A Look at Alamos Gold (TSX:AGI) Valuation After Its Northern Miner Metals Symposium Presentation

Alamos Gold (TSX:AGI) is back in the spotlight after its presentation at The Northern Miner, International Metals Symposium in London, a venue where management typically sharpens its story on growth, costs, and capital allocation.

See our latest analysis for Alamos Gold.

Despite a soft patch in the last week, with a 7 day share price return of minus 3.71 percent and a recent 1 day dip, Alamos Gold’s CA$49.89 share price still reflects strong momentum, underscored by a 30 day share price return of 14.77 percent and a 79.91 percent year to date share price return alongside an 80.59 percent 1 year total shareholder return that may indicate mounting confidence in its growth story and operational delivery.

Given that kind of run, it could be a good moment to see what else fits a strong growth and conviction profile by exploring fast growing stocks with high insider ownership.

Yet with earnings growing double digits and the shares still trading at a notable discount to analyst targets, the key question now is whether Alamos Gold remains mispriced or if the market is already factoring in years of future growth.

Most Popular Narrative: 22% Undervalued

With Alamos Gold closing at CA$49.89 against a most popular narrative fair value near CA$63.99, the implied upside leans heavily on ambitious growth and margin upgrades.

Significant organic production growth is underway, with ongoing ramp up at Magino and the Island Gold Phase 3+ expansion projected to raise consolidated output towards 900,000 to 1,000,000 ounces per year over the next several years, supporting strong top line growth and free cash flow.

Want to see how this output surge feeds into decade defining revenues and profit margins, and why the model still assumes a premium earnings multiple? The full narrative unpacks the specific growth path, the margin reset, and the valuation math that turns today’s price into a potential starting point rather than the finish line.

Result: Fair Value of $63.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could unravel if expansion projects slip or gold prices retreat, which would squeeze margins and undermine confidence in those ambitious targets.

Find out about the key risks to this Alamos Gold narrative.

Another Take On Valuation

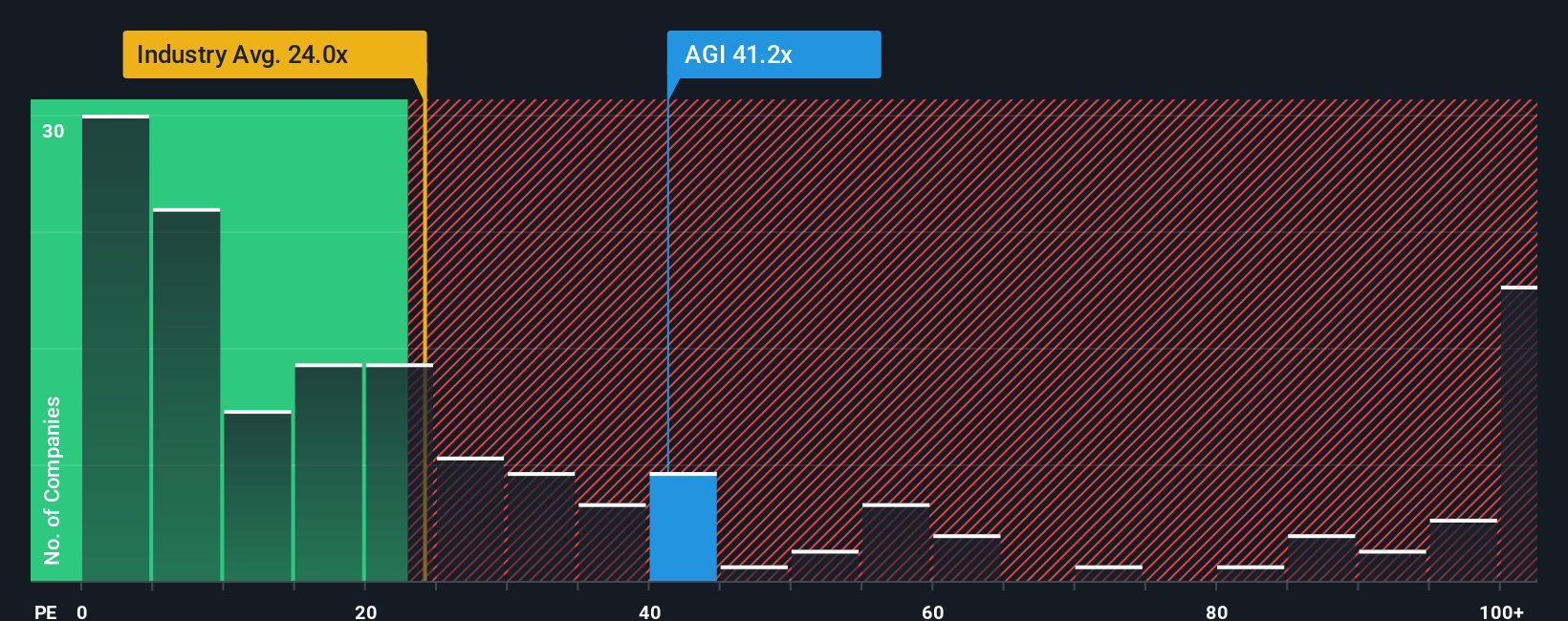

Our earnings based view paints a different picture, with Alamos Gold looking expensive on a 28.1 times price to earnings ratio versus 21.2 times for the Canadian metals and mining industry and a 23.7 times fair ratio, raising the risk of multiple compression if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alamos Gold Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a full view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Alamos Gold.

Looking for more investment ideas?

Right now is a moment to broaden your opportunity set, and you may regret it later if you ignore the high conviction ideas available in the Simply Wall St Screener.

- Explore potential mispricings by targeting companies trading below their intrinsic value using these 903 undervalued stocks based on cash flows and consider how sentiment may change over time.

- Consider the growth of artificial intelligence by examining these 26 AI penny stocks that combine innovation with solid fundamentals and scalable business models.

- Assess income-focused opportunities by scanning these 15 dividend stocks with yields > 3% and concentrating on businesses that currently offer attractive yields supported by their balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报