Should Insider Share Sales Amid Profit Pressure and Expansion Plans Require Action From Shoals (SHLS) Investors?

- In recent months, Shoals Technologies Group reported a 2.1% annual revenue decline over the past two years as customers postponed purchases, while earnings per share fell even faster, compressing profitability.

- At the same time, executives including CFO Dominic Bardos and President Jeffery Tolnar sold shares just as analysts highlighted the company’s international and battery storage expansion as potential long-term growth engines despite current profit pressures.

- We’ll now examine how insider share sales, set against Shoals’ push into international and battery storage markets, may reshape its investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Shoals Technologies Group Investment Narrative Recap

To own Shoals, you need to believe that demand for utility scale solar and related infrastructure will eventually outweigh today’s profit pressures and order delays. The key near term catalyst remains execution on its growing backlog and international and battery storage opportunities, while the biggest current risk is further margin compression if weaker profitability per sale persists. Recent insider sales and the modest two year revenue decline do not appear to materially change that near term equation.

Among recent announcements, Shoals’ emphasis on international markets and battery energy storage solutions ties most directly to this news. These areas are central to its effort to offset customer purchase postponements and diversify away from more competitive, lower margin segments. How quickly those newer markets contribute meaningfully could influence whether current profitability headwinds ease or become a more entrenched risk.

Yet investors should be aware that if margin pressure lingers and promotional pricing continues, then...

Read the full narrative on Shoals Technologies Group (it's free!)

Shoals Technologies Group's narrative projects $589.7 million revenue and $80.2 million earnings by 2028. This requires 13.8% yearly revenue growth and a $59.1 million earnings increase from $21.1 million today.

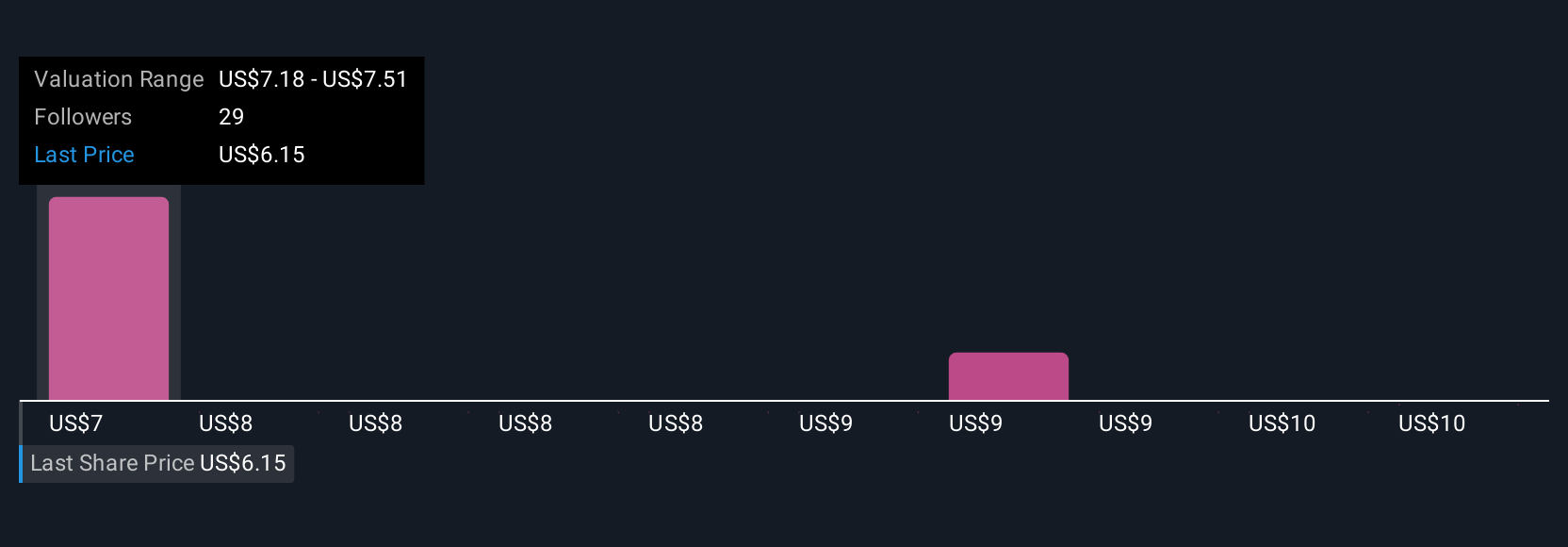

Uncover how Shoals Technologies Group's forecasts yield a $10.22 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community currently place Shoals’ fair value between US$10.23 and US$11.90, highlighting a tight band of expectations. You should weigh those views against concerns about sustained margin compression and what that could mean for Shoals’ ability to translate any revenue recovery into healthier earnings.

Explore 3 other fair value estimates on Shoals Technologies Group - why the stock might be worth as much as 48% more than the current price!

Build Your Own Shoals Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shoals Technologies Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Shoals Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shoals Technologies Group's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报