Can OneStream’s (OS) AI‑First Leadership Shuffle Really Reframe Its Long‑Term Growth Narrative?

- Recently, OneStream, Inc. announced a broad leadership transition, including the planned departure of CFO William Koefoed at the end of 2025 and the January 2026 promotion of AI and analytics leader Scott Leshinski to President, alongside the appointment of John Kinzer as interim CFO and Pamela McIntyre as Chief Accounting Officer.

- By elevating Leshinski to drive an AI‑first go‑to‑market model and formalizing McIntyre’s oversight of accounting and reporting, OneStream is clearly tying its executive bench to its multi‑product, finance‑AI expansion plans.

- We’ll now examine how Leshinski’s appointment to lead an AI‑first go‑to‑market strategy could reshape OneStream’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

OneStream Investment Narrative Recap

To own OneStream, you need to believe its Finance AI platform and multi product SaaS push can eventually offset current losses and intense competition. The latest leadership changes look more evolutionary than disruptive, so the near term focus still sits on converting AI partnerships and products into durable, recurring revenue while managing elevated investment spend and cash burn.

Among recent announcements, the Microsoft alliance that puts SensibleAI into Microsoft 365, Teams, Excel and Copilot is the clearest test of the AI first go to market plan Leshinski will lead. How effectively OneStream turns that technical integration and co selling into larger deals and expansions will likely matter more to the story than the mechanics of the CFO transition, even if both unfold in parallel over the next year.

Yet beneath the AI growth story, investors should be aware of the risk that heavy AI and global expansion spending could...

Read the full narrative on OneStream (it's free!)

OneStream's narrative projects $937.1 million revenue and $122.7 million earnings by 2028.

Uncover how OneStream's forecasts yield a $28.26 fair value, a 54% upside to its current price.

Exploring Other Perspectives

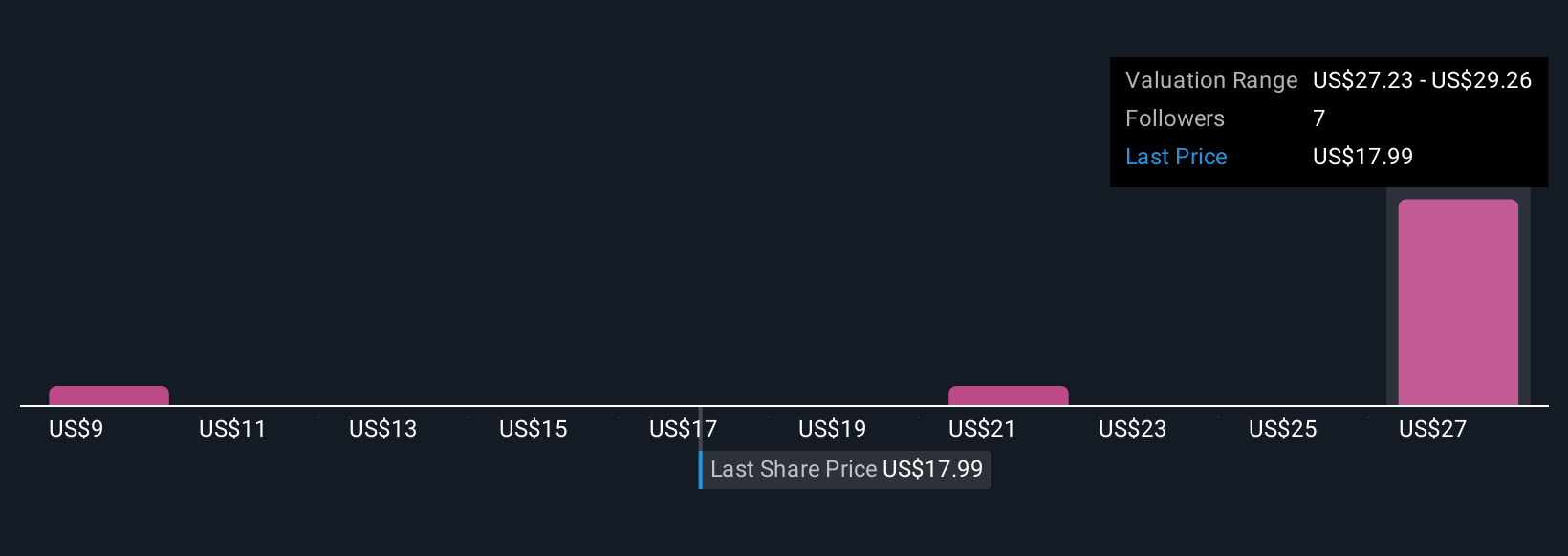

Five Simply Wall St Community valuations for OneStream span roughly US$9 to US$36 per share, underlining how far apart individual views can be. Before you form your own opinion, consider how much confidence you really have that an AI first sales model and rising spend will translate into sustained revenue growth rather than prolonged losses.

Explore 5 other fair value estimates on OneStream - why the stock might be worth as much as 98% more than the current price!

Build Your Own OneStream Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OneStream research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OneStream research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OneStream's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报