Insider-Owned Growth Companies In Global For December 2025

As global markets navigate the anticipation of potential interest rate cuts and mixed economic signals, investors are closely watching growth companies with significant insider ownership. Such companies can offer unique insights into future performance, as high insider ownership often indicates confidence in a company’s strategic direction and resilience amid fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Underneath we present a selection of stocks filtered out by our screen.

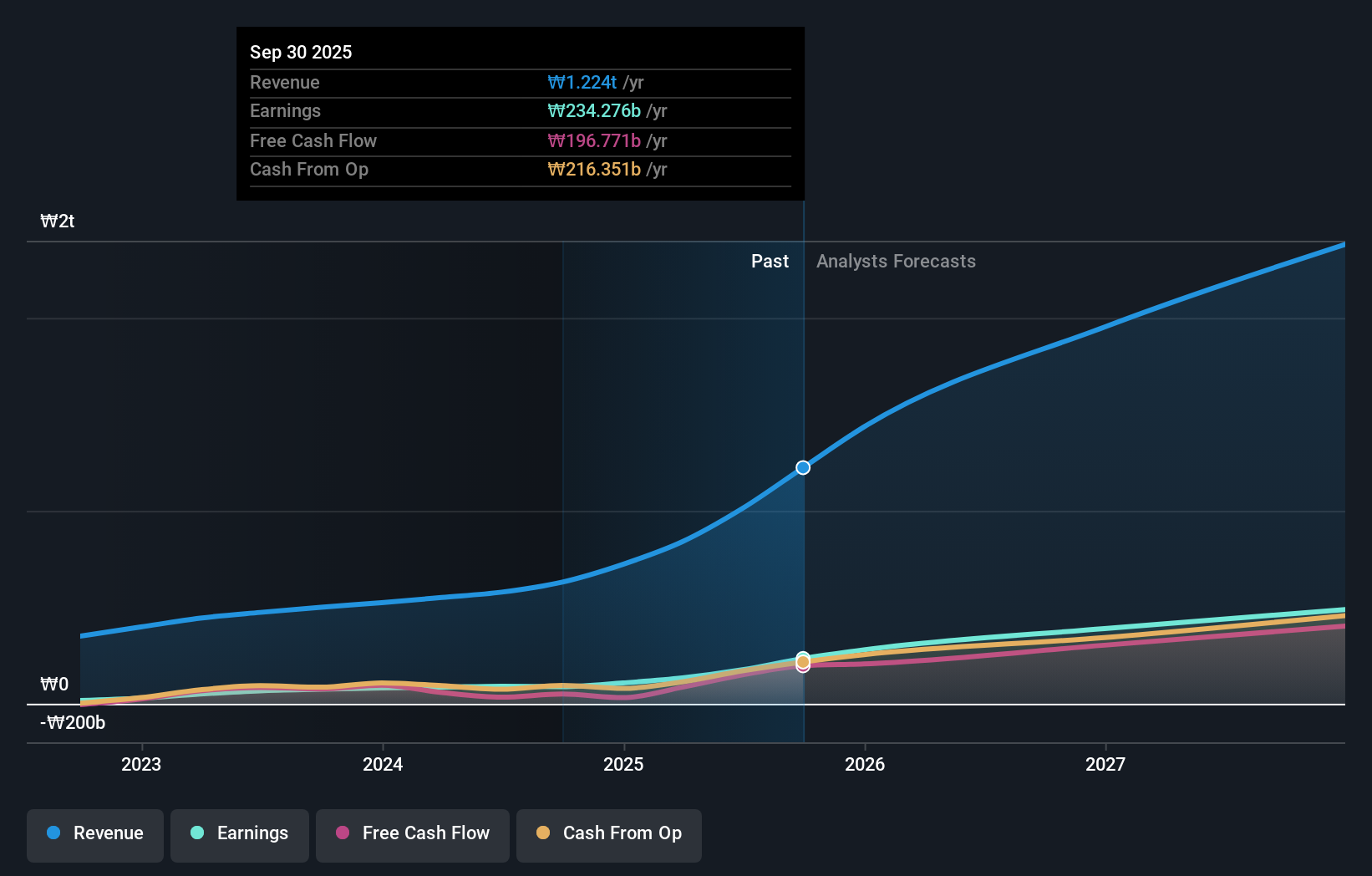

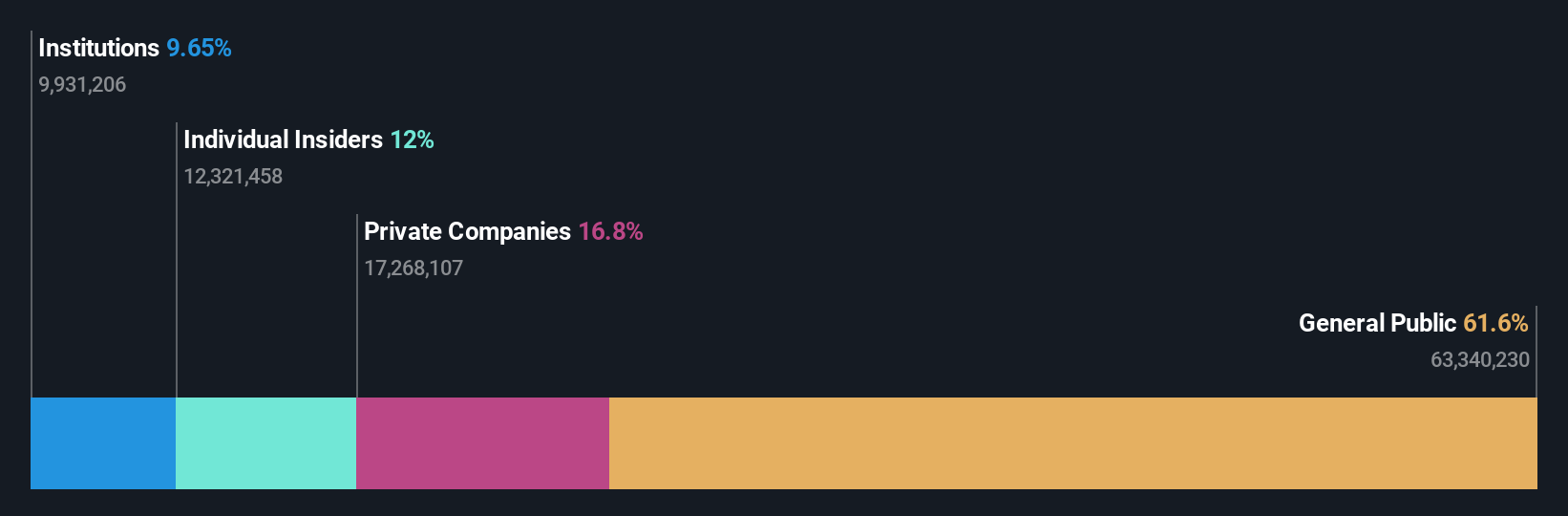

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★★

Overview: APR Co., Ltd. manufactures and sells cosmetic products for men and women, with a market cap of ₩9.53 trillion.

Operations: APR Co., Ltd. generates revenue from its cosmetics segment, amounting to ₩1.54 trillion, and the clothing fashion sector, contributing ₩38.63 billion.

Insider Ownership: 34.7%

Earnings Growth Forecast: 31.8% p.a.

APR Corp. anticipates surpassing KRW 1 trillion in revenue by the end of 2025, highlighting robust growth potential with a forecasted annual earnings increase of 31.83%. Despite trading at a discount to its estimated fair value, APR's dividend yield of 2.67% is not well-supported by free cash flows. The company's high insider ownership aligns with its strong performance metrics, including a projected return on equity reaching an impressive 50.8% within three years.

- Click here and access our complete growth analysis report to understand the dynamics of APR.

- In light of our recent valuation report, it seems possible that APR is trading behind its estimated value.

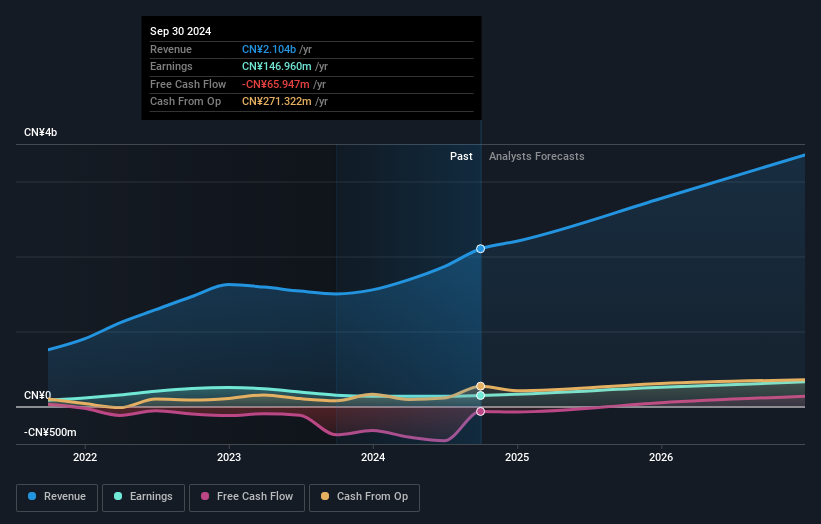

QuantumCTek (SHSE:688027)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QuantumCTek Co., Ltd. focuses on the research, development, production, and sale of quantum communication, computing, and precision measurement products in China with a market cap of CN¥47.51 billion.

Operations: QuantumCTek Co., Ltd. generates revenue through its involvement in quantum communication, computing, and precision measurement products within China.

