, cost-cutting under Re:Nissan and alliance synergies can pull the business back to sustainable profitability. The Perrone Robotics lawsuits inject legal uncertainty into Nissan’s software-defined vehicle push, but at this stage the impact on near term catalysts, such as product launches and restructuring milestones, appears limited and more reputational and financial than transformational.

The June 2025 unveiling of the all new 2026 Nissan LEAF, with expanded tech features and software rich driver assistance, is where the Perrone claims matter most, because any legal or licensing overhang around autonomy related IP could influence the economics of future EV models and the timing of software led margin improvement.

Yet investors should be aware that ongoing legal disputes around autonomous driving software could...

Read the full narrative on Nissan Motor (it's free!)

Nissan Motor’s narrative projects ¥12,909.5 billion revenue and ¥203.3 billion earnings by 2028. This implies 1.5% yearly revenue growth and roughly a ¥1,018.5 billion earnings increase from ¥-815.2 billion today.

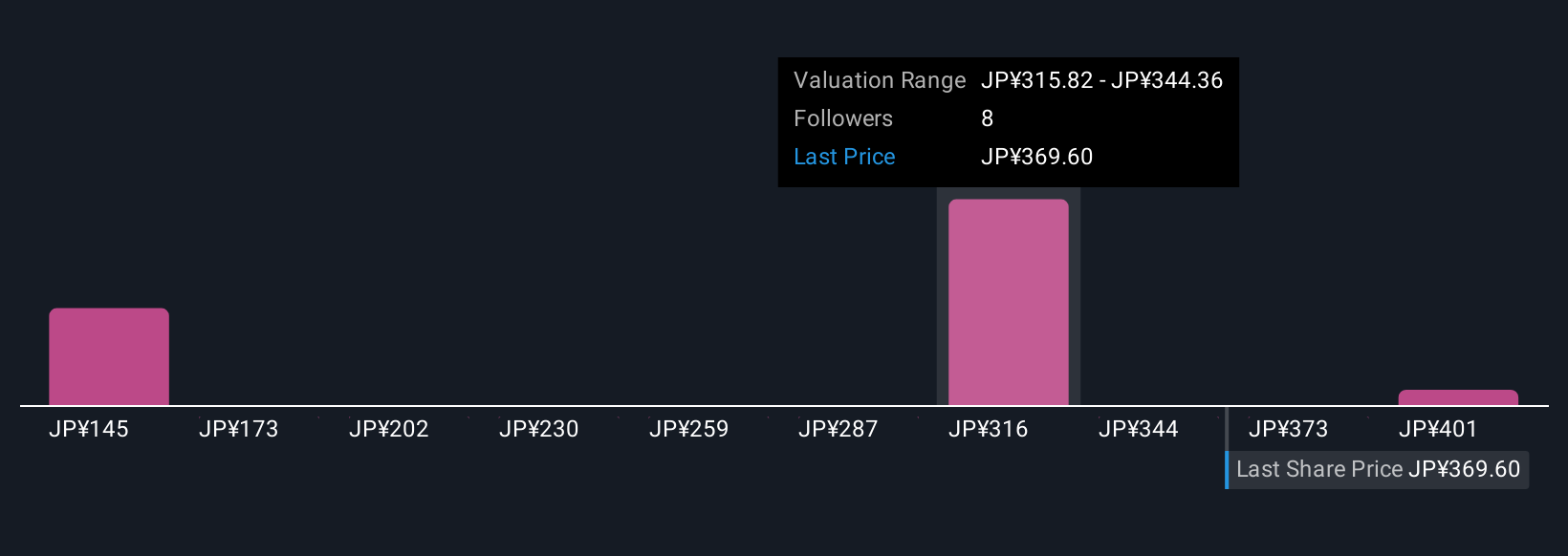

Uncover how Nissan Motor's forecasts yield a ¥336 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range widely, from ¥28.37 to ¥430 per share, showing strong disagreement on upside and downside. You are weighing these against risks like ongoing operating losses and negative free cash flow that continue to pressure Nissan’s turnaround and could influence how quickly any perceived mispricing corrects.

Explore 3 other fair value estimates on Nissan Motor - why the stock might be worth less than half the current price!

Build Your Own Nissan Motor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nissan Motor research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nissan Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nissan Motor's overall financial health at a glance.

No Opportunity In Nissan Motor?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报