Insider Ownership: 12%

Earnings Growth Forecast: 134.7% p.a.

QuantumCTek's revenue is forecast to grow at 32.7% annually, outpacing the Chinese market average of 14.4%, with profitability expected within three years. Despite recent shareholder dilution, insider ownership remains high, suggesting confidence in future prospects. The company reported CNY 189.73 million in sales for the first nine months of 2025, a significant increase from CNY 99.71 million the previous year, while net losses narrowed substantially from CNY 55.12 million to CNY 26.47 million over the same period.

- Unlock comprehensive insights into our analysis of QuantumCTek stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of QuantumCTek shares in the market.

Suzhou Recodeal Interconnect SystemLtd (SHSE:688800)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou Recodeal Interconnect System Co., Ltd specializes in the development, production, and sale of connection systems and microwave components both in China and internationally, with a market cap of CN¥14.81 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to CN¥3.15 billion.

Insider Ownership: 37.9%

Earnings Growth Forecast: 21.1% p.a.

Suzhou Recodeal Interconnect System Ltd's revenue is projected to grow at 23.1% annually, surpassing the Chinese market average of 14.4%. Recent earnings showed a notable rise in net income to CNY 233 million for the first nine months of 2025, up from CNY 105.96 million last year. Despite high share price volatility, insider ownership remains significant, indicating strong internal confidence amidst strategic moves like a recent CNY 100 million convertible bond offering.

- Click here to discover the nuances of Suzhou Recodeal Interconnect SystemLtd with our detailed analytical future growth report.

- Our valuation report here indicates Suzhou Recodeal Interconnect SystemLtd may be overvalued.

Key Takeaways

- Access the full spectrum of 863 Fast Growing Global Companies With High Insider Ownership by clicking on this link.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报